|

[Markets]

Ackman’s Pershing Square USA says IPO is still happening, despite delay notice

Published:7/26/2024 6:45:21 PM

|

[Markets]

In Defense Of Standardized Testing

In Defense Of Standardized Testing

Authored by John Hilton-O'Brien via The Epoch Times,

There’s been a lot of noise about getting rid of standardized exams. Supposedly, minorities are at a disadvantage with them. Consequently, the argument runs, doing away with standardized exams will allow more minorities to enter into prestigious career paths, enhancing “social justice.”

If you look more closely at the history of standardized exams, however, this isn’t true. Instead, getting rid of standardized exams serves the interests of an elite class—and will permanently lock minorities and entire classes of people out of social advancement.

Standardized tests have already been eliminated in a number of places. Oregon, Wisconsin, and New Hampshire no longer have bar exams. The University of California no longer uses Standardized Admission Tests as part of its entrance requirement, just like SUNY and an association of Ivy League universities. And in Canada, many provinces are decreasing the use of standardized tests.

But here’s the problem. Without the tests, how do we decide who gets admitted to university?

(Unless, as in the movie “Idiocracy,” we get rid of them.)

How do we decide who becomes a lawyer or a doctor?

The most famous example of a standardized exam is the Public Service Commission Test used to vet applications for government civil service. If we do away with those, how do we decide who is qualified to become a public servant?

Civil service examinations have been around for thousands of years. Imperial China used the examinations to allow young men from any social class or background to enter the imperial bureaucracy. Before that, and during dynasties where the exams were not used, entry into the patrician or bureaucratic class had been restricted by birth.

Of course, entry still wasn’t easy. In imperial China, even more than today, you wouldn’t have the resources to study for the difficult standard exams unless you had access to money. Then, as now, money was a good indicator of success.

But the point is that money wasn’t the only indicator. In fact, the imperial system came to run the exams as a double blind, going so far as to have exam responses copied out by another person, to ensure that nobody received favourable grading because a grader recognized their calligraphy.

The China’s worst times are instructive for us, too. When the Mongol Yuan dynasty took over, they did away with the exams. When they returned them, only 25 percent of the exam seats were allotted to the majority Han Chinese ethnicity. How did they decide which Han wrote the exams? Letters of reference, of course, from existing bureaucrats or their Mongol overlords. Without open standardized exams, in other words, advancement was based on who you knew.

That’s becoming true in the West today—complete with attempts at Yuan-style race-based admissions.

As anybody who has ever applied to an elite university knows, reference letters are already important. If you’re entering a profession like medicine or law, a good reference letter can mean the difference between getting that coveted residency and not. Reference letters already reinforce pedigree—what university or prep school you attended. Even admissions specialists who hate reference letters admit they make a difference—and expensive prep schools write much better reference letters.

In the absence of standardized tests and grading, reference letters will become even more important. And how are those rated? By who wrote them. The letter from an elite prep school is noticed as a letter from an elite school, regardless of content, and that tells the admissions expert what she or he needs to know.

Who decides who becomes a lawyer? The partners in the law firms. And how will they choose their candidates? In the absence of a standardized bar exam, admission will depend on who the partners know. The same is true for doctors.

If we wind up doing away with the public service admission tests, worse will follow. Imagine a government whose civil service is hired based on who they know. The West has been here before—but not since the days of the absolute monarchs.

So, who benefits from ending standardized tests? We suspect it is not the students.

There is a sort of feedback loop inside the education industry, when the same people designing the curriculum are the ones testing for it. Internal tests such as “performance-based assessment” check only to see if the students can do what the teacher told them to do. They don’t check to see if it will help the student in the environment that they are going to. In other words, little Suzy may consistently get top marks for her “holistic” language arts classes—but when she graduates, outsiders find that she can’t read or write.

Externally administered standardized tests are the best way to make sure that the education system helps anyone aside from the teachers’ unions.

You know who isn’t interested in dropping standardized test scores? Minorities who aren’t part of the “favoured” few. Part of the reason that elite U.S. universities are dropping standardized exams is that the U.S. Supreme Court told them that they couldn’t have race-based admission courses that left Asian-American students out in the cold. Dropping standardized tests allows universities to engage in discrimination without legal pushback. The racial policies of the Yuan and Qin dynasties live again in the Ivy League.

Today, the abandonment of standardized testing is done specifically to disadvantage poor whites, as well as Asian students. The official reason given is that institutions—which claim to be guided by the highest ideals—can favour African American and Hispanic students in the United States, and (hopefully) First Nations in Canada. In the name of social justice, of course.

But without standardized tests, admission decisions are arbitrary. Tomorrow, African-Americans, Hispanics, and First Nations may find that not all of them are favoured. Instead, favour will go to particular African American families, particular Hispanic families, and particular First Nations families. Skin tone doesn’t tell us the real story here.

The simple truth of North American society is that we are developing a class system. Those trying to get rid of standardized testing tell us outright that their motive is to decide who joins their social class of educated functionaries. They are trying to restrict entry. They are trying to become a self-selecting aristocracy.

The only mechanism that ensures everyone with academic ability can have access to universities, professions, and civil service is standardized exams. We abandon them at our peril.

|

|

[Markets]

S&P 500’s turbulent week ends with stocks rallying after inflation report

U.S. stocks rebounded Friday after a turbulent week for the S&P 500.

Published:7/26/2024 6:10:50 PM

|

|

[Markets]

Why Zelle scams worry lawmakers so much — and how they could hurt you

Published:7/26/2024 6:10:50 PM

|

|

[Markets]

Why CrowdStrike is likely shielded from billions in customer losses caused by its outage

The outage is believed to have caused $5.4 billion in losses for big enterprises — but various factors help insulate the cybersecurity company.

Published:7/26/2024 4:48:36 PM

|

|

[Markets]

Elon Musk said his trans child was ‘dead.’ She’s calling him out.

Vivian Jenna Wilson, Elon Musk’s estranged daughter, disputes his characterization of her childhood.

Published:7/26/2024 4:48:36 PM

|

|

[Markets]

Some of 2024’s most popular trades coming undone after hitting ‘stupid’ levels

Published:7/26/2024 4:48:36 PM

|

[Markets]

US Maternal Mortality Rates Remain the Highest Among High-Income Countries: Research

US Maternal Mortality Rates Remain the Highest Among High-Income Countries: Research

Authored by George Citroner via The Epoch Times (emphasis ours),

The United States continues to lead developed nations in maternal deaths, with some experts calling the recent rise unprecedented despite spending trillions on health care.

Mental health issues, racial disparities, and a shortage of specialized care providers all contribute to this “crisis,” according to a report by the Commonwealth Fund, an independent research foundation that focuses on health care issues.

(Sopotnicki/Shutterstock) (Sopotnicki/Shutterstock)

A Shortage of Health Care Professionals

The recent analysis showed that the United States had a maternal mortality rate of 22 deaths per 100,000 live births in 2022, significantly higher than other high-income countries—often more than doubling or even tripling their figures, according to the report. Half of the countries in the analysis reported fewer than five maternal deaths per 100,000 live births.

The increase is “stunning and unprecedented,” Dr. James Thorp, an obstetrician-gynecologist at the Sisters of St. Mary’s Health System in Saint Louis, Missouri, told The Epoch Times, referring to an increase in maternal deaths over the past few years. “And it really went ... kind of unrecognized, kind of just slipped under the door, so to speak,” he noted.

Maternal mortality is defined as the death of a woman while pregnant or within 42 days of pregnancy’s end from any cause related to or aggravated by pregnancy or its management, excluding accidental or incidental causes. About 75 percent of maternal deaths worldwide are caused by severe bleeding, infections, high blood pressure during pregnancy, complications from delivery, and unsafe abortion, according to the World Health Organization (WHO).

In the United States, most maternal deaths occur during the postpartum period—especially the late postpartum period between 43 and 365 days after birth, as per the Commonwealth Fund’s research. This is a critical time when women face increased risks of severe bleeding, high blood pressure, and infection.

The analysis highlights a shortage of maternal care providers in the United States, with just 16 midwives and obstetricians per 1,000 live births. Comprehensive postpartum support, including home visits from midwives and nurses, is vital to address maternal and mental health concerns and assess social health drivers, the authors wrote.

The findings support those of a 2020 study published in The Lancet Global Health, which suggested that integrating midwives into health care delivery could provide 80 percent of essential maternal care, potentially reducing maternal deaths by 22 percent, neonatal deaths by almost 23 percent, and stillbirths by 14 percent.

Many Factors Contribute to the Increase

Several complex factors contribute to the high maternal mortality rates in the United States. These include an aging demographic, the ongoing obesity epidemic, and associated health problems.

Research shows that more people are having children later in life or are becoming pregnant with chronic conditions such as obesity or cardiovascular disease. These factors increase the risk of complications during pregnancy and childbirth.

The rising rate of cesarean sections may also play a role, as this procedure has been linked to increased mortality risks for both the mother (from blood clots or complications of anesthesia) and the child.

A report by the U.S. Centers for Control and Prevention (CDC), published in September 2022, found that mental health conditions were the most common underlying cause of pregnancy-related deaths where a cause was identified. These conditions, including death by suicide and overdose or poisoning linked to substance use disorders, contributed to 23 percent of fatalities, surpassing infection (9 percent), hemorrhage (14 percent), and cardiac conditions (13 percent).

There is also a disparity in health care outcomes relative to spending, according to Dr. Thorp.

The United States has higher maternal death rates than India despite spending far more on health care. While the United States spends about $14,000 per person annually, India spends only $21 per person. Yet India, with four times the U.S. population, has “a better grade than we do,” Dr. Thorp said.

|

[Markets]

Navy To Expunge Records For SEALs, Sailors Who Refused COVID Vaccines

Navy To Expunge Records For SEALs, Sailors Who Refused COVID Vaccines

Authored by Zachary Stieber via The Epoch Times,

The U.S. Navy has agreed to correct the records of SEALs and sailors who declined to receive COVID-19 vaccines due to their religious beliefs, under a settlement approved by a federal court on July 24.

“Defendants agree to re-review the personnel records of all class members to ensure that the U.S. Navy has permanently removed records indicating administrative separation processing or proceedings, formal counseling, and non-judicial punishment actions taken against the class members solely on the basis of non-compliance with the COVID-19 vaccine mandate and adverse information related to non-compliance with the COVID-19 vaccine mandate,” the settlement agreement states.

The review must be finished within nine months, according to the agreement.

The Navy has also agreed to review the records of class members discharged over refusal to receive a COVID-19 shot. Officials “will remove any indication from that service member’s records that he or she was discharged for misconduct” and make sure the discharged members are listed as eligible for enlistment.

The expungement of records must be completed within one year according to the agreement.

All Navy members who filed a religious request for an exemption from the Navy’s COVID-19 vaccine mandate and were actively serving as of March 28, 2022, are covered by the settlement. That includes people who rescinded their accommodation requests in order to leave the military.

Some 4,339 individuals are affected by the settlement, according to court documents.

“This has been a long and difficult journey, but the Navy SEALs never gave up,” Danielle Runyan, senior counsel at the First Liberty Institute, said in a statement.

“We are thrilled that those members of the Navy who were guided by their conscience and steadfast in their faith will not be penalized in their Navy careers.”

The Navy declined to comment on the settlement.

The lawsuit, filed in 2021 by the institute on behalf of Navy personnel, prompted the court system in 2022 to block the COVID-19 vaccine mandate for members seeking religious accommodation. In 2023, the Department of Defense rescinded the mandate for all military branches, including the Navy, per a bill approved by Congress and signed by President Joe Biden.

The settlement features the Navy committing to posting a statement on its website saying in part that the branch “supports diverse expressive activities, to include religious expression, and recognizes that through inclusion we are a better military and stronger nation for it.” The statement will say accommodating religious beliefs is “a pillar of the Navy’s commitment to treating all sailors with dignity and respect.”

The Navy has also agreed to list information advising members of their rights to request religious accommodations, create a training presentation for Navy supervisors and commanders, and pay $1.5 million in attorneys’ fees.

Individuals who believe they are part of the class to which the agreement applies can visit First Liberty Institute’s website for the settlement.

More than 16,000 military members filed religious accommodation requests as of January 2023. Many of the requests were denied. If members received a denial but still refused to receive a COVID-19 vaccine, they were often booted from the force. Branches discharged 7,705 members for not complying with the COVID-19 vaccine mandate. The Navy discharged 1,566 members.

When the Navy discharged members, it gave them reentry codes that made them ineligible for reenlistment.

The Army and Air Force violated their own rules in handling exemption requests in a timely manner, the Pentagon’s inspector general said earlier this year, while the Marines and Navy generally met their timeline requirements.

The Navy, though, was among the branches that the watchdog found used incorrect codes for members who were granted exemptions. Officials attributed the incorrect codes to clerical errors.

|

|

[Markets]

Paris Olympics offer a reset for sponsors after years of troubled games

The Paris Summer Olympics could mark a reset for major sponsors after years of games held against the backdrop of geopolitical issues and the COVID-19 pandemic, according to branding expert Jim Andrews.

Published:7/26/2024 2:39:23 PM

|

[Markets]

Fair Share? Yellen Says US Opposed To Global Wealth Tax On Ultra-Rich

Fair Share? Yellen Says US Opposed To Global Wealth Tax On Ultra-Rich

Authored by Tom Ozimek via The Epoch Times,

A proposal for a worldwide tax on the assets of the ultra-wealthy that’s being pushed by some countries within the G20 does not have the support of the Biden administration, according to Treasury Secretary Janet Yellen.

Ms. Yellen told reporters at a July 25 press conference during the G20 finance ministers meeting in Rio de Janeiro, Brazil, that the United States thinks that a global agreement on taxing ultra-high-net-worth individuals is neither practical nor a particularly good idea.

“Tax policy is very difficult to coordinate globally,” Ms. Yellen said.

“We don’t see a need or really think it’s desirable to try to negotiate a global agreement on that.”

The new global tax on billionaires was proposed by the European Union Tax Observatory last year, and last month, the Brazilian G20 presidency asked its researchers to lay out their proposal in more detail.

French economist Gabriel Zucman, an architect of the proposal, has posited that individuals with more than $1 billion in net worth should be required to pay a minimum annual tax amounting to 2 percent of their wealth, according to a baseline version of what he calls an “ultra-high-net-worth tax.”

The reason the minimum is expressed as a fraction of wealth rather than income is that wealth is far more difficult to manipulate, according to the proposal.

Mr. Zucman estimates in his report to the G20 that the minimum tax on billionaires equal to 2 percent of their wealth would raise between $200 billion and $250 billion per year from about 3,000 individuals. If the tax is extended to individuals worth more than $100 million, that would generate an additional $100 billion to $140 billion a year.

Participating countries would coordinate their efforts at a global level to collect the tax through various domestic instruments, including by a tax on the broad notion of income, as well as a wealth tax.

Now is a good time to implement such a tax, according to the French economist, because bank secrecy laws have been curtailed over the past 15 years through increased global information exchange. A key obstacle to successful implementation is gaps in information exchange, which Mr. Zucman says could be overcome by enhanced surveillance to identify the beneficial owners of assets.

The global ultra-high-net-worth tax proposal is a way to make progressive taxation more effective, according to Mr. Zucman, who argues that contemporary tax systems fail to effectively tax the wealthiest individuals and so undermine tax progressivity and all its purported benefits.

“A progressive tax system strengthens social cohesion and trust in governments to work for the common good,” Mr. Zucman writes in the executive summary of his G20 report.

“It is critical to fund the public goods and services—such as education, health care, public infrastructure—that are engines of economic growth, as well as the investments needed to address the climate crisis.”

Ms. Yellen, in her remarks in Rio de Janeiro, threw cold water on the global ultra-high-net-worth tax, but not on progressive taxation.

“We think that all countries should make sure that their taxation systems are fair and progressive,” Ms. Yellen said.

The Treasury Secretary added that the Biden administration is “strongly supportive of progressive taxation, and making sure that very wealthy high income individuals pay their fair share.”

She highlighted policies proposed by President Joe Biden, such as a billionaires’ tax, which she described as “a very worthwhile initiative.”

President Biden has put forward a proposal for a billionaire’s tax that would set a minimum 25 percent tax for the nation’s billionaires, generating an estimated $500 billion in revenue over a decade.

Critics of a billionaire’s tax have argued it would face significant legal hurdles, including constitutional challenges on grounds of it potentially being recognized as a type of direct tax that is not permitted under the U.S. Constitution.

|

|

[Markets]

Investigation of Delta cancellations focuses on possibly misleading texts

Passengers whose Delta flights were cancelled during a computer meltdown beginning July 19 have reported receiving text messages only offering vouchers, not full refunds as required.

Published:7/26/2024 2:24:58 PM

|

|

[Markets]

Olympians’ families turn to GoFundMe in race to see loved ones compete in Paris

Published:7/26/2024 2:24:58 PM

|

[Markets]

Seller On Amazon Sold Merch Reading "The Only Good Trump Is A Dead One"

Seller On Amazon Sold Merch Reading "The Only Good Trump Is A Dead One"

"Why are you allowing a shirt to be sold that seems to encourage lunatics to attempt to kill members of the Trump family?" commentator and filmmaker Robby Starbuck asked Amazon & founder Jeff Bezos on X, referring to Amazon allowing a seller earlier this week to offer merchandise with the slogan "The Only Good Trump Is A Dead One."

Starbuck said, "Just searched and @Amazon has hoodies too!"

Starbuck's post garnered nearly 800k reads by Friday morning. He said the anti-Trump merch was removed from the Amazon online store on Thursday evening.

Elon Musk chimed in, "This is messed up."

After a FOX Business investigation into the anti-Trump shirts on Thursday afternoon, Amazon told the media outlet that the shirts were removed "due to non-compliance with our guidelines."

"Amazon does not allow products that promote, incite or glorify hatred, violence, racial, sexual or religious intolerance or promote organizations with such views," Amazon stated on its website.

Here's what X users are saying about anti-Trump gear on Amazon:

Sigh, Amazon. Who vets these products internally?

|

|

[Markets]

Southwest Airlines' new seating policy is 'a true blow' for some loyal fliers

Published:7/26/2024 12:07:30 PM

|

[Markets]

Apple's iPhone Falls Out Of China's Top Five As Domestic Brands Soar In Popularity

Apple's iPhone Falls Out Of China's Top Five As Domestic Brands Soar In Popularity

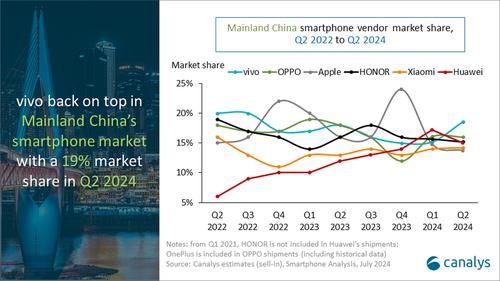

New quarterly smartphone shipment data in China reveal that domestic handset makers have secured all five top spots, pushing Apple from number 5 to number 6.

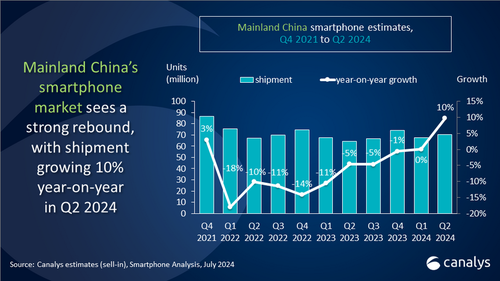

Canalys research shows China's smartphone market recorded 10% year-on-year growth in the second quarter, with shipments exceeding 70 million units.

A further breakdown of the report:

Vivo reclaimed the number one spot by shipping 13.1 million units, capturing a 19% market share. This growth, a 15% increase over the previous year, was driven by strong performance in offline channels and robust online sales during the "618" e-commerce festival. OPPO held onto second place, shipping 11.3 million units, buoyed by the launch of its new Reno 12 series. HONOR was third, with shipments of 10.7 million units, marking a 4% year-on-year increase. Huawei followed closely, taking fourth place with shipments of 10.6 million units, though its growth has slowed slightly. Xiaomi saw a 17% year-on-year increase and re-entered the top five by shipping 10 million units. The significant marketing buzz this quarter surrounding Xiaomi's first electric car, the SU7, was one of the contributors to solid sales of its K70 and flagship 14 series.

Here's the focus:

"Apple ranked sixth with a market share of 14%, a decrease of 2% from the second quarter of the previous year."

Canalys Research Analyst Lucas Zhong said, "It is the first quarter in history that domestic vendors dominate all the top five positions."

Despite Apple's aggressive discounts in the world's largest smartphone market, Tim Cook & company couldn't hold on to the number five spot as market share deteriorated in the quarter.

Apple faces intense competition from Huawei, and Chinese consumers are increasingly abandoning foreign brands for domestic ones as the tech war between Washington and Beijing intensifies.

|

|

[Markets]

‘Like taking candy from a baby’: How Andrew Left allegedly played the market like a fiddle

Touting phony positions and making secret deals with hedge funds were at the heart of the fraud authorities say Left engaged in as part of a broad market-manipulation scheme.

Published:7/26/2024 11:12:12 AM

|

|

[Markets]

How Andrew Left allegedly played the market like a fiddle

Published:7/26/2024 11:12:12 AM

|

[Markets]

Overly-Optimistic Investors Face Potential Disappointment

Overly-Optimistic Investors Face Potential Disappointment

Authored by Lance Roberts via RealInvestmentAdvice.com,

Overly optimistic investor expectations of market returns may be a problem. To wit:

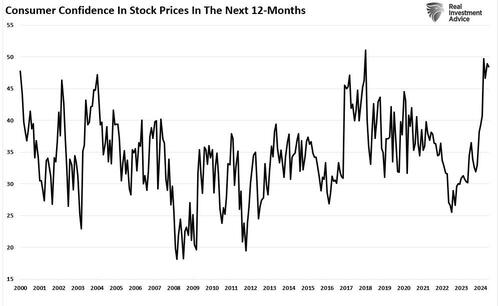

“While consumers are not very confident about the economy, they are highly optimistic about the stock market. In that same consumer confidence report from the Conference Board, the expectations for rising stock prices over the next 12 months are near the highest on record.“

Of course, after a decade of 12% returns, why should they not be optimistic that the future will be much the same as the past? A good example came from a recent discussion with an individual wanting me to review the “financial plan” for their retirement goals. The plan was generated by one of the many “off the shelf” software packages that take all the inputs of income, assets, pensions, social security, etc., and then spits out assumptions of future asset values and drawdowns in retirement.

The problem is that the return assumptions were grossly flawed.

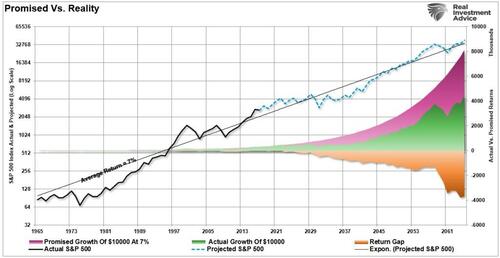

In the vast majority of these plans, the optimistic assumption is that individuals will have a rate of return of somewhere between 6-10% annually heading into retirement and 4-8% thereafter. The first major flaw in the plan is the “compounding” of annual returns over time, which does NOT happen.

“There is a massive difference between AVERAGE and ACTUAL returns on invested capital. Thus, in any given year, the impact of losses destroys the annualized “compounding” effect of money.

The chart below shows the difference between “actual” investment returns and “average” returns over time. See the problem? The purple-shaded area and the market price graph show “average” returns of 7% annually. However, the return gap in “actual returns,” due to periods of capital destruction, is quite significant.”

The second and most important is the future expectation of individual returns over the next 10-20 years.

This second point is what I want to address today.

There are two main reasons why returns over the next decade or two are currently overestimated. The first is a “you problem,” and the second is “math.”

It’s A You Problem

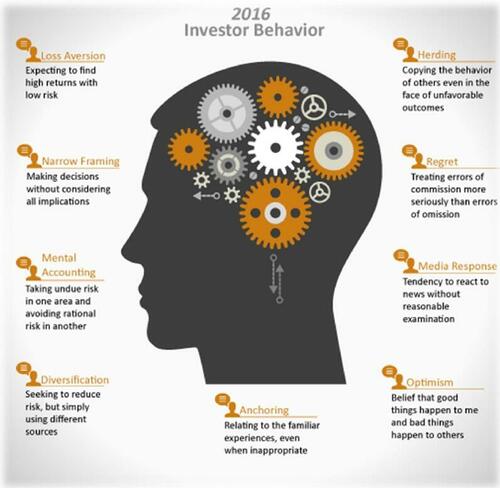

Back in 2016, I wrote an article discussing a Dalbar investor study explaining why investors consistently “suck” at investing. As I detailed in that article, one of the biggest impediments to achieving long-term investment returns is the impact of emotionally driven investment mistakes.

Investor psychology helps us to understand the thoughts and actions that lead to poor decision-making. That psychology drives the “buy high/sell low” syndrome and the traps, triggers, and misconceptions that lead to irrational mistakes that reduce returns over time.

As the Dalbar study showed, nine distinct behaviors impede optimistic investors based on their personal experiences and unique personalities.

The most significant problems for individuals are the “herding effect” and “loss aversion.”

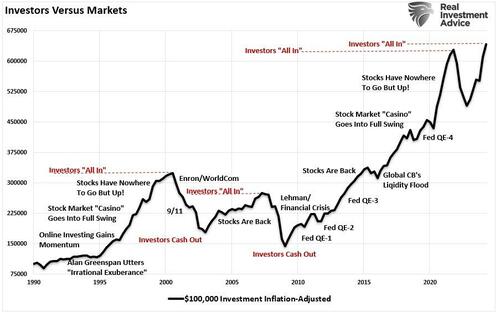

These two behaviors tend to function together compounding the issues of investor mistakes over time. As markets are rising, individuals are optimistic the current price trend will continue to last for an indefinite period. The longer the rising trend last, the more ingrained that optimistic belief becomes until the last of “holdouts” finally “buys in” as the financial markets evolve into a “euphoric state.”

As the markets decline, there is a slow realization that “this decline” is something more than a “buy the dip”opportunity. As losses mount, the anxiety of loss begins to mount until individuals seek to “avert further loss” by selling.

As shown in the chart below, this behavioral trend runs counter-intuitive to the “buy low/sell high” investment rule.”

“In the end, we are just human. Despite the best of our intentions, it is nearly impossible for an individual to be devoid of the emotional biases that inevitably lead to poor investment decision-making over time. This is why all great investors have strict investment disciplines that they follow to reduce the impact of human emotions.

More importantly, despite studies that show that “buy and hold,” and “passive indexing” strategies, do indeed work over very long periods of time; the reality is that few will ever survive the downturns in order to see the benefits.”

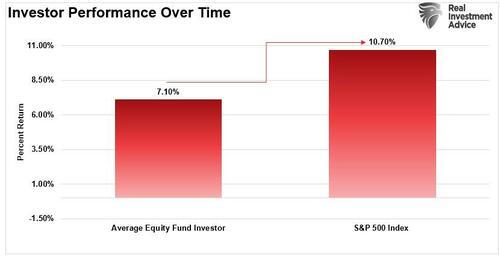

The impact of these emotionally driven mistakes leads to long-term underperformance below those “goal-based” financial projections.

It’s Just Math

“But Lance, the markets has returned 10% on average over the last century, so I will probably be okay.”

True. If you can contract “vampirism,” avoid sunlight, garlic, and crosses, you can live long enough to achieve the “average annual rate of return” over the last 124 years.

For the rest of us mere mortals, and why “duration matching” is crucial, we only have between today and retirement to reach our goals. For the majority of us – that is about 15 years.

And therein lies the problem.

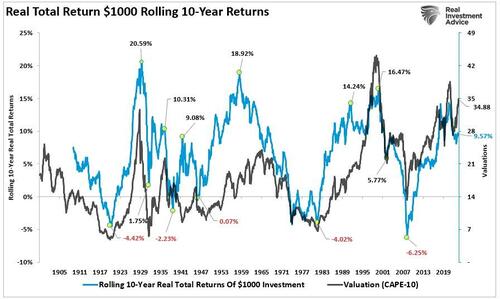

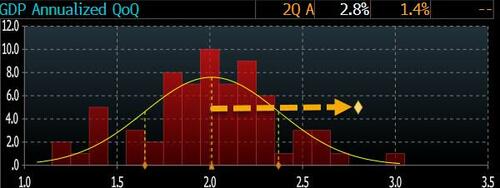

Despite much of the commentary that continues to suggest we are in a long-term secular bull market, the math suggests something substantially different. However, it is essential to understand that when low future rates of return are discussed, it does not mean that each year will be low, but the return for the entire period will be low.

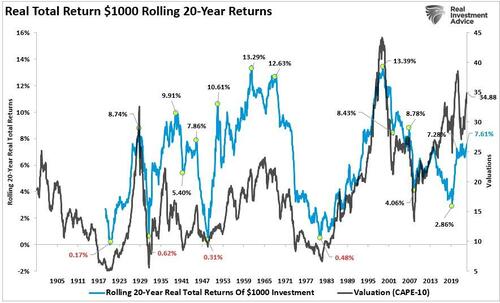

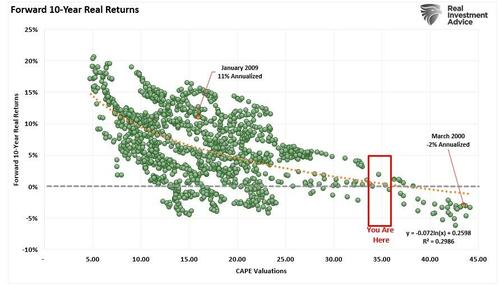

The charts below show the 10- and 20-year rolling REAL, inflation-adjusted returns for the markets compared to trailing valuations.

(Important note: Many advisors/analysts often pen that the market has never had a 10 or 20-year negative return. That is only nominal and should be disregarded as inflation must be included in the debate.)

There are two crucial points to take away from the data. First, there are several periods throughout history where market returns were near zero and negative. Secondly, the periods of low returns follow periods of excessive market valuations. Such suggests that betting “This time is not different” may not work well.

As David Leonhardt noted previously:

“The classic 1934 textbook ‘Security Analysis’ – by Benjamin Graham, a mentor to Warren Buffett, and David Dodd – urged investors to compare stock prices to earnings over ‘not less than five years, preferably seven or ten years.’ Ten years is enough time for the economy to go in and out of recession. It’s enough time for faddish theories about new paradigms to come and go.”

History shows that valuations above 23x earnings have tended to denote secular bull market peaks. Conversely, valuations at 7x earnings or less have tended to denote secular bull market starting points.

This point is proven simply by looking at the distribution of returns as compared to valuations over time.

From current levels, history suggests that returns to investors over the next 10 and 20 years will likely be lower than higher. However, as I said, we can also prove this mathematically. As I discussed in “Rising Bullishness:”

“Capital gains from markets are primarily a function of market capitalization, nominal economic growth, plus dividend yield. Using John Hussman’s formula, we can mathematically calculate returns over the next 10-year period as follows:

(1+nominal GDP growth)*(normal market cap to GDP ratio / actual market cap to GDP ratio)^(1/10)-1

Therefore, IF we assume that GDP could maintain 2% annualized growth in the future, with no recessions ever, AND IF current market cap/GDP stays flat at 2.0, AND IF the dividend yield remains at roughly 2%, we get forward returns of:

(1.02)*(1.2/1.5)^(1/10)-1+.02 = -(1.08%)

But there are a “whole lotta ifs” in that assumption. Most importantly, we must also assume the Fed can get inflation to its 2% target, reduce current interest rates, and, as stated, avoid a recession over the next decade.”

In either case, these numbers are well below most financial plan projections, leaving retirees well short of their expected retirement goals.

Conclusion

While most analysis assumes that individuals should “buy and hold” indexed-based portfolios, the reality is quite different.

Retirement plans have a finite period for asset accumulation and distribution. The time lost “getting back to even” following a significant market correction should be a primary consideration.

Unfortunately, most investors remain woefully behind their promised financial plans. Given current valuations and the ongoing impact of “emotional decision-making,” the outcome will not likely improve over the next decade or two.

Markets are not cheap by any measure. If earnings growth slows, interest rates remain elevated, and demographic trends impact the economy, the bull market thesis will disappoint as “expectations” collide with “reality.”

Such is not a dire doom and gloom prediction or a “bearish” forecast. It is just a function of how the “math works over time.”

For optimistic investors, understanding potential returns from any given valuation point is crucial when considering putting their “savings” at risk. Risk is an important concept as it is a function of “Loss.“

The more risk taken within a portfolio, the greater the destruction of capital will be when reversions occur.

This time is “not different.” The only difference will be what triggers the next valuation reversion when it occurs. If the last two bear markets haven’t taught you this by now, I am unsure what will.

Maybe the third time will be the “charm.”

|

|

[Markets]

Oil prices remain lower amid Gaza ceasefire hopes, economic weakness in China

Oil declined Friday, contributing to a loss for the week, with prices weighed down by expectations of a Gaza ceasefire deal that would ease global supply concerns, as weakness in China’s economy implied a slowdown in energy demand.

Published:7/26/2024 9:35:30 AM

|

|

[Markets]

Consumer sentiment stuck at 8-month low on inflation angst

Published:7/26/2024 9:35:30 AM

|

|

[Markets]

What the CrowdStrike outage means for investors

Published:7/26/2024 9:10:42 AM

|

[Markets]

Sinaloa Drug Cartel Co-Founder Tricked Into Flying To Small US Airfield, Greeted With Handcuffs

Sinaloa Drug Cartel Co-Founder Tricked Into Flying To Small US Airfield, Greeted With Handcuffs

In a story destined to be dramatized on the big screen, a major Mexican drug lord was tricked on Thursday into flying aboard a small plane that landed near El Paso, Texas, where federal agents greeted him on the tarmac with handcuffs.

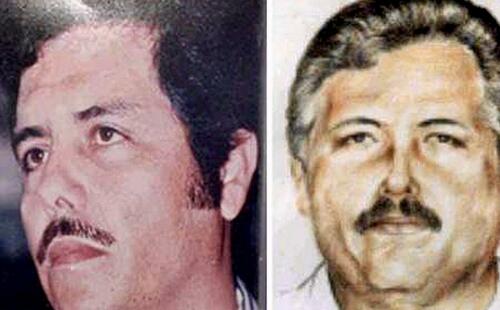

That big prize was 76-year-old Ismael "El Mayo" Zambada, who co-founded the infamous Sinaloa cartel with Joaquin "El Chapo" Guzman in the late 1980s. El Chapo was extradited to America in 2017 and is serving a life sentence at the federal supermax penitentiary in Florence, Colorado. El Chapo's son, Joaquín Guzman Lopez, may become his "so close and yet so far" neighbor at the Alcatraz of the Rockies, as he was also nabbed in the creative scheme -- and reportedly participated in it.

Ismael "El Mayo" Zambada, now 76 years old, is said to have co-founded the Sinaloa Cartel three decades ago (Mexico Attorney General/AFP/Getty Images via Wall Street Journal) Ismael "El Mayo" Zambada, now 76 years old, is said to have co-founded the Sinaloa Cartel three decades ago (Mexico Attorney General/AFP/Getty Images via Wall Street Journal)

Attorney General Merrick Garland announced the arrests in a statement issued Thursday:

“The Justice Department has taken into custody two additional alleged leaders of the Sinaloa Cartel, one of the most violent and powerful drug trafficking organizations in the world...Both men are facing multiple charges in the United States for leading the Cartel’s criminal operations, including its deadly fentanyl manufacturing and trafficking networks."

According the Wall Street Journal's Homeland Security Investigations (HSI) sources, El Mayo was led to believe the small aircraft he was boarding would take him to survey covert airstrips inside Mexico. The scheme was months in the making, and was a joint project with the FBI.

Adding to the cinematic intrigue, a high-ranking cartel member is said to have tricked the two into boarding the US-bound airplane. Plot twist: The New York Times reports that it was Guzman Lopez -- El Chapo's son who was also aboard and arrested. Fox News' Bryan Llenas reports that a source tells him Guzman Lopez was said to have turned on El Mayo because he blamed him for his father's apprehension.

While the DOJ and DEA statements didn't identify the airstrip, reports from Reuters and KTSM indicate the plane landed at Santa Teresa International Jetport, which is located in New Mexico, just across the state line from El Paso. "One worker at the Santa Teresa airport...[said] that he saw a Beechcraft King Air land on the runway, where federal agents were already waiting," Reuters reports.

The accused drug kingpins were flying in a Beechcraft King Air similar to this one (via AOPA) The accused drug kingpins were flying in a Beechcraft King Air similar to this one (via AOPA)

Since the Sinaloa Cartel is widely believed to be the foremost smuggler of illicit fentanyl, the twin-arrests represent a major triumph for federal law enforcement, and come at a time when Donald Trump and other Republican candidates are sharply criticizing the Biden administration's performance on that particular drug-war front.

Another of Chapo's sons, Ovidio Guzman, was extradited to the US in January 2023. El Chapo's four sons are known as "Los Chapitos," and the same name is used by the criminal organization they've run, which is one of four that comprise the Sinaloa Cartel. In October, the Sinaloa Cartel reportedly banned fentanyl production and trafficking, but the DEA dismissed the announcement as "probably a publicity stunt," noting that the volume of fentanyl seized at the border was undiminished.

"Fentanyl is the deadliest drug threat our country has ever faced, and the Justice Department will not rest until every single cartel leader, member, and associate responsible for poisoning our communities is held accountable," said Garland. Synthetic opioids -- including fentanyl -- were responsible for more than 74,000 deaths in the United States in 2023, according to the Centers for Disease Control and Prevention.

While the DEA crowed that the arrest of El Mayo represents an "enormous blow to the Sinaloa Cartel," don't count on it to have a material impact on the flow of drugs into the United States. "We aren’t talking about a structure that depends on a few kingpins — it’s very diffuse and resilient to these kinds of hits,” International Crisis Group senior analyst Falko Ernst tells the Times. In the near term, he adds, the principal result will likely be violence as the cartel's succession competition plays out.

It should also be noted that, in a grand example of unintended consequences of government market interventions, the rise of fentanyl is itself a product of the war on drugs. Per Richard Cowan's Iron Law of Prohibition, "As law enforcement becomes more intense, the potency of prohibited substances increases." That's because high-potency drugs are easier to smuggle -- giving a 10-pound parcel of fentanyl a far better risk/reward/ROI profile than a truckload of marijuana.

|

|

[Markets]

Watch the Vix for clues about where stocks may be headed

Published:7/26/2024 8:21:03 AM

|

|

[Markets]

Hedge funds stayed put during Wednesday market slide, Goldman says

Published:7/26/2024 8:02:09 AM

|

|

[Markets]

AMC’s summer box office set to ‘rebound notably’ says Wedbush

AMC Entertainment Holdings Inc. is set to benefit from an improved summer box office, according to analyst firm Wedbush.

Published:7/26/2024 8:02:09 AM

|

|

[Markets]

Charter’s stock could post best day in five years after earnings

Published:7/26/2024 7:53:34 AM

|

[Markets]

ChatGPT Launches AI-Powered Search Engine Prototype

ChatGPT Launches AI-Powered Search Engine Prototype

Authored by Turner Wright via CoinTelegraph.com,

According to OpenAI, SearchGPT will give users a more intuitive search experience, allowing them to ask questions to refine a search as they would using ChatGPT.

OpenAI’s ChatGPT has announced the launch of a search engine, presumably as a potential rival to Google.

In a July 25 notice, ChatGPT’s website included a page for ‘SearchGPT,’ a prototype “using the strength of our AI models to give you fast answers with clear and relevant sources.”

SearchGPT was not available for all users at the time of publication, as the platform is awaiting feedback from a small group before a full release.

According to the platform, results will be more visual than Google’s and allow follow-up questions to refine a search.

For example, SearchGPT has partnered with publishers and creators, citing sources in relevant search results.

“While this prototype is temporary, we plan to integrate the best of these features directly into ChatGPT in the future,” said OpenAI.

|

|

[Markets]

SEC accuses activist investor Andrew Left and Citron of making $20 million by misleading investors

SEC charges firm with selling stocks after allegedly recommending readers to buy them.

Published:7/26/2024 7:45:00 AM

|

|

[Markets]

Breaking PCE inflation news: Prices rise 0.1% in June, core up 0.2%

Published:7/26/2024 7:36:30 AM

|

|

[Markets]

Apollo Global Management to acquire gaming companies IGT and Everi in $6.3 billion deal

Apollo to buy both companies after they had agreed to a merger deal in February.

Published:7/26/2024 7:25:29 AM

|

|

[Markets]

Money buys a better position. Just look at Southwest’s new seating.

Airline seating is much like America’s economic divide — the less room you have to be comfortable, the more likely you’ll get stuck in a miserable middle position.

Published:7/26/2024 7:25:28 AM

|

|

[Markets]

Market bubbles expand longer than many expect. But this metric shows valuations will matter.

Valuation may not matter in the short term but it eventually does, says this fund manager

Published:7/26/2024 6:54:17 AM

|

|

[Markets]

Royal Caribbean CEO explains why cruises are so popular

Royal Caribbean reported Thursday quarterly profit that beat expectations and raised its full-year outlook, citing continued strong demand for cruises into next year and increased onboard spending.

Published:7/26/2024 6:45:17 AM

|

|

[Markets]

Arson attacks paralyze French rail network hours before start of Olympics

Published:7/26/2024 6:19:42 AM

|

|

[Markets]

Bristol Myers Squibb results beat expectations as newer drugs deliver growth

Bristol Myers Squibb Co. on Friday reported second-quarter results that topped analysts’ estimates as some of the company’s newer drugs began to hit their stride.

Published:7/26/2024 6:11:25 AM

|

|

[Markets]

The life of two Boeing Starliner astronauts stuck indefinitely in space

Astronauts Butch Wilmore and Suni Williams blasted off for a short trip on June 5. Almost two months later, they’re still in space.

Published:7/26/2024 6:11:25 AM

|

[Markets]

African Countries Are Turning To Gold

African Countries Are Turning To Gold

Authored by Mike Maharrey via MoneyMetals.com,

A growing number of African countries are turning to gold to hedge geopolitical risk and protect against currency losses.

Nigeria, Uganda, Zimbabwe, Madagascar, and several other African nations have made moves to increase gold reserves, bring their gold home, and even back their currencies with the yellow metal.

South Sudan is the latest country to turn to gold. Last weekend, the country’s central bank governor said he plans to expand the country’s gold reserves.

“We are in the stage of preparing policy documents and studying examples of other countries and lessons drawn.”

Earlier this month, the Ugandan central bank announced a domestic gold-buying program to purchase gold directly from local artisanal miners to help “address the risks in the international financial markets.”

In June, Tanzania announced a plan to spend $400 million on six tons of gold. Tanzania Finance Minister Dr. Mwigulu Nchemba also issued a directive to curb the widespread use of the U.S. dollar in the country.

Nigeria has launched a domestic gold-buying plan to bolster its reserves. In addition to buying locally sourced gold, the Nigerian central bank has announced plans to bring its existing gold reserves back into the country “to mitigate risks associated with the weakening U.S. economy.”

“Economic indicators such as rising inflation, escalating debt levels, and geopolitical tensions have raised apprehensions among Nigerian policymakers about the stability of the U.S. financial system.”

Last year, the Central Bank of Madagascar implemented a domestic gold purchases program as income from vanilla exports declined.

As an analyst explained to Bloomberg, “Central banks can add gold to their official reserves using their local currency, allowing them to grow reserve assets without having to sacrifice other hard-currency reserves.”

Meanwhile, a presidential candidate in Ghana recently said he would back the country’s currency with gold if he wins the election.

“Ultimately, my goal is that we are going to back our currency with gold and that is where I want us to go, increasingly backing our currency with gold.”

This would follow the lead of Zimbabwe, which created a gold-backed currency earlier this year. The ZiG (Zimbabwe gold; ZiG; ZWG) replaced the Zimbabwean dollar (RTGS; 1980-2008: ZWL). The currency is a “structured currency” backed primarily by gold but also by other forex reserves including U.S. dollars (USD).

To some degree, African leaders and central bankers are trying to fix problems they created by printing too much money and running up dollar-denominated debt.

But they are also concerned about America’s weaponization of the dollar and other risks associated with the greenback including the profligate spending and growing national debt.

A Tellimer (Dubai) emerging market equity strategy told Bloomberg the move makes sense.

“For countries taking a view that either the price of gold is going to go up, the price of the U.S. dollar is going to go down, or their access to U.S. dollars may be compromised by sanctions then increasing the allocation of gold in their reserves might make sense.”

|

|

[Markets]

Liquidation of crowded trades is healthy but levels must hold: Bank America

Published:7/26/2024 5:56:09 AM

|

|

[Markets]

Hedge-fund giant Man says assets reach record levels

Man Group, the world’s largest publicly traded hedge fund manager, on Friday said investment gains helped its assets under management grow by 17.5% in the first half to record highs of $178.2 billion.

Published:7/26/2024 5:56:09 AM

|

|

[Markets]

Who’s most likely to adopt — or get adopted

This week, we do a deep dive into your many, many — oh so many! — questions about adoption.

Published:7/26/2024 5:22:10 AM

|

|

[Markets]

Dow futures rise after worst three-day stretch for S&P 500 in nine months

Published:7/26/2024 4:40:10 AM

|

|

[Markets]

Buy the dip on Nvidia and other chip stocks? Not quite yet, says this analyst.

Should investors use the recent weakness in semiconductor stocks as a buying opportunity? Not quite yet, according to one analyst.

Published:7/26/2024 4:24:56 AM

|

[Markets]

Artificial Intelligence Is Sparking A Copper-Boom In Zambia

Artificial Intelligence Is Sparking A Copper-Boom In Zambia

Authored by Felicity Bradstock via OilPrice.com,

-

Zambia's copper reserves, boosted by AI-driven exploration, are set to play a crucial role in meeting the surging global demand for electric vehicles and renewable energy.

-

The country has the potential to become a major supplier of copper, reducing reliance on other nations and contributing significantly to its economy.

-

To maximize the benefits of this mining boom, Zambia needs to invest in downstream industries and improve its investment climate to attract further foreign investment.

Zambia is attracting the attention of the world’s energy and mining companies as it shows significant potential for critical mineral extraction. Innovative technologies have helped uncover massive deposits of copper in Zambia, which could help massively expand the country’s mining industry over the next decade. This discovery could help provide the resources needed for the massive clean tech pipeline and make Zambia a critical minerals hub for years to come.

The digital exploration company KoBold Metals has spent several years developing complex artificial intelligence (AI) technology to enhance mineral exploration activities around the globe. This month, KoBold announced it had likely made the largest copper discovery in over a decade thanks to this technology. The find in Zambia could contribute to the production of 300,000 tonnes of copper annually, worth billions of dollars. When developed, two decades of production in KoBold’s discovery region could provide enough copper to manufacture around 100 million electric vehicles (EVs). A third-party company corroborated KoBold’s claims, agreeing there is significant potential for using AI technology for exploration activities. KoBold hopes to develop a $2.3 billion copper mine in Zambia to commence production by the early 2030s.

The demand for copper and other critical minerals has been rapidly growing in recent years, a trend that shows no sign of slowing as countries around the globe increase their renewable energy capacity and roll out clean technologies. In 2023, the total copper mine production was estimated at around 22 million metric tonnes, marking a significant increase from 16 million metric tonnes in 2010. Production is expected to increase to around 30 million metric tonnes a year by 2036 as the global demand grows. However, there are fears that this increase in supply will not be enough to meet the rapidly rising demand for the critical mineral.

In addition to renewable energy development, the demand for copper is expected to increase significantly with the rollout of new technologies, such as AI. Data centres will require vast amounts of copper and other critical minerals in the coming years. This is expected to boost the value of copper substantially. According to Bank of America, supply shortages and the growth in demand could increase the price of copper by 11 percent, to $5.44 per pound by 2026. This is bad news for renewable energy producers but great news for countries with untapped copper deposits, just as Zambia.

New exploration technologies are helping mining companies improve their prospects, advancing exploration practices that have remained relatively unchanged over the last century. In addition, as the U.S. is concerned about its heavy reliance on China for critical minerals, new technologies could help American companies boost their mining capacity and ensure the country’s energy security. Connie Chan, a partner at venture capital firm Andreessen Horowitz, stated, “The more you realize how dependent we are on these technologies, the more you ask: How the hell were we so slow to the fact that we needed vast amounts of raw material to make it all possible?”

Recent estimates suggest that Zambia was the world’s 10th largest copper producer in 2023, producing around 4 percent of the world’s copper and increasing its output by 4 percent between 2022 and 2023. Production in the southern African country increased at a CAGR of 2.68 percent between 2017 and 2022 and is expected to grow at a CAGR of 2 percent between 2023 and 2027. Chile, Peru, the Democratic Republic of the Congo (DRC) and China are currently the world’s biggest copper producers, but there is major potential for Zambia to further develop its resources. First Quantum Minerals, Barrick Gold and Glencore are among the major producers operating in Zambia.

Copper exports contribute over $6 billion of Zambia’s annual revenue. However, there is great potential for growth according to a recent report from the London School of Economics' International Growth Centre (IGC). The industry mainly centres around extraction and early-stage refinement at present, but greater value could be added through the development of Zambia’s downstream activities. Most of Zambia’s copper comes from 10 mines in its Copperbelt province, with new discoveries slowly expanding production to other areas of the country. The IGC suggests that Zambia could attract higher levels of foreign investment in its minerals industry by improving its tax regime, which is currently unstable, and has deterred investors in the past. The IGC report also encourages Zambia to deepen ties with neighbouring DRC to establish a special economic zone (SEZ) to attract investment and create a manufacturing sector to add greater value.

Zambia’s copper mining industry is expected to grow significantly in the coming years, following several successful production years. New technologies, like the AI tech being used by KoBold, could help enhance exploration activities in Zambia to boost production as the global demand for copper rises. In addition, there is significant potential to add value to the sector through the development of its downstream activities and greater collaboration with neighbouring producers the DRC.

|

|

[Markets]

OpenAI announces SearchGPT in challenge to Google

OpenAI has announced it’s going into the search business in a direct challenge to Google’s dominance.

Published:7/26/2024 3:58:56 AM

|

[Markets]

To Hell With The Will Of The People...

To Hell With The Will Of The People...

Via ReMix News,

The globalist left is increasingly unscrupulous in its disregard for the voters’ choice.

The third-strongest faction, the Patriots for Europe, will not have a single official in the European Parliament. It won’t happen, because the globalist-Jacobin majority —which, for the sake of simplicity, is mostly called “the left” — is violating all written rules and customary law and ignoring the will of the people and has now prevented it. The Ursulas announced that, in their opinion, the sovereigntist faction — largely created by Viktor Orbán— is far-right and, as such, anti-Europe, anti-progress and anti-humanity, and therefore should be quarantined, isolated and suffocated.

There is no talk of their deportation yet, but based on the dynamics of events, this may even happen in a few years.

Germany's Manfred Weber, of the group of the European People's Party listens during a press briefing at the European Parliament in Strasbourg. (AP Photo/Jean-Francois Badias)

So the Patriots get nothing, let alone positions — perhaps even eventually a few bullets, like Fico and Trump. This is how people’s representation “works” for the champions of democracy in Brussels.

In fact, one of the pillars of Ursula von der Leyen’s forthcoming five-year EU commission presidency will be to break down resistance to the imperialism of the EU, to remove the veto of small states, especially the meddling Hungary. If there is no veto, everyone will do what the big ones want. In other words: “Shut up!”

Now, imagine for a moment that in the Hungarian parliament, opposition parties could not nominate vice-presidents to head the House, could not have committee chairs and vice-chairs. Obviously, the problem is with the Hungarian conception of democracy, but in this country such a thing has not even been thought of — neither during the period of left-wing nor right-wing governments did anyone think of such a despicable act, such disregard for the will of the electorate. But Brussels has done so without scruples. They take part in this disgusting act and in the meantime, act as if nothing had happened, as they continue lecturing us about democracy, the rule of law, checks and balances.

Where is the respect for the will of the voters? The rule of the people? The principle of popular sovereignty? Of course, we Hungarians have a dictatorship on the rampage, where even with a two-thirds majority from Fidesz, there is always an opposition leader (this time Zoltán Sas, a Jobbik member of the National Security Committee), not to mention the opposition deputy speakers of the National Assembly and many other officials.

So goes the trampling of voters by the European People’s Party (EPP). In order to give the globalists a majority, Manfred Weber, with the spine of a snail, has teamed up with the Bolsheviks — as if he had just been ordered to do so by text message. He lured the more naive right-wingers to his side with blatant lies and nationalist promises, only to be swept away by the left’s agenda.

Even though his voters are fed up with illegal migrants, Weber and his crew do not care — with their approval they will continue to fly and ship millions of Africans and Asians into the continent because the population replacement must continue. Weber is like a hijacker: He has hijacked the right-wing vote. If I say that this figure is a fraud, a scoundrel traitor, a moral lunatic, I am certainly putting it too mildly.

But it’s not just the will of the voters that globalists ignore. A few years ago, during one of the hearings of the show trials against Hungary, the European Parliament failed to get the necessary number of votes for the next “yes” vote, so the vote was repeated the next day, citing “technical reasons.” So it was done. Ursula can roll her dice all she wants at home until she gets the position she wants, it’s a private matter. But the Union is not a flea circus, and we didn’t join it to be the playthings of evil villains who wipe their muddy boots on us every day.

The same was done when the Sargentini report was adopted: Abstentions were not taken into account, in violation of the EU treaties and the European Parliament’s Rules of Procedure, because that was the only way to force through the opening of Article 7 proceedings against our country. Of course, the European Court of Justice later legalized this breach of the law, but there is nothing surprising in that. The law is just a front for them; they are in fact the people’s commissioners of the open society. See their latest gigantic penalty against Hungary in the quota case.

The Ursulas are just puppets, doing whatever the Democratic puppet masters in Washington want them to do. It is therefore theoretically impossible for them to carry out what the majority of European voters want and what they are supposed to have been entrusted with. They are not interested in, and are even irritated by, the fact that the majority of Europeans do not want population replacement, multiculturalism, war, sanctions and war inflation.

In the autumn of 2022, German Foreign Minister Annalena Baerbock summed up perfectly the Western elite’s view of democracy: “But if I promise the people of Ukraine that we will be on their side for as long as they need us, I intend to deliver. No matter what my German voters think.” Really, what do the voters’ opinions matter, right? The will of the people. The people are stupid, but the clever Baerbocks will do it for them. And if all these “smart” Baerbocks happen to start a world conflagration (apparently that’s their goal), so be it. We would have liked to have launched these half-wits into space in time.

Even in the supposed home of democracy, the United States, much is made of the opinion of the electorate, respecting the will of the people. For months, for years, people have been saying how healthy, how fresh and fresh in spirit President (Biden) is. Their soapboxes have been slamming the table, repeating that Biden is not lost in his own backyard, that he is not dozing off during a meeting, that it is all a lie of right-wing propaganda.

My favorite is the “fact-finding” by the Soros group Lakmusz, in which they proved, even in the moments before the fall, that footage of the president wandering around was manipulated.

Then Biden was pushed back from the presidential nomination like a draft. But the operators of the Biden remote control are betting big that millions of Americans put their faith in this old man in the Democratic primaries this spring after all. And when he was put in the Democratic seat, they knew exactly what a desperate state he was in: He was no less stammering and rambling then than he is now. So they had to have it, and the will of the people should be respected. By the way, if Biden is as unfit to run for president as he is now said to be — and as he was in 2020, by the way, but his caretakers denied it then — is he not unfit to run for president for the remaining six months?

It is getting more and more hypocritical, more and more shabby, both over there and here in Brussels. The way they blather on about democracy, the rule of law, diversity and solidarity.

The way they try to make you believe that they are democrats, while if you dare to say anything different from them, they threaten you, blackmail you, take your money and send you to Kyiv. Lately they’ve been talking about expelling us.

Elina Valtonen, the Finnish foreign minister, recently predicted that “Hungary should think about whether it is right for it to be a member of the EU, given its different values.”

OK, we will think about it.

There can be only one thing of value: what they have.

Only one opinion: theirs.

And only one party: the socialist-green-communist-democratic-rainbow coalition.

The future Party.

Everyone else is a Nazi. The cheeky people too, because despite the brainwashing they no longer applaud enthusiastically enough.

|

|

[Markets]

Mercedes lowers margin guidance for cars as quarterly profit falls 16%

Mercedes-Benz Group on Friday reiterated its financial goals for the year, but with a better margin for vans and a worse one for cars.

Published:7/26/2024 3:22:35 AM

|

[Markets]

Georgia Is The Next Country That Might Face A High-Profile Assassination Attempt

Georgia Is The Next Country That Might Face A High-Profile Assassination Attempt

Authored by Andrew Korybko via substack,

Georgia’s State Security Service (SSS) informed the public that they’re investigating a criminal group linked to the former government which plotted to assassinate the founder of the ruling Georgian Dream party. According to RT, Prime Minister Irakli Kobakhidze claimed that these are the same forces that were behind the attempted assassinations of his Slovak counterpart Robert Fico and former US President Donald Trump, while Politico cited local media to report that the Georgian Legion is under suspicion.

It was explained in early May why “The Georgian State Security Service & The Georgian Legion Are On The Brink Of War”, namely because that pro-US armed group can play a crucial role in catalyzing a spree of urban terrorism ahead of, during, or right after fall’s parliamentary elections. The preceding analysis followed the failed attempt by rioters to storm the parliament over a week prior in protest of their country’s FARA-inspired foreign agents legislation, which readers can learn more about here.

In brief, although the ruling conservative-nationalist party aspires to join the EU and NATO, it doesn’t want to surrender the country’s sovereignty to the West in exchange and that’s why it’s been targeted for regime change over the past year and a half. The replacement of Georgian Dream with Western puppets would lead to “NGO”-propagated liberal-globalist values destroying their traditional society, hence the need for the foreign agents law, but there are also geopolitical consequences too.

The authorities warned last year that the prior attempt to overthrow them was aimed at opening up a second front against Russia, while there’s also the chance that a puppet regime would allow Georgia to be used by NATO to send more armed aid to Armenia in preparation of another war against Azerbaijan. Georgian Dream wants to stay out of all regional conflicts, so much so that it hasn’t even sanctioned Russia, which is yet another argument against their continued rule from the West’s perspective.

Speaking of Russia, its foreign intelligence service released a statement in early July warning that the West is preparing to exploit fall’s parliamentary elections as the pretext for another regime change attempt, and it’s possible that they shared information about this with their Georgian counterparts. That could explain why the local media cited by Politico said that some Georgian Legion members have been detained for questioning, while their leader claimed that 300 others have been added to the wanted list.

Although comparatively small in number, this pro-US armed group could play a similar role in Tbilisi later this year as the Azov Battalion did in Kiev a little more than a decade ago during “EuroMaidan”, which was explained in the earlier hyperlinked analysis about why they’re on the brink of war with the SSS. The most effective “Democratic Security” policy that Georgian Dream can promulgate right now is banning the Georgian Legion as a terrorist group if the ongoing investigation ties them to the assassination plot.

Allowing them to continue operating inside the country with impunity would constitute an enormous risk to Georgia’s national model of democracy considering the likelihood that they’ll catalyze a spree of urban terrorism ahead of, during, or right after the upcoming elections at the US’ regime change behest. Cracking down on this group ahead of the vote would greatly neutralize their ability to disrupt the democratic process and make associated Hybrid War threats much more manageable for the authorities.

Aware that the window of opportunity for destabilizing their country might soon close, the Georgian Legion might desperately try to carry out a high-profile assassination attempt in the near future, even if it isn’t against the ruling party’s founder but someone else like the Prime Minister and they use a patsy instead of their own members. Everyone should therefore keep a very close eye on Georgia since it’s still a major New Cold War battleground given its geostrategic significance in the broader region’s dynamics.

|

[Markets]

Civil Unrest Is The Next Most Predictable Crisis For America Now

Civil Unrest Is The Next Most Predictable Crisis For America Now

Authored by Brandon Smith via Alt-Market.us,

For the past six months I’ve been writing about the clear uptick in civil war rhetoric within the establishment media in the US, and we all know that the coming presidential election is the reason for it. The bottom line is that no matter who ends up in the White House in 2025 there will be mass violence, but most of this violence will be reserved for the possibility of Donald Trump’s return.

Set aside the recent attempted assassination (and how the Secret Service made it possible) for a moment and let’s consider the common leftist response to it – Around 30% of Democrats believe the attack was “staged” (virtually impossible given the circumstances and evidence). The rest are enraged that the shooter missed. No event has exposed the political left for what they truly are more than the near-murder of Donald Trump. We are dealing with bloodthirsty mental deficients that will do anything to win.

The “false left/right paradigm” is dead, at least when it comes to average American citizens. The political left is not just an innocent subset of the population being led astray by false leadership – They are a big part of the problem. They are willing participants in the destruction of the west. Globalists would get nowhere on economic centralization, the DEI agenda, the trans agenda, carbon taxation, anti-2A legislation, open borders, etc. without help from a large portion of leftists.

I have long cautioned that the political left is slowly but surely becoming a happy cannon fodder army in service to globalism. And sadly, leftists tend to engage in warfare while conservatives tend to engage in politics. Leftists use any means necessary and feel thoroughly justified. Conservatives color within the lines for fear of being accused of “fascism.” We don’t have to abandon our moral compass, but the sooner we realize that war is being waged on us the sooner we can defend ourselves against it.

As we have seen in Europe (in France the past month), any perceived shift towards conservative influence in government will undoubtedly result in riots and chicanery from socialists. The media has so infected the minds of progressives that they truly believe they are the “good guys” and that conservatives intend to “end democracy.” Thus, in their view all violence or sabotage against conservatives (and independents) is justified.

In the long run the left’s violence and hysteria is only inspiring conservatives to respond with aggression in kind. This is where the potential for civil conflict arises. Leftists argue that only they are virtuous enough to be allowed to dictate policy and law. Yet, their ideology also embraces moral relativism, so you can see where this thing is headed…

They will continue to press for the erosion of western heritage and principles and, eventually, regular people are going to fight back; they have no choice. Leftists and globalists expect resistance, to a point. I believe part of their strategy is a classic communist provocation; for patriots to react with violence thereby giving the establishment fuel for a demonization campaign (much like January 6th). It’s not going to go the way they think it will next time and the response will be far larger and more swift than they anticipate.

Meanwhile, if Trump enters office again the rioting America dealt with in 2020 will be a cakewalk compared to 2025.

Progressives claim they are “protecting democracy” but you will see very quickly that as soon as democracy doesn’t go their way they will abandon it in a heartbeat and seek to prevail using other methods.

This means a campaign of “monkey wrenching” followed by riots, looting and disruptions in major cities.

One rising trend that should have all business owners and preppers on alert is the use of social media apps to coordinate seemingly spontaneous riots. These events can be organized within hours, encouraging some of the worst people to congregate and strike a business block without ever meeting each other before. What I worry about is that these methods will expand beyond business districts and local government buildings.

Travel routes will come under threat, freight could be targeted and we may even see looters and rioters move into residential areas further away from the city center. Supply chain issues will surely arise. At the very least there will be concerns among freight drivers that they are taking a risk carrying truckloads of goods into places where they could be surrounded by an angry mob and hijacked (or worse).

Large scale crime in general is bad for the economy. As we’ve witnessed in cities like Chicago and San Francisco, unchecked crime forces companies to move out of a region and leave those places barren. They call it a “food desert” – A place where tens of thousands of people have no close access to groceries or retail goods. Looting and rioting are an accelerating catalyst for this scenario. Once stores are looted or burned, they may never try to rebuild.

What I am describing is a much larger number of incidents with a longer duration than 2020. I’m talking about prolonged civil unrest and I predict this will become the norm going into next year. Don’t count on the government to provide sufficient aid. Don’t count on FEMA rations or a national guard response that does anything other than exacerbate the problem. Don’t rely on outside help – You’ll regret it.

There are different levels of civil unrest. Sometimes it starts as a less malicious redress of grievances, but often it becomes a vehicle for random destruction. The best way to counter indiscriminate violence is with directed and focused self defense, along with the proper supplies to keep you going until things calm down.

Also, don’t think just because you live in the suburbs or a rural town that these threats don’t concern you. In Argentina during their economic collapse in 2001, gangs of looters stalked rural areas with impunity while cities ground to a standstill. Once the cities are hollowed out, where do you think the worst people will go next?

In the US we have similar circumstances to Argentina in which economic crisis has the ability to feed directly into preexisting divisions. Politically motivated bad actors could be inspired to sabotage normal services in the face of limited law enforcement opposition. There are people who will do anything to get their way.

Organize accordingly and keep your own supplies ready. There are plenty of people out there that think they are owed something. They think they are owed a political win, or social power, or maybe they just think they’re owed access to other people’s stuff.

Right now the US is a powderkeg waiting to go off and the coming election period will be the fuse.

* * *

If you would like to support the work that Alt-Market does while also receiving content on advanced tactics for defeating the globalist agenda, subscribe to our exclusive newsletter The Wild Bunch Dispatch. Learn more about it HERE.

|

[Markets]

An Empire Of Lies

An Empire Of Lies

Authored by Brian Maher via DailyReckoning.com,

Why does government lie so repeatedly — and so atrociously?

Why does it fear truth as the vampire fears garlic?

The answer, we hazard, reduces to its desperate quest for prestige.

Government equals authority. And an authority is an authority.

Its word must be the final word. Its word must be the ultimate word.

A supreme authority cannot withstand rivals — else its authority falls into question.

It cannot endure mockery, ridicule or derision.

And if its undeniable incompetence is exposed, its back goes up… and its dukes go up.

Consider for example Monday’s congressional testimony of a certain Kimberly Cheatle…

The Greatest Sin Against Government

Ms. Cheatle directed the United States Secret Service when an aspiring assassin made a mockery of the lady’s organization.

How can a murderous fellow scale a low rooftop with a rifle — some 140 yards from a former and potentially future United States president — and let eight projectiles loose — before being scotched?

Here he was… placing his thumbs in his ears… wiggling his fingers… and putting out his tongue at Ms. Cheatle and the organization she bosses.

And in the private opinion of Ms. Cheatle, that is the highest sin. It is not act itself.

Is greater professional incompetence scarcely conceivable? We do not believe it is.

“It’s an Ongoing Investigation”

Yet the lady donned her armor, barricaded herself within fortress walls and deflected all questions concerning her agency’s abominations.

She could not answer this question or that question because it is an “ongoing investigation.”

“Was July 13 a Saturday, madam?”

“It’s an ongoing investigation.”

“What time did the attempted assassination take place? What was the local temperature?”

“It’s an ongoing investigation.”

“What color blazer was the former president Trump sporting?”

“It’s an ongoing investigation.”

“In which hemisphere of Earth did the incident occur?”

“It’s an ongoing investigation.”

“What color is the sky?”

“It’s an ongoing investigation.”

Governing Means Never Saying You’re Sorry

Could the lady openly and candidly concede her organization’s botchwork? What government functionary ever does?

Imagine her arguing, for example, that her sniper may have failed to shoot first because his scope was trained not on the rooftop — but on the fetching young lady in the third row with the cropped top and the shortest shorts.

Imagine her arguing that the 5’4” female agent lacked the height to cover adequately her 6’3” protectee.

Furthermore, that the identical female agent was admitted to the United States Secret Service on a sliding scale — that she did not satisfy the physical standards required of men.

Imagine her conceding that her personnel were snoozing on the job.