|

[Editorial Cartoons]

One Down, One to Go

by Tom Stiglich at CDN -

Former President Trump knocked Biden out of the race without trying all that hard or spending much of his campaign war chest. That leaves a lot of money and energy to focus on his next opponent – Kamala Harris. Commentary by Editor-in-Chief R. Mitchell. Editorial cartoon by Tom Stiglich (@TStig822).

Click to read the rest HERE-> One Down, One to Go first posted at Conservative Daily News

Published:7/27/2024 7:58:33 AM

|

|

[c8b3d6f1-45bc-5631-a9c2-66bfad8b7f4c]

Judge permanently blocks part of Florida's 'Stop WOKE Act' as unconstitutional on First Amendment grounds

A federal judge delivered a final blow to the part of Florida's "Stop Woke Act" that sought to ban critical race theory training in private workplaces.

Published:7/27/2024 7:58:32 AM

|

[Entertainment]

Who Is Barron Trump? Meet Donald Trump's 18-Year-Old Son

When Donald Trump moved into the White House in January 2017, first lady Melania Trump continued to live primarily at Trump Tower in Manhattan so their son Barron Trump could finish out the school...

When Donald Trump moved into the White House in January 2017, first lady Melania Trump continued to live primarily at Trump Tower in Manhattan so their son Barron Trump could finish out the school...

Published:7/27/2024 7:58:32 AM

|

|

[Gear]

HP Elitebook Ultra G1q Review: Windows Battery Leader

HP’s new business laptop sets a record for the best Windows battery life in our testing. Too bad its performance isn’t as notable.

Published:7/27/2024 7:58:32 AM

|

|

[World]

In Miami, Venezuelan diaspora anxiously watches an election it can’t participate in

Many Venezuelans in the United States would like to cast ballots against Nicolás Maduro. But the vast majority won’t be able to vote in what could be a consequential election.

Published:7/27/2024 7:58:32 AM

|

|

[Markets]

These cheap loans are becoming a hit with home buyers. But there are catches.

Assumable loans let buyers take over government-backed mortgages and lock in low rates — under certain conditions.

Published:7/27/2024 7:58:32 AM

|

|

[Uncategorized]

Trump Derangement Syndrome on Campus Week in Education

Your weekly report on education news.

The post Trump Derangement Syndrome on Campus Week in Education first appeared on Le·gal In·sur·rec·tion.

Published:7/27/2024 7:58:32 AM

|

|

[87cbdf0b-8857-5e4f-a37c-92e6e2ed6693]

Here's what American universities should teach instead of activism

Colleges and universities are failing our country. This seems to be the consensus among an increasingly large percentage of Americans and business leaders.

Published:7/27/2024 7:58:32 AM

|

[Markets]

Why'd A Ukrainian Neo-Nazi Just Kill Their Country's Top "Linguistic Nationalist"?

Why'd A Ukrainian Neo-Nazi Just Kill Their Country's Top "Linguistic Nationalist"?

Authored by Andrew Korybko via substack,

A Neo-Nazi with the nom de guerre “Ukrainian Autonomous Revolutionary Racist” (UARR) claimed credit for assassinating fellow fascist Irina Farion on 19 July. This ex-MP was an infamous “linguistic nationalist” who was investigated by the SBU for defaming the armed forces after claiming late last year that Russian-speaking members of the Azov Battalion aren’t real Ukrainians.

Their video manifesto, which was reported on by Ukrainian media here and summarized here, sheds some light onto the motive.

The author condemned her as a “wrecker and racial traitor”, the first presumably in connection to her above-mentioned scandal that inadvertently served to divide the Ukrainian Armed Forces and the second in response to her teaching Ukrainian to Africans, which they showed a clip of in their video. They also promised to “punish everyone who sold the country after the Maidan”, thus implying that she was one of those who they deemed guilty of this crime.

The UARR is allegedly connected to the “National Socialism/White Power” group, which the previously cited Ukrainian media report conspiratorially speculated is run by Russian intelligence. That’s a kooky theory though which is only being circulated to deflect from the fact that Ukrainian fascists just killed one of their own icons. It also builds upon GUR chief Kirill Budanov’s narrative that the culprits, which he strongly implied are linked in some way or another to Russia, “try to use any tools to divide our nation.”

The reality is that the Western-backed spree of urban terrorism and associated coup in early 2014, which are collectively known as “EuroMaidan”, were what irreparably divided Ukraine. The rise to power of fascist forces provoked the Crimeans into breaking away from Ukraine and reuniting with Russia, which was then followed by their ethnic Russian kin in Donbass. Ukraine’s substantial Russian minority that remained under Kiev’s control then lost a lot of their rights and began to live as second-class citizens.

Even though leading Ukrainian officials claimed in late November that no Russian minority exists in Ukraine anymore, and those that still do supposedly deserve to have their rights infringed upon, they’re still objectively present in the country in large numbers. The top state language official lamented in early July that many schoolchildren still speak Russian, while Le Monde reported in late February that front line soldiers do too, which the armed forces are now trying to change by giving them Ukrainian lessons.

While the majority of these troops were forcibly conscripted against their will, a few are volunteers, and it’s fitting to remember that the zeal of a convert is stronger than a born believer’s. What’s meant by this is that those Russians who decided to identify as Ukrainians instead of continuing to identify as Russians in Ukraine are predisposed to radicalism. Accordingly, it’s not surprising that some might have felt deeply offended by Farion’s attack against them, thus explaining why they wanted her dead.

An 18-year-old from Dnipropetrovsk named Vyacheslav Zinchenko was arrested Thursday afternoon, but it’s presently unclear whether he was the author of the UARR’s manifesto and if he acted entirely alone, not to mention whether he’s a native Russian speaker like his home region would suggest. The working theory as suggested thus far in this piece is that those behind Farion’s killing are Russian-speaking Ukrainians and/or ethnic Russians who consider themselves Ukrainians, which will now be elaborated.

The SBU understands the strategic importance of entertaining this radical minority’s delusions since they’re spun to allege that: Russians aren’t oppressed; they don’t even exist anymore after deciding to become Ukrainian; and some of those who made this choice now want to kill Russians. That’s why they decided to investigate Farion for what she said last November about how Russian-speaking members of the Azov Battalion supposedly aren’t real Ukrainians because that risked letting the cat out of the bag.

An average Ukrainian fascist would agree with what she said because they have an exclusive view of their ethno-national and linguistic identity, but a Russian that’s converted to it would disagree since they have a comparatively more inclusive view thereof. The first is the conventional understanding while the second is relatively new and has been weaponized since 2014 for recruiting Russians in Ukraine as cannon fodder for their cause by convincing them that Ukrainians are the so-called “real Russians”.

It's beyond the scope of this analysis to elaborate on their hateful ideology, but it basically claims that the inhabitants of modern-day Ukraine are the real heirs of the former Kievan Rus, not their fellow East Slavs who successfully regathered that lost polity’s lands over the centuries under Moscow’s leadership.

Additionally, Ukrainian ultra-nationalists allege that they’re “pure Slavs”, while Russians (who they smear as “Muscovites”) are allegedly too mixed with Finns, Tatars, and other groups to still be considered Slavs.

Farion gave voice to what her fellow fascists believe, who look down upon ethnic Russians and Russian-speaking Ukrainians, even those who consider themselves Ukrainian.

It’s therefore unlikely that one of her own ethno-linguistic kin killed her, with it being much more probable that those who fit the aforesaid criteria were responsible and 18-year-old Zinchenko is just their patsy.

Such fascists are trying to be “more Ukrainian than the Ukrainians”, but they’ll only ever just be their cannon fodder against Russia.

|

|

[Entertainment]

14 books to get you through summer and beyond

From Joseph Kanon's suspense to Casey McQuiston's romance, find your next favorite book in our summer reading roundup.

Published:7/27/2024 7:58:32 AM

|

|

[]

FBI: On Second Thought, Trump Was Shot

Published:7/27/2024 7:58:32 AM

|

|

[Make Room]

Artist Fawn Rogers On Her Work, Showing at Make Room and the State of the World Today

As I peer through the large glass window of the new one-room solo installation by artist Fawn Rogers, my eyes

Published:7/27/2024 7:58:32 AM

|

|

[Markets]

Don’t know what your Social Security benefits will be? Uh oh.

What people don’t know can hurt them in planning for the long haul of retirement.

Published:7/27/2024 7:58:32 AM

|

|

[Alarmism]

AEA: Kamala Harris on Energy

“Kamala Harris has a plan for American energy: make it harder to produce and more expensive to purchase.”

Published:7/27/2024 7:58:32 AM

|

|

[]

The Classical Saturday Morning Coffee Break & Prayer Revival

I bet the coffee was anything but awful.............. Good morning Horde. Here we are again on another Saturday morning. Before we get to Annie's hard work with the Prayer Request List just a few house keeping matters to go...

Published:7/27/2024 7:58:32 AM

|

[Markets]

"CopenPay" – Europe's First Climate-Centric Social Credit Scheme

"CopenPay" – Europe's First Climate-Centric Social Credit Scheme

Authored by Kit Knightly via Off-Guardian.org,

The world’s first climate-related social rewards scheme came into being two weeks ago, when the city of Copenhagen officially launched it’s new “CopenPay” system.

Through the CopenPay scheme, tourists visiting the city will be rewarded for “green actions” – such as using public transportation or cycling – with access to “cultural experiences”, free meals etc.

For example, arriving at the CopenHill dry ski slope by foot or on a bike will get you 20 free minutes of ski time, while anyone who volunteers at an organic urban farm will get a free lunch (vegetarian, naturally).

The official CopenPay website describes the purpose of the system as follows:

…to encourage sustainable behaviour and enrich the cultural experience of visitors and residents in Copenhagen by transforming green actions into currency for cultural experiences.

WonderfulCopenhagen.com adds:

There is a need to change the mindset of tourists and encourage green choices […]Through CopenPay we therefore aim to incentivize tourists’ sustainable behaviour while enriching their cultural experience of our destination. It is an experimental and a small step towards creating a new mindset […] The hope is not only to continue the pilot project, but also to inspire other cities around the world to introduce similar initiatives.

Now, complimentary organic meals and free windsurfing lessons might seem benign enough, but any talk of “changing mindset” and/or “encouraging behaviour” makes my brain itch.

It’s pretty easy to see through the happy-clappy tone of the promotion to the heart of the issue, it’s right there in their own words: Transforming green actions into currency.

This is climate change based behavioral modification. This is a social credit system. Small scale and optional, sure, but there’s no denying that’s what it is.

For now it’s optional and only for tourists. They are testing the waters. Barring a catastrophic failure it won’t stay that way for long. They likely won’t ever make it mandatory to take part, rather – like bank accounts and cellphones – opting out will simply be too difficult for most people to bother with.

Eventually “rewarding green actions” will segue into “punishing non-green actions”. The currency of “cultural experiences” replaced with actual currency.

This isn’t guesswork.

We don’t have to guess where this leads, because we know. They told us.

They laid out the world they want to build, and this is just one of the first bricks.

|

|

[Science]

Project 2025 Wants to Propel America Into Environmental Catastrophe

Tracking emissions, managing pollutants, responding to natural disasters—even accurately predicting the weather—would all be trampled in a wave of privatization, deregulation, and unfettered fossil-fuel exploitation.

Published:7/27/2024 6:07:51 AM

|

|

[Politics]

[Josh Blackman] Today in Supreme Court History: July 27, 1929

7/27/1929: The Geneva Conventions are signed by United States. The Supreme Court would consider the Conventions in Hamdan v. Rumsfeld (2006).

Published:7/27/2024 6:07:51 AM

|

|

[Markets]

With a September rate cut seen as a virtual done deal, questions turn to how far and how fast Fed will ease

Fed officials are meeting next week and are widely expected to hold interest rates steady before easing in September.

Published:7/27/2024 6:07:51 AM

|

|

[World]

Taking cue from Supreme Court, Breed to launch aggressive homeless sweeps in San Francisco

San Francisco Mayor London Breed said the city will start aggressively clearing homeless camps in August, following a U.S. Supreme Court ruling that gives cities greater authority to move people off the streets.

Published:7/27/2024 5:58:59 AM

|

|

[Markets]

Age-proofing your résumé? New law helps job applicants hide their age.

Job hunting is never easy, and that’s especially true for older workers. But a new law that went into effect in Colorado on July 1 could give more experienced job seekers a leg up.

Published:7/27/2024 5:58:59 AM

|

|

[World]

Never mind the post-PCE stock rally — it’s not yet time to buy the Big Tech dip, strategists say

This week’s pullback in tech stocks was long overdue, but investors should wait for more earnings before “jumping in with both feet,” one analyst says.

Published:7/27/2024 5:58:59 AM

|

|

[World]

At Manny’s cafe, group therapy for newly hopeful Democrats

Evening gatherings in this Mission-district haunt in deep-blue San Francisco let liberals process their emotional rollercoaster during a historic week.

Published:7/27/2024 5:58:59 AM

|

|

[PDD]

Alibaba's Future: International Commerce And Cloud AI Deployment

Published:7/27/2024 5:44:57 AM

|

|

[Biden Administration]

WATCH: Veep Thoughts With Kamala Harris (Vol. 15)

Vice President Kamala Harris didn't pass the California State Bar Exam on her first try, unlike the vast majority (72 percent) of her fellow aspiring lawyers that year (1989). But she would get the last laugh, or cackle, by growing up to become one of the most profound legal minds of her generation.

The post WATCH: Veep Thoughts With Kamala Harris (Vol. 15) appeared first on .

Published:7/27/2024 5:44:57 AM

|

|

[3bbd0b05-c6f4-5b84-b4d9-6d11312118ba]

Trump knocks Harris as a 'bum,' scorns her handling of southern border: 'A failed vice president'

Former President Trump criticized Vice President Kamala Harris for the influx of migrants flowing through the southern border under the Biden administration.

Published:7/27/2024 5:44:57 AM

|

|

[Vance, J D]

JD Vance, an Unlikely Friendship and Why It Ended

His political views differed from a transgender classmate’s, but they forged a bond that lasted a decade — until Mr. Vance seemed to pivot, politically and personally.

Published:7/27/2024 5:05:04 AM

|

|

[Markets]

This S&P 500 sector is expected to grow profits most rapidly through 2026 — and it’s not tech. Here are 14 related stocks.

Two money managers discuss what lies ahead for a reviving sector.

Published:7/27/2024 5:05:04 AM

|

|

[Markets]

Crypto fanatics flock to Trump, hoping to ‘make bitcoin great again’

The crypto community is rallying behind Trump for the 2024 election, hoping to avoid regulation.

Published:7/27/2024 5:05:04 AM

|

|

[Politics]

Usha Vance told friends Trump appalled her. Now she’s working to elect him.

Usha Vance privately told friends she was outraged by Donald Trump’s role in the Jan. 6, 2021, attack and lamented the social breakdown that fueled his political support.

Published:7/27/2024 5:05:04 AM

|

|

[World]

Netanyahu’s U.S. visit revealed ‘no workable plan’ for peace, critics say

A “day after” plan in Gaza is a critical component of President Biden’s vision for peace. Lawmakers say that, for all the effort, it remains a pipe dream.

Published:7/27/2024 5:05:04 AM

|

|

[World]

Pennsylvania presidential election results could again take days to count

Republicans in the state Senate refused to change the law and allow mail-in votes to be counted ahead of Election Day, despite widespread calls for change.

Published:7/27/2024 5:05:04 AM

|

|

[3add04a8-1c64-5eea-8fda-360e52a3c8eb]

Morning Glory: Nine things Trump needs to do the second he takes office

If former President Trump can win big in November, he and fellow Republicans need to move fast and start legislating. Here are nine moves they can make if they are victorious.

Published:7/27/2024 5:05:04 AM

|

|

[]

Friday Night News Dump: Biden Administration Pays Peter Strzok and Lisa Page TWO MILLION DOLLARS

Published:7/27/2024 5:05:04 AM

|

|

[World]

These ETFs let you invest based on political leanings — but taking a stance can be costly

With the 2024 U.S. presidential election on the horizon, these ETFs are poised to capture investments on both sides.

Published:7/27/2024 5:05:04 AM

|

|

[Climate ugliness]

NYT exposes EV ‘green’ fraud: ‘More than 70% of world’s cobalt…the blood diamond of electric vehicle batteries, comes from Democratic Republic of Congo, where child labor & sexual violence are rampant in mines’

More than 70 percent of the world’s cobalt, sometimes called the blood diamond of electric vehicle batteries, comes from the Democratic Republic of Congo

Published:7/27/2024 4:10:34 AM

|

|

[World]

If Maduro loses, will he cede power? Venezuela’s election, explained.

The opposition is hoping for a victory so overwhelming that the authoritarian socialist will be compelled to negotiate a transition.

Published:7/27/2024 4:10:34 AM

|

|

[Entertainment]

Even Richard Schiff thinks we’re living in ‘The West Wing’

Schiff, who played Toby Ziegler on the hit political drama “The West Wing,” discusses the presidential race and how the show shaped his own political views.

Published:7/27/2024 4:10:34 AM

|

|

[World]

Some of 2024’s most popular trades are coming undone after reaching ‘stupid’ levels

The selloff in U.S. semiconductor and megacap stocks has sucked up most of investors’ attention over the past couple of weeks. But they aren’t the only momentum trades that have stopped working.

Published:7/27/2024 4:10:34 AM

|

|

[d4eb59b9-4b54-5dd0-b153-158983f3347e]

Harris vs. Trump: 100 days from election, it's a dramatically altered presidential race

This weekend marks 100 days until Election Day and one week since President Biden's announcement he was ending his re-election rematch against former President Trump & endorsing Vice President Harris

Published:7/27/2024 3:55:57 AM

|

|

[Markets]

What to make of this week’s action in the stock market and the ‘Great Rotation’

Also: Surprising data on home prices; combining your investments with your politics; and a retirement account mistake you can avoid.

Published:7/27/2024 3:55:57 AM

|

|

[a1bedc23-074e-54bf-b686-893619a6b939]

Newsom urges Oakland officials to tighten 'extreme' policy that restricts police chases

California Gov. Gavin Newsom is urging Oakland officials to change a policy that restricts when cops can pursue a criminal suspect, saying it allows "criminals to act with impunity."

Published:7/27/2024 3:05:28 AM

|

|

[d0e21adc-f9ff-563e-85d7-fce40c14e19a]

Meghan Markle steps up Hollywood networking with Kimberly Williams-Paisley lunch, reported Hamptons trip

Meghan Markle is continuing to make California home as she makes friends with Brad Paisley's wife Kimberly Williams-Paisley.

Published:7/27/2024 3:05:28 AM

|

|

[]

Daily Tech News 27 July 2024

Top Story Journalistic Lysenkoism: What a Kamala Harris presidency would mean for science. (Scientific American) Starvation, slavery, misery, and death. Possibly not in that order.As the daughter of a cancer researcher, Kamala Harris would bring a lifelong familiarity with science...

Published:7/27/2024 3:05:28 AM

|

|

[BAC]

Dividend Champion, Contender, And Challenger Highlights: Week Of July 28

Published:7/27/2024 2:39:08 AM

|

|

[In The News]

Left-Wing Media Outlet Attacks Heritage President Over Alleged ‘Radical’ Catholic Ties

by Wallace White at CDN -

A left-wing media outlet accused Heritage Foundation President Kevin Roberts on Friday of having ties to what they describe as a “radical and secretive” Catholic group. The Guardian published an article alleging Roberts was tied to Opus Dei, a Catholic faith group, by saying he receives “spiritual guidance” from the …

Click to read the rest HERE-> Left-Wing Media Outlet Attacks Heritage President Over Alleged ‘Radical’ Catholic Ties first posted at Conservative Daily News

Published:7/27/2024 12:48:59 AM

|

|

[World]

The Decline and Fall of the Western Church

Published:7/27/2024 12:48:59 AM

|

[Entertainment]

Meet Katie Grimes, the Olympic Swimmer Dubbed the Future of Her Sport

Katie Grimes wasn't going to let one disappointing swim sink her chances of going to her first Olympics.

Or her second.

"I'm just a stubborn person by nature," the 18-year-old athlete, who will be...

Katie Grimes wasn't going to let one disappointing swim sink her chances of going to her first Olympics.

Or her second.

"I'm just a stubborn person by nature," the 18-year-old athlete, who will be...

Published:7/27/2024 12:03:39 AM

|

|

[Intermittent Wind and Solar]

East coast wind turbine fiasco in the making

Where are the true environmentalists with what is going on?

Published:7/27/2024 12:03:38 AM

|

|

[World]

Russia, adapting tactics, advances in Donetsk and takes more Ukrainian land

The new offensive focus comes as Ukraine faces depleted forces, sweltering heat and turmoil in a potentially consequential U.S. election.

Published:7/27/2024 12:03:38 AM

|

|

[Harris, Kamala D]

Silent No More, Harris Seeks Her Own Voice Without Breaking With Biden

The vice president’s expressions of concern for Palestinian suffering marked a shift in emphasis from the president’s statements as she moved to establish herself as the leader of her party.

Published:7/26/2024 11:12:26 PM

|

|

[In The News]

Vivek Ramaswamy Says There’s One ‘Big Risk’ GOP Has To Worry About Heading Into November

by Hailey Gomez at CDN -

Former Republican presidential candidate Vivek Ramaswamy warned Friday evening that the GOP could get “distracted by the shenanigans of the Democrats” and forget to deliver its own message heading into November. Ramaswamy appeared on Fox News’ “The Ingraham Angle” to discuss the recent endorsement of the vice president from both …

Click to read the rest HERE-> Vivek Ramaswamy Says There’s One ‘Big Risk’ GOP Has To Worry About Heading Into November first posted at Conservative Daily News

Published:7/26/2024 11:12:25 PM

|

|

[Foreign Affairs]

Realism, Restraint, and Freedom Conservatism

Preservation of liberty at home precludes imperial adventures abroad.

The post Realism, Restraint, and Freedom Conservatism appeared first on The American Conservative.

Published:7/26/2024 11:03:53 PM

|

[Markets]

Biden And The Media's 'Anti-Disinformation' Campaign

Biden And The Media's 'Anti-Disinformation' Campaign

Authored by Andrew Lowenthal via The Brownstone Institute,

"The Party told you to reject the evidence of your eyes and ears. It was their final, most essential command.”

- George Orwell, 1984

For years the media, “fact-checkers,” and “anti-disinformation” initiatives told the public there was nothing wrong with Joe Biden. A few weeks ago, in the space of five minutes, they flipped. Rapid-onset dementia had struck the President and it was time for change.

The people who claim they can sort truth from fiction spent years lying despite the crippling obvious. What is more baffling is why so many people went along with it for so long. Was it fear? Complacency? Cowardice? An incredible level of discipline was enforced – that has thankfully now unraveled.

Rather than debunking “misinformation,” Biden’s protectors often spread it.

In August 2020 the Aspen Institute coordinated a Hunter Biden laptop pre-bunk exercise that sought to suppress a true story to protect Biden’s wayward son and shield the President from major corruption allegations. A swathe of major media and Big Tech participated in that exercise, including the New York Times, Washington Post, Twitter, Facebook, and many more. Claire Wardle, former director of “anti-disinformation” NGO First Draft (now the Information Futures Lab at Brown University) also participated.

In a letter allegedly organised by Anthony Blinken, 51 former intelligence agents claimed the Hunter Biden laptop was a “Russian information operation” and Facebook, Twitter, and others suppressed the story on their platforms. Almost everyone now admits the laptop was real.

Or take Biden’s claim that “You’re not going to get Covid if you have these vaccinations.”

PolitiFact thought that may have been an “exaggeration” but reassured us that cases of the vaccinated getting Covid are “rare.”

The Party told you to reject the evidence not just of your eyes and ears, but your whole body.

However, perhaps the biggest lie was the years-long campaign to “debunk” suggestions that Biden was growing incapable of commanding the highest office in the land. PolitiFact was very diligent in “fact-checking” “cheap fakes” and other stories that alleged Joe Biden was senile, reassuring us that everything was fine.

The term “cheap fake” was coined by Britt Paris and Hunter Biden laptop denialist Joan Donovan. Donavan has long been a darling of the “anti-disinformation” field.

In the words of Aspen Hunter Biden laptop pre-bunker Claire Wardle, the Biden cheap fakes are “the weaponization of context. It’s genuine content, but the context changes via minor edits. Anyone can be vulnerable with the right edit.” In fact, as recently as June 21 Wardle was carrying water for Biden. In a New York Times article that sought to debunk “misleading videos that play into and reinforce voters’ longstanding concerns about his [Biden’s] age and abilities,” Wardle explained that “This isn’t a new narrative, it builds on an existing one, which tends to be much more effective.” Yes, adding more true information to other true information tends to make an argument more convincing.

Or take Rebekah Tromble, Associate Professor of Media and Public Affairs and the director of the Institute for Data, Democracy, and Politics at George Washington University. According to Tromble “Biden became a main target of deceptive edits.” “These clips draw on a common trope about President Biden that’s popular among his detractors: He’s old, bumbling, and senile, meaning he’s incompetent and incapable of doing this job.” His gaffes and inability to speak clearly are unrelated to his cognitive ability, and are instead because “Biden grew up stuttering.”

PolitiFact is a project of the Poynter Institute which coordinates the biggest network of fact-checkers in the world, the International Fact-Checking Network (IFCN). IFCN is funded largely by Facebook but also by the “Craig Newmark Foundation, the Koch Foundation, the Knight Foundation, the Omidyar Network, the National Endowment for Democracy, Microsoft, and the Washington Post.” This is not a small fringe “fact-checking” outfit; it is one of the leading organizations in the sector.

Perhaps the name makes it clear – it is Politi(cised) Fact-checking.

Newsguard, a “disinformation” ranking service that can punish a news site’s advertising revenue through its rating system, has also been active. Power Line, a conservative online news outlet, alleges they were contacted by Newsguard in 2021 about their claims of Biden’s cognitive decline. In an email, Newsguard asked:

We’ve noticed that the site has repeatedly stated as fact in its article[s] that Joe Biden has dementia, both during the 2020 election cycle and since he became president. Why does the site make this claim without providing credible evidence that he has dementia?

Newsguard’s approach is particularly concerning because of its ability to impact the revenue of media outlets, and due to its strong links to the State Department and intelligence agencies – its board includes former CIA Director Michael Hayden.

If all that fails you can always blame the Russians. EUvsDisinfo, a European Union project to “forecast, address, and respond to the Russian Federation’s ongoing disinformation campaigns” claimed reports of Biden being “senile” are “false” and are part of “pro-Kremlin disinformation.”

Mainstream media have also been a critical part of the lying machine, claiming recent videos that show Biden wandering off at a G7 event were “misinformation” or “cheap fakes” and are part of a concerted effort to “hammer the narrative that Biden is too old to be president.” PolitiFact also “fact-checked” the story with the usual line.

The list could go on and on and on but Matt Orfalea’s amazing “sharp as a tack” compilation puts the nail in the coffin. More “out of context” clips and “cheap fakes” according to the “anti-disinformation” “experts” no doubt.

What is the lesson?

On one hand, censorship and suppression only work for so long. Reality will eventually catch up with you. However, it also tells us that a lot of people can pretend the emperor does have clothes, even when he is stark naked and half the court is screaming and pointing at the top of their lungs – also known as “spreading misinformation.”

It seems there is an endless supply of “fact-checking” and “anti-disinformation” sycophants ready to bow and scrape before the mad king.

Ultimately it tells us just how corrupt the “fact-checking” and “anti-disinformation” industries are. Whilst there are an increasing number of people on the outside speaking up, internally cowardice and the silencing of critics have allowed a prolific level of corruption to grow. This is an across-the-board problem in the liberal and progressive spheres where pious bullies have shut down dialogue. This corruption has led progressives and liberals down a disastrous dead end. Barring a miracle, Trump is coming.

If there is any justice a reckoning is also coming for the “fact-checkers” and “anti-disinformation” “experts.”

* * *

Republished from the author’s Substack

|

|

[9ac25ad9-43a0-5c46-be48-b1719304bccd]

Trump announces to crowd he 'just took off the last bandage' at faith event after assassination attempt

Donald Trump shared publicly for the first time Friday since his assassination attempt he removed his bandage over the gunshot wound on his ear.

Published:7/26/2024 10:06:29 PM

|

[Entertainment]

2024 Olympics: Metal Band Gojira Shocks With Marie Antoinette Moment

You could say Gojira started a new French revolution at the 2024 Paris Summer Games.

As the first-ever heavy metal band to perform at an Olympic Opening Ceremony, the head-bangin' quartet...

You could say Gojira started a new French revolution at the 2024 Paris Summer Games.

As the first-ever heavy metal band to perform at an Olympic Opening Ceremony, the head-bangin' quartet...

Published:7/26/2024 10:06:29 PM

|

|

[World]

Iran's impact on U.S. institutions threatens our national security

We now know that the United States had intelligence that Iran was brewing a plot to kill former President Donald Trump weeks before 20-year-old Thomas Matthew Crooks' assassination attempt this month.

Published:7/26/2024 9:22:58 PM

|

|

[London / Europe]

Paris Olympics Opening Ceremony Recreates 'Last Supper' with Drag Queens & Trans Performers

Further making the Olympics opening ceremonies the “gayest ever,” Parisian Olympics officials also featured an LGBTQ parody of the "Last Supper" along with a woke fashion show featuring gender-bending fashions and transgender models.

The post Paris Olympics Opening Ceremony Recreates ‘Last Supper’ with Drag Queens & Trans Performers appeared first on Breitbart.

Published:7/26/2024 9:22:58 PM

|

|

[511e57b9-660e-5913-91b8-2faef9f7ec06]

Harris campaign claims she no longer supports fracking ban she touted in 2019: report

Vice President Kamala Harris no longer supports banning fracking as she did when she was a presidential candidate in 2019, her campaign reportedly said.

Published:7/26/2024 9:22:57 PM

|

|

[World]

Why Were the DC Protests So Out of Control? There Were Only 29 Police!

Published:7/26/2024 9:22:57 PM

|

|

[Uncategorized]

Olympics Opening Ceremony Mocks Christianity With a Drag Last Supper

It's hard to offend me. The best way to offend me is to degrade my religion, especially the most sacred and important part of it.

The post Olympics Opening Ceremony Mocks Christianity With a Drag Last Supper first appeared on Le·gal In·sur·rec·tion.

Published:7/26/2024 9:22:57 PM

|

[Entertainment]

Billy Ray Cyrus' Ex Firerose Speaks Out After Audio Release

Firerose is making her voice heard.

The estranged wife of Billy Ray Cyrus broke her silence after audio leaked of a man who sounds like the Hannah Montana alum yelling and insulting Firerose over...

Firerose is making her voice heard.

The estranged wife of Billy Ray Cyrus broke her silence after audio leaked of a man who sounds like the Hannah Montana alum yelling and insulting Firerose over...

Published:7/26/2024 9:22:57 PM

|

|

[39f351bc-ba74-5518-b6a6-d7c4ef1926fa]

How to fight Democrats' devious Kamala Harris disinformation? Start with a song in your heart

One way to fight disinformation is with a musical number. In that spirit here are three new versions of songs we know to take on the spin around Kamala Harris and her various roles.

Published:7/26/2024 9:22:57 PM

|

|

[Politics]

Trump calls Harris a ‘bum,’ complains about Biden’s withdrawal

The former president urged attendees at a faith-themed event to vote, promising that in four years, “we’ll have it fixed so good you’re not going to have to vote.”

Published:7/26/2024 9:22:57 PM

|

[Markets]

"A Crisis Of Extremes": Behind The Homeless Surge In California's High Desert

"A Crisis Of Extremes": Behind The Homeless Surge In California's High Desert

Authored by Beige Luciano-Adams via The Epoch Times (emphasis ours),

In the scrubby Mojave desert north of Los Angeles, a sprawling encampment of decrepit RVs sits just off a dirt road separating the city of Lancaster from Los Angeles County’s unincorporated expanse.

A homeless man lives in an old RV that sits in the Mojave desert, near Lancaster, Calif., on July 10, 2024. (John Fredricks/The Epoch Times) A homeless man lives in an old RV that sits in the Mojave desert, near Lancaster, Calif., on July 10, 2024. (John Fredricks/The Epoch Times)

In every direction, garbage spreads out like an algae super bloom—beyond that, endless sand and brush, baking in the summer sun.

“Keep your head on a swivel for dogs,” a member of the city’s public safety and emergency response unit tells us. Through the haze, we see two pit bulls and a German Shepherd under a tarp, but they are tethered, too hot to move.

Freddy, a resident, seems only moderately bothered by the 110 degree temperature. “I don’t have a car anymore, so I can’t get my own water,” he says, when asked how he survives out here.

“Someone brings me water every two weeks,” he said, referring to a nonprofit.

Pointing down at his legs, scaly and engorged beneath black shorts, he adds, “And I’m sick, too. They bring me medicine.”

There is no grid here, no power or water. RV residents dump their raw sewage in the desert, either right outside their vehicles, or sometimes with a hose that carries it a little farther out.

Such encampments, which are also a magnet for illegal construction dumping, appear as clusters on satellite maps, dotting the rugged terrain just past the county line. Officials say they stretch out as far as 10 miles into the desert, but most stay closer to town.

Freddy is one of thousands without housing in the northern part of the county, according to data released last month by the Los Angeles Homelessness Services Authority (LAHSA).

On any given night, an estimated 6,672 people are homeless in the Antelope Valley—a 42 percent increase over the year prior. But only 1,057 of the region’s homeless people live in its two main cities, Lancaster and Palmdale, leaving the remaining 5,615 in smaller towns and the region’s rural unincorporated areas.

It’s surprising that so many people could be living in tents, under tarps, inside of old RVs, out in the middle of the high desert with no water or infrastructure.

But those familiar with the situation say the population was already high, and the dramatic jump simply represents a more thorough count this year.

“The count went up this year because the count was done wrong in previous years,” said a city official, who asked not to be identified by name. “This year we utilized a drone, and our teams went out to remote areas and did the count,” he said, estimating the actual increase over last year might be closer to 25 percent.

L.A. County Supervisor Kathryn Barger, whose 5th District includes the Antelope Valley, also suggested the increase may not be as straightforward as it looks.

“The Point In Time Count is not a perfect science and it’s rightfully evolving,” she said in an email to The Epoch Times, expressing uncertainty over whether the number reflects an increase or a better count.

A wind turbine system outside of Palmdale, Calif., on July 10, 2024. Palmdale’s homeless count rose from 177 in 2023 to 537 in 2024. (John Fredricks/The Epoch Times) A wind turbine system outside of Palmdale, Calif., on July 10, 2024. Palmdale’s homeless count rose from 177 in 2023 to 537 in 2024. (John Fredricks/The Epoch Times)

“Regardless, we will use those results to draw down more federal and state funding so that we can deliver more local housing and shelter options. The need in the region is real.”

Either way, the uptick is an outlier in 2024, when the county overall and most city homeless populations are either remaining stable or shrinking slightly.

The City of Lancaster’s overall homeless count went down in 2024, to 520 people from 590 the year prior, with fewer unsheltered homeless and more sheltered homeless individuals. Palmdale’s, meanwhile, rose from 177 to 537.

Inquiries to Palmdale city officials, including the mayor and city councilmembers, were not returned.

LAHSA also did not respond to a request for comment on the increase in the homeless population in Antelope Valley.

While many municipalities across the West stopped clearing homeless encampments after a series of Ninth Circuit Court decisions determined anti-camping laws violated the Eighth Amendment, Lancaster bypassed those restrictions with procedural caveats, by offering shelter before moving people.

Since the Supreme Court reversed the lower court rulings earlier this month, officials say, enforcement is easier.

Critics of such enforcement, such as the ACLU, have long argued Lancaster is pushing people who have nowhere to go into dangerous, extreme conditions. But officials say there are beds available, and enforcement is attended by offers of services and shelter.

So why are thousands of people homeless in the desert?

End of the Line

Lancaster Mayor Rex Parris, an outspoken critic of what he says is the county’s neglect of the region, allows there are various factors that might contribute to an increase in homelessness—former inmates at California State Prison, in Lancaster, who end up in the community without services, along with a small percentage of people losing housing or falling on hard times.

Lancaster has always been a far more affordable bedroom community, but median rent is currently $2,595 a month—only about $200 cheaper than Los Angeles, according to real estate website Zillow.

But the main reason, Mr. Parris told The Epoch Times, is L.A.’s systematic tendency—not a conspiracy, exactly, more like a default setting—to send its problems north.

“I think it’s tied to the L.A. area pushing them up here,” he said of the homeless count increase. “They tend to push all of their problems up here, if they can. And now you’ve got the World Cup, and you’ve got the Olympics coming, and they’re in a mad rush to get rid of their homeless, and so they encourage them to come here.”

Mr. Parris says his teams are “constantly interviewing people who were given a ticket and told, “go to Lancaster, we’ll feed and take care of them,” but did not specify by whom.

“It’s at the end of the Metro line, literally. This is not unusual.”

The county’s transit system, plagued by violence in recent months, has its own problems. Used as a de facto shelter by thousands during the day, its buses and trains are emptied for cleaning each night, which some end-of-line cities say has resulted in sharp increases in their transient homeless populations.

Lancaster, 60 miles north of Los Angeles and at the very end of the Metro transit system, is far more remote than other such cities.

(Top) A homeless man walks with his belongings along a street in Santa Ana, Calif., on July 15, 2024. (Bottom) A homeless individual rests by a busy street in Santa Ana, Calif., on July 15, 2024. (John Fredricks/The Epoch Times) (Top) A homeless man walks with his belongings along a street in Santa Ana, Calif., on July 15, 2024. (Bottom) A homeless individual rests by a busy street in Santa Ana, Calif., on July 15, 2024. (John Fredricks/The Epoch Times)

Lt. William Kitchin, who oversees the Los Angeles Sheriff’s Department’s (LASD) homeless outreach team for the entire county, said he has not personally seen evidence to support the idea that people are being directed to the region, but has observed migration to end-of-line cities.

However they end up there, once in Lancaster, civil rights groups say, authorities have routinely pushed homeless people out into the desert.

In a study based on interviews with 53 unhoused people in and around Lancaster from February 2019 to October 2020, the ACLU claimed the LASD “banished” people to remote county areas, combining the threat of criminal and civil sanctions with “suggestions” to leave town.

Such claims, the lieutenant said, are easily disproved by body cameras that record deputies’ interactions when enforcing local ordinances.

Lt. Kitchin’s team works with LAHSA to resolve encampments of more than five people, and he said such operations are always done with advance notice and offers of services and housing.??

“We can’t dictate or tell people where to go. We just say you can’t be here. We prefer you take the services that were provided, so you can go inside and get your life started on the right track, but we can’t force them into it,” he said.

Starting on July 22, his team plans to clear desert encampments in an area north of Lancaster and place an estimated 40 people in hotels as part of the county’s “Pathway Home” program.

“Prior to the pandemic,” the lieutenant said, “what we used to see is that people who were homeless in that area either grew up there or had roots there, parents or family. Now we’re seeing more people from out of state.”

Officials who asked not to be identified by name said they see a constant influx of new faces in Lancaster and the surrounding area. “We know everyone here and everyday we’re seeing new people. It’s not people losing their homes, there’s some of that, but mostly it’s not. They came from somewhere else, they moved here,” one said.

The city’s team has access to five beds for immediate shelter. After two weeks, they move people to Kensington, Lancaster’s sprawling homeless housing campus—so those five beds always stay open for people who might need them, officials said.

Mayor Parris told The Epoch Times that beds remain open at Kensington throughout the year, except when extreme weather drives occupancy up.

Opened in 2019, the campus has 153 interim beds and 150 permanent supportive housing beds, and receives more referrals than it has availability, a representative for A People Concern, the organization that operates the campus, told The Epoch Times in an email.

The representative said they are currently “nearing capacity,” with a “fluctuating occupancy as individuals may choose to transition between programs.”

Michael, a homeless man, passes by an area with tents housing the homeless, near Lancaster, Calif., on July 10, 2024. (John Fredricks/The Epoch Times) Michael, a homeless man, passes by an area with tents housing the homeless, near Lancaster, Calif., on July 10, 2024. (John Fredricks/The Epoch Times)

Mr. Parris draws a hard line between what he characterizes as a minority of the homeless population in his city, who have fallen on hard times or been pushed out of housing—and an overwhelming majority, who refuse housing and choose the streets and drug abuse as a lifestyle.

“I was a drug addict, and I have been homeless. And I have been in jail,” Mr. Parris, a lawyer, said. “So none of this is foreign to me. You know, I think I probably have a better understanding of it than most. But I know the difference between a looter and someone who needs help—and wants help.”

Read more here...

|

|

[]

There's No Place Like ONT

Friday night! Time to fill up on memes!...

Published:7/26/2024 9:22:57 PM

|

|

[Climate News]

Climate Change Weekly #513: ?? Hey, Ho! Biden/Harris Climate Policies Have to Go ??

From Heartland Daily News H. Sterling Burnett YOU SHOULD SUBSCRIBE TO CLIMATE CHANGE WEEKLY. IN THIS ISSUE: Watch ALL the Presentations by the ALL-STARS of Climate Realism at the Archive…

Published:7/26/2024 8:18:10 PM

|

|

[World]

The Paris Olympics, in comics

We asked our favorite cartoonists to watch and live illustrate the 2024 Paris Summer Olympics.

Published:7/26/2024 8:18:10 PM

|

|

[Politics]

A bullet — or bullet fragment — hit Trump during assassination attempt, FBI says

“What struck former President Trump in the ear was a bullet, whether whole or fragmented into smaller pieces, fired from the deceased subject’s rifle,” the FBI said in a statement Friday.

Published:7/26/2024 7:39:23 PM

|

|

[Congress]

Biden Isn’t Running Again, but House Investigates Who’s Running Government

President Joe Biden is out of the running for a second term, but Congress still wants answers about who’s been running the executive branch and... Read More

The post Biden Isn’t Running Again, but House Investigates Who’s Running Government appeared first on The Daily Signal.

Published:7/26/2024 7:29:42 PM

|

|

[Uncategorized]

Trump Announces He’s Returning To Butler, PA For Another HUGE Rally

Fight! Fight! Fight!

The post Trump Announces He’s Returning To Butler, PA For Another HUGE Rally first appeared on Le·gal In·sur·rec·tion.

Published:7/26/2024 7:20:29 PM

|

[Markets]

On Kamala's "Inspiring" Backstory & The Big Lie About "Unity"

On Kamala's "Inspiring" Backstory & The Big Lie About "Unity"

Authored by James Hickman via SchiffSovereign.com,

The year was 1994.

Former NFL superstar OJ Simpson has just fled from police in the infamous low speed chase in his white Ford Bronco. Pulp Fiction was playing in the cinemas.

And 29 year old Kamala Harris began dating one of the most powerful politicians in the State of California— Willie Brown.

Brown had been in politics for decades at that point and has risen to become the Speaker of California State Assembly, then Mayor of San Francisco.

(And despite having spent his entire adult life in politics, Brown somehow managed to amass a collection of $6,000 suits and expensive sports cars.)

Willie Brown was also at 60 years of age back in 1994 (he’s 90 now), three decades older than his girlfriend Kamala.

Obviously she was in it for love. I’m sure that’s the case.

But it just so happened that, barely a few months into their steamy relationship, Speaker Willie Brown appointed Kamala to multiple, senior-level positions in the state, including a seat on the California Unemployment Insurance Appeals Board and the Medical Assistance Commission.

I’m also sure that Brown appointed his girlfriend due entirely to her competence, and absolutely no other reason whatsoever.

These appointments, along with Sugar Daddy’s public support and endorsement, were integral in Harris’s later campaign to become San Francisco District Attorney, then Attorney General of California in 2010.

Willie Brown also endorsed her for Senate when she declared her candidacy in 2016, and was instrumental in securing her top endorsements, including from Joe Biden and Barack Obama.

Again, all of this success was clearly due exclusively to Kamala’s tremendous competence and nothing more.

Now, a lot of people have been remarking lately that Kamala is a DEI (Diversity, Equity, and Inclusion) hire.

But that’s completely unfair.

Talk about a low blow. I mean, Kamala’s critics have completely missed the point that this woman— who claims to embody female empowerment— got her start by having sex with a powerful California politician 30 years her senior.

So let’s give credit where credit is due: she slept her way to the top well before she became a DEI hire.

In fact it wasn’t until she was picked to be Joe Biden’s running mate that she started benefiting from the DEI obsession.

Curiously, it is now considered racist to even bring this up. CNN has decided that calling Vice President Kamala Harris a “DEI Candidate” is a “pseudonym for the N-word” and “racist dog whistle”.

That’s absurd. Joe Biden’s entire presidency has been about promoting DEI candidates, and he admitted this himself recently when he said:

“To me the values of Diversity, Equality, Inclusion are literally— and that’s not kidding— the core strengths of America. That’s why I’m proud to have the most diverse administration in history that taps into the full talents of our country. It starts at the top with the Vice President.”

Biden also made it perfectly clear in 2020 that he wanted to select a woman of color as his running mate.

So why exactly is it controversial to assert that Kamala was a DEI hire? Is it also controversial that the sky is blue, or that Michael Jordan was an exceptional basketball player?

But these people in charge have a way of acting offended about even the most basic and obvious truths. It’s quite a talent.

Speaking of talent, Kamala has none.

Whenever she opens her mouth, she is as incompressible as Joe Biden yet without the excuse of age and dementia. Like this gem:

“So I think it’s very important… for us, at every moment in time, and certainly this one, to see the moment in time in which we exist and are present, and to be able to contextualize it, to understand where we exist in the history and in the moment as it relates not only to the past, but the future.”

This is also the person that was put in charge of the border security, which has been a total disaster. But in her televised explanation, she justified having not been to the border by saying she hadn’t been to Europe either.

Wow, really racking up those foreign policy credentials!

And on the topic of foreign policy, check out this inspiring quote as Kamala showcased her encyclopedic understanding of European affairs:

“Ukraine is a country in Europe. It exists next to another country called Russia. Russia is a bigger country. Russia is a powerful country. Russia decided to invade a smaller country called Ukraine, so, basically, that’s wrong.”

Note that this wasn’t an interview on Nickelodeon or some event with elementary school kids. This was an actual response in a real interview about the war in Ukraine.

One of my favorite Kamala stories, though, is when she visited Puerto Rico earlier this year.

Protesters were in the streets of San Juan, singing in Spanish. Kamala merrily clapped along, until an aide quietly whispered that the song was protesting her visit as a representation of the federal government’s “colonization” of Puerto Rico.

Her track record as a prosecutor is also far from impressive.

As the Attorney General of California, she prosecuted and incarcerated cannabis users. But in 2019, asked if she herself had ever smoked weed, she cackled and said, “I have. And I inhaled.”

In 2014, Kamala’s office argued to keep non-violent inmates (including from minor drug convictions) locked up so that the state would have free prison labor to fight wildfires.

But Kamala would prefer that her Black Lives Matters voters forget about all that.

The Big Lie they are now force-feeding us is that the party of democracy is energized and united around Kamala Harris.

Personally I think they are terrified and desperate. Deep down they know this woman is an incompetent buffoon. And more importantly, they are still incredibly fractured.

Just look what the radical left has been doing this very week.

Their Marxist foot soldiers have been busy burning American flags, defacing public monuments, and hoisting Hamas flags, while chanting “Allahu Akbar!” in the streets. Curiously most of them are white atheist 20-somethings from upper-middle class upbringings.

And some of the Left’s most prominent politicians boycotted a speech given by the Prime Minister of Israel— one of America’s strongest allies during its time of war.

This continues to look like a group that is completely out of touch, but insists that they have everything under control… which is pretty much par for the course given the last few years under Biden.

Having said all that, it would be foolish to think they won’t pull out all the stops— continue to create all the propaganda, tell whatever lie, manufacture whatever hoax, and suppress whatever truth is necessary to win.

|

|

[Olympic Games (2024)]

Doused by Rain, Paris Opens Its Games With a Boat Party on the Seine

Undeterred by arson attacks on rail lines earlier in the day, the Parade of Nations continued beneath a glittering Eiffel Tower, where Celine Dion belted out a love anthem.

Published:7/26/2024 7:20:29 PM

|

|

[Markets]

Ackman’s Pershing Square USA says IPO is still happening, despite delay notice

Published:7/26/2024 6:45:21 PM

|

|

[World]

Olympic Ceremonies on the Seine were a daring feat. Paris stuck the landing.

Paris transformed into a spectacular stage — and demonstrated that bold thinking could bring a shine back to a global event that has seen its popularity slump.

Published:7/26/2024 6:27:48 PM

|

|

[World]

Ackman’s Pershing Square USA says IPO is still happening, despite NYSE delay notice

The timeline for the initial public offering of billionaire investor Bill Ackman’s new investment fund Pershing Square USA appeared to get a bit hazier on Friday, according to the New York Stock Exchange — though the fund claimed it was still moving ahead with the offering.

Published:7/26/2024 6:27:48 PM

|

[Entertainment]

Angelina Jolie & Brad Pitt's Daughter Shiloh Is "Dedicated" to Dancing

Shiloh Jolie-Pitt has just gotta dance.

The daughter of Angelina Jolie and Brad Pitt is no stranger to the limelight with two famous parents, but the 18-year-old is finding ways to forge her own...

Shiloh Jolie-Pitt has just gotta dance.

The daughter of Angelina Jolie and Brad Pitt is no stranger to the limelight with two famous parents, but the 18-year-old is finding ways to forge her own...

Published:7/26/2024 6:19:17 PM

|

|

[Uncategorized]

Flashback: Kamala Harris Wanted to ‘Reexamine ICE’ and Suggested ‘Parallels Between ICE and the KKK’

The border crisis will only get worse under her regime.

The post Flashback: Kamala Harris Wanted to ‘Reexamine ICE’ and Suggested ‘Parallels Between ICE and the KKK’ first appeared on Le·gal In·sur·rec·tion.

Published:7/26/2024 6:19:17 PM

|

|

[57137c40-771d-53cb-8261-e224514d08b1]

Top Democratic super PAC launches massive $50M ad spend for Harris leading up to DNC

Democratic super PACs launched a massive spending campaign for Kamala Harris this week as she approaches the Democratic National Convention in Chicago next month.

Published:7/26/2024 6:19:17 PM

|

[Markets]

In Defense Of Standardized Testing

In Defense Of Standardized Testing

Authored by John Hilton-O'Brien via The Epoch Times,

There’s been a lot of noise about getting rid of standardized exams. Supposedly, minorities are at a disadvantage with them. Consequently, the argument runs, doing away with standardized exams will allow more minorities to enter into prestigious career paths, enhancing “social justice.”

If you look more closely at the history of standardized exams, however, this isn’t true. Instead, getting rid of standardized exams serves the interests of an elite class—and will permanently lock minorities and entire classes of people out of social advancement.

Standardized tests have already been eliminated in a number of places. Oregon, Wisconsin, and New Hampshire no longer have bar exams. The University of California no longer uses Standardized Admission Tests as part of its entrance requirement, just like SUNY and an association of Ivy League universities. And in Canada, many provinces are decreasing the use of standardized tests.

But here’s the problem. Without the tests, how do we decide who gets admitted to university?

(Unless, as in the movie “Idiocracy,” we get rid of them.)

How do we decide who becomes a lawyer or a doctor?

The most famous example of a standardized exam is the Public Service Commission Test used to vet applications for government civil service. If we do away with those, how do we decide who is qualified to become a public servant?

Civil service examinations have been around for thousands of years. Imperial China used the examinations to allow young men from any social class or background to enter the imperial bureaucracy. Before that, and during dynasties where the exams were not used, entry into the patrician or bureaucratic class had been restricted by birth.

Of course, entry still wasn’t easy. In imperial China, even more than today, you wouldn’t have the resources to study for the difficult standard exams unless you had access to money. Then, as now, money was a good indicator of success.

But the point is that money wasn’t the only indicator. In fact, the imperial system came to run the exams as a double blind, going so far as to have exam responses copied out by another person, to ensure that nobody received favourable grading because a grader recognized their calligraphy.

The China’s worst times are instructive for us, too. When the Mongol Yuan dynasty took over, they did away with the exams. When they returned them, only 25 percent of the exam seats were allotted to the majority Han Chinese ethnicity. How did they decide which Han wrote the exams? Letters of reference, of course, from existing bureaucrats or their Mongol overlords. Without open standardized exams, in other words, advancement was based on who you knew.

That’s becoming true in the West today—complete with attempts at Yuan-style race-based admissions.

As anybody who has ever applied to an elite university knows, reference letters are already important. If you’re entering a profession like medicine or law, a good reference letter can mean the difference between getting that coveted residency and not. Reference letters already reinforce pedigree—what university or prep school you attended. Even admissions specialists who hate reference letters admit they make a difference—and expensive prep schools write much better reference letters.

In the absence of standardized tests and grading, reference letters will become even more important. And how are those rated? By who wrote them. The letter from an elite prep school is noticed as a letter from an elite school, regardless of content, and that tells the admissions expert what she or he needs to know.

Who decides who becomes a lawyer? The partners in the law firms. And how will they choose their candidates? In the absence of a standardized bar exam, admission will depend on who the partners know. The same is true for doctors.

If we wind up doing away with the public service admission tests, worse will follow. Imagine a government whose civil service is hired based on who they know. The West has been here before—but not since the days of the absolute monarchs.

So, who benefits from ending standardized tests? We suspect it is not the students.

There is a sort of feedback loop inside the education industry, when the same people designing the curriculum are the ones testing for it. Internal tests such as “performance-based assessment” check only to see if the students can do what the teacher told them to do. They don’t check to see if it will help the student in the environment that they are going to. In other words, little Suzy may consistently get top marks for her “holistic” language arts classes—but when she graduates, outsiders find that she can’t read or write.

Externally administered standardized tests are the best way to make sure that the education system helps anyone aside from the teachers’ unions.

You know who isn’t interested in dropping standardized test scores? Minorities who aren’t part of the “favoured” few. Part of the reason that elite U.S. universities are dropping standardized exams is that the U.S. Supreme Court told them that they couldn’t have race-based admission courses that left Asian-American students out in the cold. Dropping standardized tests allows universities to engage in discrimination without legal pushback. The racial policies of the Yuan and Qin dynasties live again in the Ivy League.

Today, the abandonment of standardized testing is done specifically to disadvantage poor whites, as well as Asian students. The official reason given is that institutions—which claim to be guided by the highest ideals—can favour African American and Hispanic students in the United States, and (hopefully) First Nations in Canada. In the name of social justice, of course.

But without standardized tests, admission decisions are arbitrary. Tomorrow, African-Americans, Hispanics, and First Nations may find that not all of them are favoured. Instead, favour will go to particular African American families, particular Hispanic families, and particular First Nations families. Skin tone doesn’t tell us the real story here.

The simple truth of North American society is that we are developing a class system. Those trying to get rid of standardized testing tell us outright that their motive is to decide who joins their social class of educated functionaries. They are trying to restrict entry. They are trying to become a self-selecting aristocracy.

The only mechanism that ensures everyone with academic ability can have access to universities, professions, and civil service is standardized exams. We abandon them at our peril.

|

|

[Entertainment]

A grand vision guides unprecedented Opening Ceremonies down the Seine

Thomas Jolly’s liberated take on the opening ceremonies was a love letter to France, and a testament to his own ambitions.

Published:7/26/2024 6:10:50 PM

|

|

[Politics]

By the Way, Kamala Harris Is a Dangerous Authoritarian

With some hard work, pluck, the right boyfriend, and a bit of genetic luck, Vice President Kamala Harris has found her way onto the presidential... Read More

The post By the Way, Kamala Harris Is a Dangerous Authoritarian appeared first on The Daily Signal.

Published:7/26/2024 6:10:50 PM

|

|

[Open Threads]

Bookworm Beat 7/26/24: Memes from the Banana Republic of America

Currently, we are not a serious or constitutional country. We are a Third World joke. And speaking of jokes, have I got memes for you...

Published:7/26/2024 6:10:50 PM

|

|

[ef9c0370-7e8e-56d2-8152-9d9eccc70067]

HGTV star Christina Hall slams ex Josh Hall amid divorce: 'This one is personal'

Christina Hall has spoken out since filing for divorce from Josh Hall earlier this month. The HGTV star noted that she's "not as nice and quiet" as she used to be.

Published:7/26/2024 6:10:50 PM

|

|

[Markets]

S&P 500’s turbulent week ends with stocks rallying after inflation report

U.S. stocks rebounded Friday after a turbulent week for the S&P 500.

Published:7/26/2024 6:10:50 PM

|

|

[]

Automaker Stellantis Takes Big Hit, Talking Big Changes

Published:7/26/2024 6:10:50 PM

|

|

[Markets]

Why Zelle scams worry lawmakers so much — and how they could hurt you

Published:7/26/2024 6:10:50 PM

|

|

[]

Knockin' Off Early Cafe

a gull is unbothered by the weather Mark Dobson/@wildseascapes Barracuda attacks shark. Jumping off a cliff in a wingsuit is so 2022. Now we all jump off cliffs in wingsuits with a flare burning on our foot. Sniping pictures...

Published:7/26/2024 6:10:50 PM

|

|

[Election Integrity]

WATCH: ‘Kamala’s Baggage’ on ‘The Tony Kinnett Cast’

On the latest episode of “The Tony Kinnett Cast,” we ford a river of radical statements from the de facto Democratic nominee, Kamala Harris. From... Read More

The post WATCH: ‘Kamala’s Baggage’ on ‘The Tony Kinnett Cast’ appeared first on The Daily Signal.

Published:7/26/2024 5:31:38 PM

|

[Entertainment]

Justin Timberlake Wasn't Intoxicated During DWI Arrest, Lawyer Says

Justin Timberlake is trying to say bye, bye, bye to his DWI case with a simple defense.

Following a court hearing relating to the "SexyBack" singer's arrest in the Hamptons last month, his lawyer...

Justin Timberlake is trying to say bye, bye, bye to his DWI case with a simple defense.

Following a court hearing relating to the "SexyBack" singer's arrest in the Hamptons last month, his lawyer...

Published:7/26/2024 5:31:38 PM

|

|

[Business / Artificial Intelligence]

Open Source AI Has Founders—and the FTC—Buzzing

DC went to YC to talk OS.

Published:7/26/2024 5:31:38 PM

|

|

[World]

Weekend Parting Shot: Mark Cuban's Poll Backfires Spectacularly

Published:7/26/2024 5:31:38 PM

|

|

[3756c92b-698f-5b39-bf6e-1708da438824]

Harvey Weinstein hospitalized in NYC with COVID-19 and double pneumonia

Disgraced movie mogul Harvey Weinstein has been hospitalized at New York's Bellevue Hospital Prison Ward after testing positive for COVID-19 and contracting double pneumonia, according to his representative.

Published:7/26/2024 5:31:38 PM

|

|

[]

In a Terrible Blow to 'Ear Truthers' the FBI CONFIRMS President Trump Was Struck with a Bullet

Published:7/26/2024 5:31:38 PM

|

|

[]

Facebook and Instagram Have Decided That Olympic Shooting Sports Are Dangerous and Glorify Violence

So no Olympic shooter can be shown with their guns. Imagine Instagram blocking non-followers from seeing a post by Steph Curry because it featured a basketball, or a post from U.S. Olympic track star Noah Lyles that highlighted his running...

Published:7/26/2024 5:31:38 PM

|

|

[Politics]

Ali: Kamala Harris has a campaign soundtrack: Beyoncé's 'Freedom'

Beyoncé gives Vice President Kamala Harris her blessing to use her song 'Freedom,' an explosive expression of empowerment, at campaign events.

Published:7/26/2024 4:48:36 PM

|

|

[London / Europe]

'Gayest Olympics Ever': Paris Olympics Opens with Suggested Bisexual Threesome

From the moment that the 2024 Paris Olympics launched its opening ceremony with an elaborate street dance scene, it became clear that pushing the LGBTQ agenda was at the top of the program with a sequence that made the opening the "gayest opening ceremony ever."

The post ‘Gayest Olympics Ever’: Paris Olympics Opens with Suggested Bisexual Threesome appeared first on Breitbart.

Published:7/26/2024 4:48:36 PM

|

|

[Democrats]

Bob Casey Praises Radical Admiral Rachel Levine's 'Deep Qualifications'

Sen. Bob Casey has largely avoided taking a public stance on the most controversial aspects of the debate over transgender issues. But the Pennsylvania Democrat was more forthcoming in a questionnaire seeking the endorsement of an LGBT group earlier this year, according to documents obtained by the Washington Free Beacon.

The post Bob Casey Praises Radical Admiral Rachel Levine's 'Deep Qualifications' appeared first on .

Published:7/26/2024 4:48:36 PM

|

|

[Uncategorized]

President Trump Warmly Greets Israeli Prime Minister Netanyahu At Mar-a-Lago, Warns of WWIII if Kamala Wins

"You are closer to a third World War right now than at any time since the Second World War. We've never been so close because we have incompetent people running the country."

The post President Trump Warmly Greets Israeli Prime Minister Netanyahu At Mar-a-Lago, Warns of WWIII if Kamala Wins first appeared on Le·gal In·sur·rec·tion.

Published:7/26/2024 4:48:36 PM

|

|

[World]

[John Ross] Short Circuit: A Roundup of Recent Federal Court Decisions

Venue roulette, a sham affidavit, and uninspected bloomin’ onions.

Published:7/26/2024 4:48:36 PM

|

|

[Uncategorized]

Quadrupled Border Crossings

Illegal border crossings quadrupled immediately after Kamala Harris was put in charge of slowing them down. Why Illegal Border Crossings Are So High – The New York Times Biden tasks Harris with ‘stemming the migration’ on southern border

Published:7/26/2024 4:48:36 PM

|

[Entertainment]

MLB Player Freddie Freeman's Son, 3, Can't Stand, Walk Amid Infection

MLB's Freddie Freeman and his family are in the midst of a difficult time.

The Dodgers first baseman and his wife Chelsea Freeman shared that their 3-year-old son Maximus was rushed to the...

MLB's Freddie Freeman and his family are in the midst of a difficult time.

The Dodgers first baseman and his wife Chelsea Freeman shared that their 3-year-old son Maximus was rushed to the...

Published:7/26/2024 4:48:36 PM

|

|

[e61fc0c9-0378-5b64-8869-4444a6a96cba]

Trump announces plan to hold rally in Pennsylvania town of failed assassination attempt

Published:7/26/2024 4:48:36 PM

|

|

[Congress]

Jay Stefany to Lead Navy’s New Maritime Industrial Base Program Office

The Navy is standing up a new maritime industrial base program office and has tapped one of its career civil servants to take the helm. Jay Stefany, who previously performed the duties of the assistant secretary of the Navy for research, development and acquisition (RDA), will lead the office as a direct reporting program manager, according to a Friday Navy news release. “Building on the progress and achievements of the Submarine Industrial Base (SIB) and Surface Combatant Industrial Base (SCIB) programs, DPRM-MIB creates a cohesive organization focused on the health of the maritime industrial base centered on construction and sustainment,”

Published:7/26/2024 4:48:36 PM

|

|

[Railroads]

Rail Sabotage Blights an Olympic Moment for France

The arson attacks were carefully planned to cause maximum disruption on a train network so vast it is virtually impossible to fully secure.

Published:7/26/2024 4:48:36 PM

|

|

[Climate News]

While the west watches a game show, the rest build a new world order

We are becoming so fixated on the simple, the sensational, that we’re not noticing the storm clouds.

Published:7/26/2024 4:48:36 PM

|

|

[Markets]

Why CrowdStrike is likely shielded from billions in customer losses caused by its outage

The outage is believed to have caused $5.4 billion in losses for big enterprises — but various factors help insulate the cybersecurity company.

Published:7/26/2024 4:48:36 PM

|

|

[Markets]

Elon Musk said his trans child was ‘dead.’ She’s calling him out.

Vivian Jenna Wilson, Elon Musk’s estranged daughter, disputes his characterization of her childhood.

Published:7/26/2024 4:48:36 PM

|

|

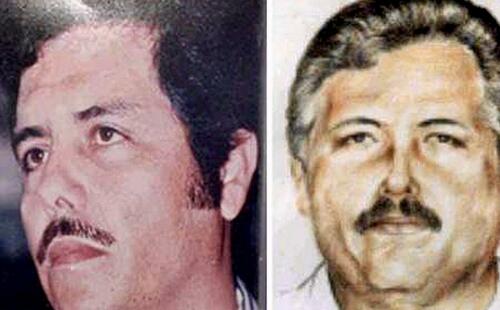

[World]

Mexico wasn’t told of cartel arrests until kingpins were in U.S. custody

The capture of Sinaloa cartel leaders Ismael “El Mayo” Zambada and Joaquín Guzmán López was a historic coup against a syndicate that’s flooded the United States with fentanyl.

Published:7/26/2024 4:48:36 PM

|

|

[Entertainment]

Celine Dion returns to stage at Opening Ceremonies

Celine Dion performed at the Olympics Opening Ceremonies for the first time since she was diagnosed with the rare neurological disorder stiff-person syndrome.

Published:7/26/2024 4:48:36 PM

|

|

[Markets]

Some of 2024’s most popular trades coming undone after hitting ‘stupid’ levels

Published:7/26/2024 4:48:36 PM

|

[Markets]

US Maternal Mortality Rates Remain the Highest Among High-Income Countries: Research

US Maternal Mortality Rates Remain the Highest Among High-Income Countries: Research

Authored by George Citroner via The Epoch Times (emphasis ours),

The United States continues to lead developed nations in maternal deaths, with some experts calling the recent rise unprecedented despite spending trillions on health care.

Mental health issues, racial disparities, and a shortage of specialized care providers all contribute to this “crisis,” according to a report by the Commonwealth Fund, an independent research foundation that focuses on health care issues.

(Sopotnicki/Shutterstock) (Sopotnicki/Shutterstock)

A Shortage of Health Care Professionals

The recent analysis showed that the United States had a maternal mortality rate of 22 deaths per 100,000 live births in 2022, significantly higher than other high-income countries—often more than doubling or even tripling their figures, according to the report. Half of the countries in the analysis reported fewer than five maternal deaths per 100,000 live births.

The increase is “stunning and unprecedented,” Dr. James Thorp, an obstetrician-gynecologist at the Sisters of St. Mary’s Health System in Saint Louis, Missouri, told The Epoch Times, referring to an increase in maternal deaths over the past few years. “And it really went ... kind of unrecognized, kind of just slipped under the door, so to speak,” he noted.

Maternal mortality is defined as the death of a woman while pregnant or within 42 days of pregnancy’s end from any cause related to or aggravated by pregnancy or its management, excluding accidental or incidental causes. About 75 percent of maternal deaths worldwide are caused by severe bleeding, infections, high blood pressure during pregnancy, complications from delivery, and unsafe abortion, according to the World Health Organization (WHO).

In the United States, most maternal deaths occur during the postpartum period—especially the late postpartum period between 43 and 365 days after birth, as per the Commonwealth Fund’s research. This is a critical time when women face increased risks of severe bleeding, high blood pressure, and infection.

The analysis highlights a shortage of maternal care providers in the United States, with just 16 midwives and obstetricians per 1,000 live births. Comprehensive postpartum support, including home visits from midwives and nurses, is vital to address maternal and mental health concerns and assess social health drivers, the authors wrote.