|

[Entertainment]

Washington Post paperback bestsellers

A snapshot of popular books.

Published:7/24/2024 8:06:13 AM

|

[Markets]

CJ Hopkins: The People's Court Of New Normal Germany

CJ Hopkins: The People's Court Of New Normal Germany

Authored by CJ Hopkins via The Consent Factory,

Just when I thought things could not possibly get more shockingly totalitarian in New Normal Germany, where I’m being prosecuted in criminal court (for the second time) for tweeting, the German authorities have gone and surprised me again.

No, they haven’t established an actual Nazi-style People’s Court (pictured below) yet, and, of course, there is absolutely no similarity between the current German justice system, which is totally fair and democratic and a paragon of impartial justice and the rule of law, and The People’s Court of Berlin during the Nazi era, nor is there any similarity between Nazi Germany and New Normal Germany (i.e., modern-day Germany), and I would never, ever, suggest that there was, as that would be intellectually lazy, and tasteless, and completely inaccurate, and illegal, and … well, let me fill you in on the latest.

The Berlin Superior Court has set a date for my next thoughtcrime trial.

As regular readers will probably recall, my first thoughtcrime trial in January ended with my acquittal. So, the German authorities are putting me on trial again. Yes, they can do that in Germany. But, wait, that’s not the best part.

The best part is, at my new thoughtcrime trial - this time in Berlin Superior Court - full-scale Anti-Terrorism Security protocols will be effect in the courtroom. Everyone will be subjected to TSA-style scanning and screening, and will have to surrender all their personal possessions and hats and coats and head coverings to the Security Staff, and completely empty their pockets of all items, before entering the courtroom. No computers, phones, smart-watches, or any other potential recording devices will be allowed in the courtroom. Pencils and sheets of paper will purportedly be provided to members of the press by Security Staff. Members of the press and public will be limited to 35, and, after they have successfully passed their “security screening,” they will be cordoned off in the last five rows of the gallery in the very back of the courtroom, “for security reasons,” and monitored by the armed Security Staff.

For the benefit of any new readers unfamiliar with me and my case, I am not a terrorist. I’m an award-winning American playwright, novelist, and political satirist. I have lived here in Berlin for 20 years. The German authorities have been investigating and prosecuting me since August 2022. My case has been covered in The Atlantic, Racket News, Neue Zürcher Zeitung, Multipolar, and many other outlets, so I won’t reiterate every little detail again here. Basically, I am being prosecuted for “spreading pro-Nazi propaganda” because I criticized the Covid mask mandates and tweeted the cover artwork of one of my books, The Rise of The New Normal Reich.

Here’s the cover artwork of that book. The other two images are the recent covers of Der Spiegel and Stern, two well-known mainstream German magazines, which are not being prosecuted for “spreading pro-Nazi propaganda.”

As anyone (even the German authorities) can see, the Spiegel cover artwork uses exactly the same concept as the cover artwork of my book. The only difference is, the Spiegel swastika is covered by the German flag, whereas the swastika on my book is covered by a medical mask.

Both artworks are obviously intended as warnings of the rise of a new form of totalitarianism. Der Spiegel was warning about the Alternativ für Deutschland party (AfD) — as was Stern with its swastika floating in a champagne glass. I was warning about what I dubbed “The New Normal Reich,” the new nascent form of totalitarianism that emerged during 2020-2023, which is still very much on the rise, and which is thoroughly documented and analyzed in my book (which book was banned by Amazon in Germany at the same time the German authorities launched a criminal investigation of me and instructed Twitter to censor my Tweets, which Twitter did).

The pretext the Court is citing for ordering these Anti-Terrorism Security protocols at my trial is ridiculous, and infuriating. The Court claims that the courtroom in which my trial is to take place is occasionally used for a certain “high-security” trial. Therefore, according to the Court, my trial must also be subjected to Anti-Terrorism Security protocols. Seriously, the Court sent my attorney a fax setting forth this “explanation,” which is, of course, a load of horseshit. The Berlin Superior Court is a huge building containing multiple courtrooms, one or two which are probably not subject to such Anti-Terrorism Security protocols when “high-security” trials are not taking place within them.

No, the imposition of these Anti-Terrorism Security protocols is clearly a cynical ploy intended (a) to suppress coverage of the trial, (b) to discourage the press and public from attending, and (c) to intimidate and harass me and my legal counsel, and any members of the press and public who nevertheless attend the trial in spite of the “security procedures” they will be subjected to.

This cynical tactic — which is not an official press blackout, because journalists can still attend and attempt to scribble notes on their knees with the pencils and sheets of paper provided by the Security Staff — comes as no real surprise. As I mentioned above, my case and my first trial got a fair amount of attention from the international press, enough to put the Court on notice that my prosecution was being watched. So, it’s no mystery why the German authorities would want to discourage any reporting on my “do-over” trial in Superior Court.

Also, the gallery was filled to capacity at my original trial in January, where I delivered a rather unusual closing Statement to the Court, which was then published and disseminated widely in Germany. So, again, it is no real mystery why the Superior Court wants to discourage members of the public from attending this new trial by threatening to subject them to these humiliating “security” protocols, and why it has limited the gallery size to only 35 seats.

I assume the German authorities — and by “authorities” I mean the Berlin District Prosecutor’s office, the Berlin Superior Court (Der Kammergericht), and whatever other authorities are intent on punishing me, and making an example of me, for daring to criticize the government’s edicts during 2020-2022, i.e., suspension of the constitutional rights, mask mandates, segregation, the banning of protests, etc. — I assume these authorities are particularly motivated to prevent the press from covering this second trial in Superior Court, because, from what I understand of the German legal system, they are going to “do” me (i.e., convict me) this time.

The way the German legal system works, if they want to do you, is (1) you are acquitted in the lower Criminal Court, (2) the District Prosecutor appeals the verdict to the Superior Court, (3) the Superior Court overturns your acquittal, and (4) the prosecution goes back to the original Criminal Court, which stages a new trial, at which you will be found guilty, because, once the Superior Court has overruled your acquittal, the Criminal Court will convict you based on the Superior Court’s ruling. At which point you will appeal. And on and on and on it will go, until you are broke, or until you give up fighting because you are just so fucking exhausted.

I’m not making this up. This is how The People’s Court of New Normal Germany (i.e., the post-Covid German justice system, which, again, bears no resemblance whatsoever to The People’s Court of Berlin in Nazi Germany, or to the courts in the Soviet Union during the Stalin era, or any other totalitarian “justice” system) … this is how it works in New Normal Germany if you are a critic of the authorities and refuse to meekly accept whatever punishment they want to summarily dish out for whatever they deem to be your thoughtcrimes.

But, hey, at least they’re not going to take me out and put me up against a wall and shoot me, like they did with political criminals in Nazi Germany, and the USSR, so I suppose I should be grateful. I’ll have to work on that.

If you think my case is an aberration, it isn’t. There are many, many other people — critics of the government’s “Covid measures” during 2020-2023 — who are being persecuted and made examples of. Most of these people do not have the financial resources to pay lawyers to fight these prosecutions, so they plead guilty to the charges and pay the fines, which are typically much less than what they would face in attorney’s fees. Being somewhat of a public figure, I thought it was my responsibility not to do that. I’m extremely grateful to everyone who has donated to my legal defense fund, which is how I have been able to cover my legal expenses. There’s enough left in that fund to cover this next trial in Superior Court, so I’m OK for now, financially. I mention that because people are already asking how they can send me money.

What people can do, if they want to do something helpful, is make as much noise as possible about what is happening, not just in Germany, but all throughout the West. Because what is happening is, well, what I tried to capture and analyze in my book. The Powers That Be are going totalitarian on us. They are gradually, and not so gradually, phasing out the so-called “liberal” or “democratic” rights and principles that it was necessary to placate the Western masses with during the Cold War era, which it is no longer necessary to do beyond a certain superficial point.

I have published three books of essays documenting this transition to a new global-capitalist form of totalitarianism, so I’m not going to go on and on about it here. But that’s what all the censorship is about. That’s what all the manufactured hysteria, fomented hatred, fanaticism, the permanent state of “emergency” and “crisis,” the “culture wars,” the cults of personality, the bombardment of our minds with absolutely meaningless nonsense, the naked displays of force, the blatant instrumentalization of the justice system to punish political dissidents, not just here in Germany, but throughout the “democratic” West … that is what all this is about.

I’ll keep my readers posted on the details of my upcoming trial in Berlin Superior Court. My attorney is objecting to these “security protocols,” of course. We’ll see how that goes. In the meantime, instead of sending me money this time, maybe try to step back from all the mass hysteria and hatred that we are being inundated with and see the big picture. It isn’t pretty.

Help spread the word about the new totalitarianism, about the phasing-out of our democratic rights. I don’t care which “side” of whatever you are on — Trump, Biden, Palestine, Israel, the culture wars, the cancel campaigns, Covid, Elon Musk, Russia, whatever — and neither do The Powers That Be. Take a step back and try to see the bigger picture … the forest, instead of just the trees. And then make as much noise about it as you can.

We are heading somewhere very ugly … somewhere most of us can’t imagine. Some of us will get there first, but all of us will be there, together, eventually. My story is just one example of what it will be like there, in that ugly place. It isn’t really a story about Germany. It is a story about the end of the myth of democracy, and the rule of law, and all that good stuff. As Frank Zappa once so eloquently explained …

“The illusion of freedom will continue as long as it’s profitable to continue the illusion. At the point where the illusion becomes too expensive to maintain, they will just take down the scenery, they will pull back the curtains, they will move the tables and chairs out of the way and you will see the brick wall at the back of the theater.”

It’s something to behold, that brick wall is, especially up close and personal. You’ll see when you get here. I’ll save you a seat.

|

[Markets]

True Purpose Of NATO Remains USA Hegemony

True Purpose Of NATO Remains USA Hegemony

Authored by Yves Engler via Counterpunch.org,

NATO’s new focus on China harkens back to the belligerent alliance’s early days.

At the North Atlantic Treaty Organization’s 75th anniversary summit in Washington, DC, last week China was a big part of the agenda. The NATO summit’s final declaration mentioned the People’s Republic of China’s (PRC) 14 times. It noted that “the PRC continues to pose systemic challenges to Euro-Atlantic security” and China’s “stated ambitions and coercive policies continue to challenge our interests, security and values.”

The leaders of NATO “partner” nations Japan, South Korea, New Zealand and Australia attended the summit. They collectively met NATO Secretary General Jens Stoltenberg to map out strategy for the Asia Pacific region. NATO announced four new joint projects with countries that are important to Washington’s bid to establish an anti-China military bloc. In response, Beijing accused NATO of “inciting bloc confrontation and hyping up regional tensions”.

Unsurprisingly, NATO frames its focus on China as defensive. “The PRC has become a decisive enabler of Russia’s war against Ukraine”, claimed the summit’s final communique. According to this storyline, Chinese relations with Russia threaten NATO. But this is exaggerated. China has taken a cautious approach to Russia’s war largely complying with (illegal) US sanctions and refusing to sell arms (though its companies sell some dual use products to Russian firms). Conversely, North Korea and Iran are selling Russia arms while NATO countries are donating large amounts of weapons to Ukraine.

Comparing Chinese ties to India’s highlights NATO’s exaggeration. India is buying more oil and weapons from Russia than China and when NATO began its meeting Indian Prime Minister Narendra Modi was in Moscow to meet President Vladimir Putin.

In 2022, NATO released a strategic concept listing China for the first-time. It labeled Beijing a challenge to the alliance’s “interests, security and values” and at the time Stoltenberg declared, “China is substantially building up its military forces, including nuclear weapons, bullying its neighbours, threatening Taiwan ….”

This is all part of the US empire’s bid to contain China’s rise. Washington has become obsessed with an emerging “peer competitor” that may eventually rival its power.

While it seems strange that an alliance to defend the ‘north Atlantic’ should target a faraway Asian state, NATO is neither defensive nor only about the north Atlantic. The alliance’s recent wars in Afghanistan and Libya demonstrate that it’s a tool to enable US-led global domination.

That’s been clear for 75 years.

As part of the Parliamentary debate over NATO’s founding Canada’s external affairs minister Lester Pearson said:

“There is no better way of ensuring the security of the Pacific Ocean at this particular moment than by working out, between the great democratic powers, a security arrangement the effects of which will be felt all over the world, including the Pacific area.”

Two years later he said:

“The defence of the Middle East is vital to the successful defence of Europe and north Atlantic area.”

In 1953 Pearson went even further:

“There is now only a relatively small [5000 kilometre] geographical gap between southeast Asia and the area covered by the North Atlantic treaty, which goes to the eastern boundaries of Turkey.”

Pearson believed that the newly created ‘defensive’ alliance justified sending 27,000 Canadian troops to Korea. In a history of the 1950-53 US-led Korean war David Bercuson writes that Canada’s external minister “agreed with [President] Truman, [Secretary of State] Dean Acheson, and other American leaders that the Korean conflict was NATO’s first true test, even if it was taking place half a world away.”

The Korean War was partly a reaction to Mao’s 1949 communist/nationalist revolution in China. After US forces approached its border, China intervened. The war left around three million dead.

In reality, NATO was established to bring a decolonizing world under the US geopolitical umbrella. This remains true 75 years later as the alliance continues to advance US hegemony.

|

[Markets]

Engineering A Crisis: How Political Theater Helps Keep The Deep State Stay In Power

Engineering A Crisis: How Political Theater Helps Keep The Deep State Stay In Power

Authored by John & Nisha Whitehead via The Rutherford Institute,

“The two ‘sides’ of mainstream politics are not fighting against one another, they’re only fighting against you. Their only job is to keep you clapping along with the two-handed puppet show as they rob you blind and tighten your chains while your gaze is fixed on the performance.”

- Caitlin Johnstone

A failed assassination attempt on a presidential candidate. An incumbent president withdrawing his re-election bid at the 11th hour. A politicized judiciary that fails to hold the powers-that-be accountable to the rule of law. A world at war. A nation in turmoil.

This is what controlled chaos looks like.

This year’s election-year referendum on which corporate puppet should occupy the White House has quickly become a lesson in how the Deep State engineers a crisis to keep itself in power.

Don’t get so caught up in the performance that you lose sight of what’s real.

This endless series of diversions, distractions and political drama is the oldest con game in the books, the magician’s sleight of hand that keeps you focused on the shell game in front of you while your wallet is being picked clean by ruffians in your midst.

It’s the Reichstag Fire all over again.

It was February 1933, a month before national elections in Germany, and the Nazis weren’t expected to win. So they engineered a way to win: they began by infiltrating the police and granting police powers to their allies; then Hitler brought in stormtroopers to act as auxiliary police; by the time an arsonist (who claimed to be working for the Communists in the hopes of starting an armed revolt) set fire to the Reichstag, the German parliamentary building, the people were eager for a return to law and order.

That was all it took: Hitler used the attempted “coup” as an excuse to declare martial law and seize absolute power in Germany, establishing himself as a dictator with the support of the German people.

Fast forward to the present day, and what do we have? A discontented citizenry, a disconnected government, and a Deep State that wants to stay in power at all costs.

So what happens? Trump has a near miss, Biden bows out, and politics becomes exciting to the masses again.

It works the same in every age.

This is how the police state will win, no matter which candidate gets elected to the White House.

You know who will lose? Every last one of us.

After all, politics today is not about Republicans and Democrats.

Nor is it about abortion, healthcare, higher taxes, immigration, or any of the other buzzwords that have become campaign slogans for individuals who have mastered the art of telling Americans exactly what they want to hear.

Politics today is about one thing and one thing only: maintaining the status quo between the Controllers (the politicians, the bureaucrats, and the corporate elite) and the Controlled (the taxpayers).

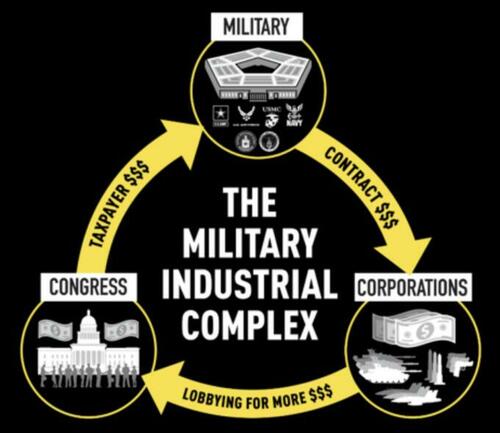

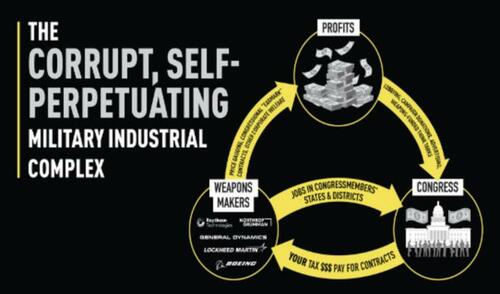

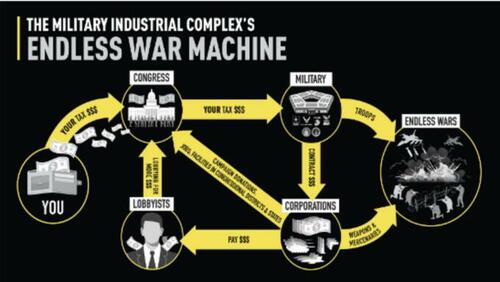

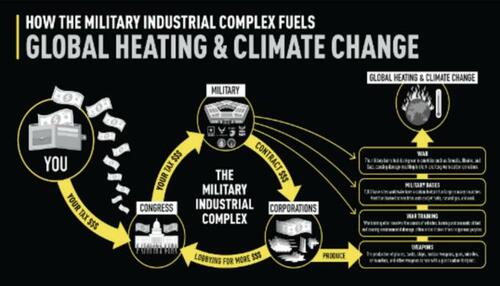

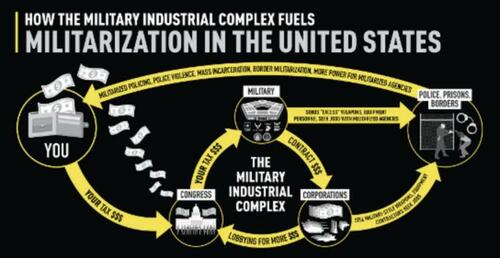

Indeed, it really doesn’t matter what you call them—the 1%, the elite, the controllers, the masterminds, the shadow government, the police state, the surveillance state, the military industrial complex—so long as you understand that no matter which party occupies the White House in 2025, the unelected bureaucracy that actually calls the shots will continue to do so.

In other words, no matter who wins this next presidential election, you can rest assured that the new boss will be the same as the old boss, and we—the permanent underclass in America—will continue to be forced to march in lockstep with the police state in all matters, public and private.

Consider the following a much-needed reality check, an antidote if you will, against an overdose of overhyped campaign announcements, lofty electoral promises and meaningless patriotic sentiments that land us right back in the same prison cell.

-

FACT: According to a scientific study by Princeton researchers, the United States of America is not the democracy that it purports to be, but rather an oligarchy, in which “economic elites and organized groups representing business interests have substantial independent impacts on U.S. government policy.”

-

FACT: Despite the fact that the number of violent crimes in the country is down substantially, the lowest rate in sixty years, the number of Americans being jailed for nonviolent crimes such as driving with a suspended license continues to skyrocket.

-

FACT: Thanks to an overabundance of 4,500-plus federal crimes and 400,000-plus rules and regulations, it is estimated that the average American actually commits three felonies a day without knowing it. In fact, according to law professor John Baker, “There is no one in the United States over the age of 18 who cannot be indicted for some federal crime. That is not an exaggeration.”

-

FACT: Despite the fact that we have 38 million Americans living at or below the poverty line, 13 million children living in households without adequate access to food, and 1.2 million veterans relying on food stamps, enormous sums of taxpayer money continue to be doled out on wasteful programs that do little to improve the plight of those in need.

-

FACT: Since 2001 Americans have spent $93 million every hour for the total cost of the nation’s so-called war on terror.

-

FACT: It is estimated that 5 million children in the United States have had at least one parent in prison, whether it be a local jail or a state or federal penitentiary, due to a wide range of factors ranging from overcriminalization and surprise raids at family homes to roadside traffic stops.

-

FACT: According to a Gallup poll, Americans place greater faith in the military and the police than in any of the three branches of government.

-

FACT: At least 400 to 500 innocent people are killed by police officers every year. Indeed, Americans are now eight times more likely to die in a police confrontation than they are to be killed by a terrorist. Americans are 110 times more likely to die of foodborne illness than in a terrorist attack. Police officers are more likely to be struck by lightning than be made financially liable for their wrongdoing.

-

FACT: On an average day in America, over 100 Americans have their homes raided by SWAT teams. Most of those SWAT team raids are for a mere warrant service. There has been a notable buildup in recent years of heavily armed SWAT teams within non-security-related federal agencies such as the Department of Agriculture, the Railroad Retirement Board, the Tennessee Valley Authority, the Office of Personnel Management, the Consumer Product Safety Commission, the U.S. Fish and Wildlife Service, and the Education Department.

-

FACT: For all intents and purposes, we now have a fourth branch of government: the surveillance state. This fourth branch came into being without any electoral mandate or constitutional referendum, and yet it possesses superpowers, above and beyond those of any other government agency save the military. It is all-knowing, all-seeing and all-powerful. It operates beyond the reach of the president, Congress and the courts, and it marches in lockstep with the corporate elite who really call the shots in Washington, DC. The government’s “technotyranny” surveillance apparatus has become so entrenched and entangled with its police state apparatus that it’s hard to know anymore where law enforcement ends and surveillance begins. They have become one and the same entity. The police state has passed the baton to the surveillance state.

-

FACT: Everything we do will eventually be connected to the Internet. By 2030 it is estimated there will be 100 trillion sensor devices connecting human electronic devices (cell phones, laptops, etc.) to the Internet. Much, if not all, of our electronic devices will be connected to Google, which openly works with government intelligence agencies. Virtually everything we do now—no matter how innocent—is being collected by the spying American police state.

-

FACT: Americans know virtually nothing about their history or how their government works. In fact, according to a study by the National Constitution Center, 41 percent of Americans “are not aware that there are three branches of government, and 62 percent couldn’t name them; 33 percent couldn’t even name one.”

-

FACT: Only six out of every one hundred Americans know that they actually have a constitutional right to hold the government accountable for wrongdoing, as guaranteed by the right to petition clause of the First Amendment.

Perhaps the most troubling fact of all is this: we have handed over control of our government and our lives to faceless bureaucrats who view us as little more than cattle to be bred, branded, butchered and sold for profit.

As I make clear in my book Battlefield America: The War on the American People and in its fictional counterpart The Erik Blair Diaries, if there is to be any hope of restoring our freedoms and reclaiming control over our government, it will rest not with the politicians but with the people themselves.

One thing is for sure: the reassurance ritual of voting is not going to advance freedom one iota.

|

[Markets]

Understanding Lab Tests For Optimal Health

Understanding Lab Tests For Optimal Health

Authored by Emma Tekstra via The Epoch Times (emphasis ours),

Study Challenges 'Bad Cholesterol' Label For LDL

(IvanRiver/Shutterstock) (IvanRiver/Shutterstock)

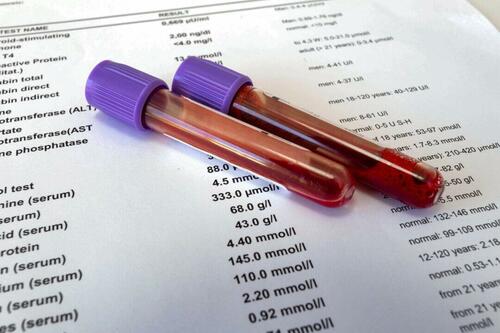

Annual Lab Tests Are a Good Idea

Maybe you already submit to blood tests as part of your annual check-up with your doctor. If you’re generally healthy they may advise everything “looks normal” whether or not you have been complaining of various symptoms.

If you’re managing a chronic condition perhaps your doctor requests more regular testing and monitors your numbers to adjust medication accordingly. Or maybe you’ve been avoiding the doctor and haven’t had any lab work done in a while.

Blood tests are one of the least invasive and cost-effective tests you can get to be proactive about managing your health. Testing centers are typically easy to find and make an appointment with. In fifteen minutes you can be in and out, having had a few vials of blood drawn in a usually pleasant setting, and be on your way. Results are often available online a week or so later.

According to the Cleveland Clinic, “blood tests are an essential tool healthcare providers use to monitor your overall health or diagnose medical conditions.” But you don’t need to be under a doctor’s care to obtain blood tests. Consumer-focused companies like Grassroots Labs or Function Health can put you firmly in the driver’s seat.

Limitations of Normal Ranges

The trick though is in understanding the context of all those numbers and how your results compare to the cited “normal range.” Only then can you begin to glean relevant insights to optimize your health.

For starters, even if you test 100 different biomarkers in your blood, it is barely scratching the surface of what is going on inside your infinitely complex body that is constantly working to keep you in balance and functioning well.

A blood test generally measures a moment in time and may be influenced by what you ate the day before, how much you exercised, if you had an argument with your spouse, or how well you slept the previous night. You are an individual. There is no such thing as a perfect score for any element being tested.

An article published in the journal Heliyon last year discusses the pros and cons of biomarkers which include tests of other bodily fluids and cells such as hair—useful to test for heavy metals—and stool—useful to assess your microbiome—and sound an alert to certain cancers and other conditions. One of the clear disadvantages cited of biomarker monitoring is the difficulty of establishing what is “normal.”

The reference values or normal ranges listed on your test results are typically lab-specific and are based on the test results of a subset of the population studied. The range then covers the results for 95 percent of this sample population who are deemed to be healthy. The lowest 2.5 percent and the highest 2.5 percent are considered outliers, with the rest considered normal.

The lab may adjust its range by demographics such as males/females and age groups, but this vastly oversimplifies all the elements that affect any individual biomarker for a given human.

Typical Tests Your Doctor May Order

The biggest use of blood tests is to assist your doctor in making diagnosis and treatment decisions. The pharmaceutical industry relies on biomarker testing to prove its drug is doing what it claims to do better than a placebo.

Most drugs are evaluated by their effect on a biomarker rather than their impact on actual health. But as long as we understand the context and limitations of the tests, we can use them to our advantage helping to inform our priority interventions.

The most common tests your doctor is likely to order include:

- Metabolic markers—to understand your kidney and liver function, blood sugar level, proteins, and electrolyte balance including your hydration status.

- Complete blood count—looks at your red and white blood cells and platelets which can indicate an infection, anemia, or blood clotting issues.

- Lipids—will include your LDL (low-density lipoprotein) and HDL (high-density lipoprotein) cholesterol, and your triglycerides (a type of fat stored in your liver).

- Thyroid function—especially for women, specifically your TSH (thyroid-specific hormone) levels indicating potential hypo- or hyperthyroidism which can affect many aspects of your health including infertility.

- Hemoglobin A1C—especially for those who have a high basic glucose level or who are overweight. It measures the percentage of your blood cells that are saturated with glucose and provides a better measure of your average glucose level over the last 2—3 months.

- PSA (prostate-specific antigen)—men only. Can indicate problems with the prostate, including cancer, but other factors can also affect PSA levels.

Without going into the details of each test and the shortcomings of its quoted normal range, it is important to do your own research and consider additional testing if:

- You are outside of normal ranges and your doctor is proposing pharmaceutical treatment to address it.

- You are inside of normal ranges but are suffering from “unexplained” symptoms.

Examples of other blood tests that can provide additional context and guidance are:

- Inflammatory markers—C-reactive protein (hs-CRP, the high-sensitivity version) can be used as a general measure of inflammation and risk for cardiovascular disease and depression. Homocysteine is an amino acid that needs certain B vitamins to break down—elevated levels can indicate impaired ability to detox and make neurotransmitters.

- Thyroid detail—beyond the basic TSH score, more accurate tests can measure additional elements such as free T4, total T3, free T3, and reverse T3 to get a better picture of how your thyroid is performing.

- Full hormone panel—such as the DUTCH testing service, which stands for dried urine test for comprehensive hormones—which tests over 24 hours to get a more accurate picture.

- Cancer detection—such as the Galleri test that has been validated to detect early signals of over 50 types of cancer.

- Pathogen antibodies—including Lyme disease and mold using specialty tests such as those offered by Realtime Laboratories and IGeneX.

- Essential nutrients—like vitamin D, iron/ferritin, B12, folate (B9), magnesium, and omega-3s.

These more advanced tests may not be covered by your insurance plan but are often an excellent investment to better understand your health issues and how to tackle them. This is especially true if the aim is to avoid pharmaceuticals so often designed to address a biomarker rather than improve overall health.

Essential nutrient testing in particular can often provide the missing link to explain mystery symptoms or unusual “scores” in other blood tests.

Understanding Nutrient RDAs

In our modern world of over-scheduling, ultra-processed food, insidious technology, and other toxin exposures, so much of what ails us is due to an underlying nutrient deficiency. There are simply inadequate nutrients going into our body to run all the many complex systems that rely on them.

If we’re taking any pharmaceuticals the risk of deficiencies is higher as many pharmaceuticals are known to leach nutrients out of the body.

It is therefore recommended to include nutrient-level testing in your annual blood work. But make sure you apply a similar level of caution in their interpretation and your response for three main reasons:

1. The “normal” ranges quoted for nutrient tests are usually far too low given the vast majority of the U.S. population is deficient, and therefore any sample taken to set the ranges. A deficiency in certain nutrients may not immediately present with symptoms so the sample population may be considered healthy subjects but in fact, their nutrient levels are not optimal.

For example, most labs will quote a normal range for vitamin D blood levels of 30–150 nanograms per milliliter (ng/ml). A well-informed doctor may push you to be over 50 ng/ml and supplement up to that level. However, research now suggests over 75 ng/ml is optimal.

2. It is important to understand that blood levels are not always a good indication of absorption or availability to your cells. Magnesium for example is stored in your bones and tissues with only a small amount circulating in the blood. Absorption of one nutrient can also affect another, with low magnesium levels potentially responsible for low potassium or calcium levels as well, emphasizing the need to look at all test results holistically.

3. Another factor to understand when responding to nutrient test results is the recommended daily allowance (RDA) suggestions—more often now quoted in the United States as daily value (DV) requirements for individual nutrients.

It’s worth noting a bit of the history about how RDAs were developed decades ago before we understood the interaction of different nutrients and how factors like the health of our microbiome, age, weight, and lifestyle greatly affect our personal nutrient needs.

The focus was to prevent the occurrence of specific diseases like scurvy, beri beri, pellagra, and rickets (respectively long-term deficiencies in vitamin C, B1, B3 (niacin), and vitamin D for calcium absorption). They weren’t (and still aren’t) focused on optimal health.

The U.S. Food and Drug Administration took over the ownership of DV levels to help consumers determine the level of various nutrients in a standard serving of food compared to their approximate requirement for it. You are likely to find the percentage of DV now quoted on supplement bottles. However, your personal needs may be far higher.

In Conclusion

It can seem a bit overwhelming to synthesize the pros and cons of lab testing plus make an informed decision on what tests to undertake and how to interpret the results. As with all aspects of your health, it is a very individual decision and warrants taking the time to research some details rather than ceding responsibility to the professional in a white coat. Standardized guidelines are never a substitute for an informed holistic assessment.

8 Key Tips

- Annual blood tests are a good idea—despite their drawbacks analyzing your blood can provide important insights.

- You don’t need to go through a doctor—several direct-to-consumer options are now available without a doctor’s requisition order.

- Non-standard tests may be helpful particularly if symptomatic—consider additional testing for better insight although be aware your insurance plan may not cover them.

- Reference ranges are not always useful—individual physiology is important as well as taking a holistic view of all tests and their levels over time.

- Focus on symptoms not just numbers—context is key. The numbers are just a set of data points. Energy levels, digestion, mental health, and pain for example are important indicators.

- Absorption and interaction of different nutrients may not line up with test numbers—monitor symptoms for indication of deficiency and take a holistic view.

- A whole food diet is optimal to address nutrient deficiencies and other concerning test results—make food your first line of defense opting for nutrient density over convenience.

- If supplementation is required select quality brands—nutrient combinations from whole foods (not synthetically made) and a formulation that optimizes absorption is critical.

|

[Markets]

Anti-Free Speech Laws Hit New Heights In Italy: Reporter Fined For "Body Shaming' PM Meloni

Anti-Free Speech Laws Hit New Heights In Italy: Reporter Fined For "Body Shaming' PM Meloni

Authored by Jonathan Turley,

I have long been critical of the erosion of free speech in Italy and other Western European countries, including the use of criminal libel laws against critics of the police or government. This week a Milan court has ordered a journalist to pay Italian Prime Minister Giorgia Meloni damages of 5,000 euros ($5,465) for making fun of her in a social media post. Giulia Cortese was also given a suspended fine of 1,200 euros for a joke on X. It is the latest absurd example of the expanding crackdown on free speech.

In my new book, “The Indispensable Right: Free Speech in an Age of Rage,” I discuss how this anti-free speech wave from Europe has finally reached our shores. The rapid loss of free speech in countries like Italy, France, Germany, and Great Britain should be a wake up call for all Americans to protect this “indispensable right.”

There are many in the United States, including Hillary Clinton, who want to replicate the anti-free speech laws in the United States.

This is a prototypical example of how vague laws are being used to crackdown on everyone from journalists to politicians to even comedians.

Cortese posted a comment on Twitter in Oct. 2021 about Meloni’s height.

She objected to the government’s attack on “freedom of expression and journalistic dissent.”

Cortese published a mocked-up photo of Meloni with a picture of the late fascist leader Benito Mussolini in the background. As she clashed with the Prime Minister, she then later added:

“you don’t scare me, Giorgia Meloni. After all, you’re only 1.2 metres (4 feet) tall. I can’t even see you.”

Notably, Meloni supported the legal action despite the fact that she is part of a party long in the minority and threatened by such laws. She also successfully sued best-selling author Roberto Saviano after he insulted her on television in 2021 over her position on illegal immigration.

This is the slippery slope that our own country could soon find itself on if many politicians and pundits have their way.

Just recently, the New York Times published another anti-speech diatribe titled “The First Amendment is Out of Control.”

It is, of course, no easy task to convince a free people to give up a core part of identity and liberty. You have to make them afraid. Very afraid.

Anti-free speech books have been heralded in the media. University of Michigan Law Professor and MSNBC legal analyst Barbara McQuade has written how dangerous free speech is for the nation. Her book, “Attack from Within,” describes how free speech is what she calls the “Achilles Heel” of America.

There is even a movement afoot to rewrite the First Amendment through an amendment. George Washington University Law School Professor Mary Anne Franks believes that the First Amendment is “aggressively individualistic” and needs to be rewritten to “redo” the work of the Framers. She wants the language change to balance your right to speak against the interests of “equity.”

Meloni’s use of these laws to silence critics is disgraceful. At the same time, the media has been largely supportive of these laws in targeting others with dissenting political and religious views. The Cortese case shows how many in journalism and academia remain silent on the rights of others until they are themselves threatened by the growing intolerance for opposing views.

As the anti-free speech movement literally reaches new heights in countries like Italy, Americans should take note. This remains an existential fight over a right that defines us all. That is the long and short of it.

|

|

[Culture]

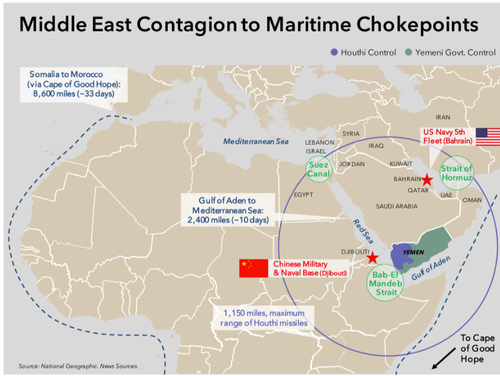

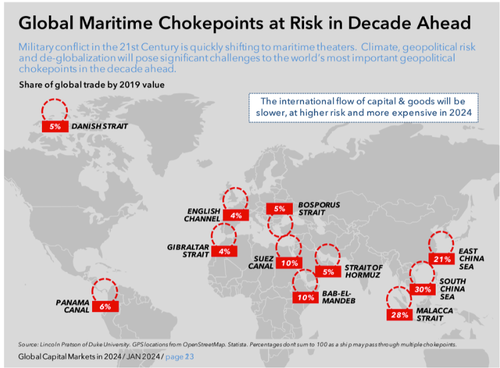

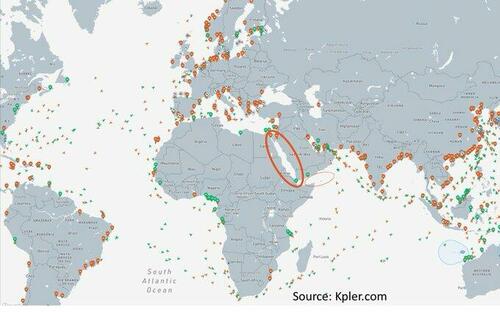

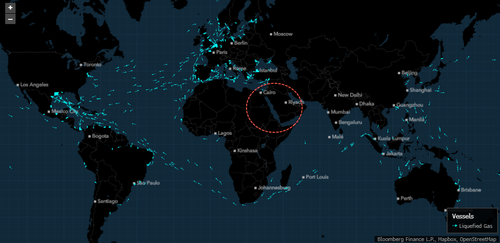

Dire Strait

While the Republican and Democratic parties plunge into painful realignments, China is making its own moves internationally. Taiwan has become a major flashpoint of the U.S.-China rivalry, and two books on the topic reveal not only some of the key arguments taking place in the United States about Taiwan, but also why this realignment is happening.

The post Dire Strait appeared first on .

Published:7/21/2024 5:11:36 AM

|

[Markets]

Carnegie Mellon University Prof Says Trump Assassination Attempt Was "Staged" Like "Stupid Tubi Movie Set"

Carnegie Mellon University Prof Says Trump Assassination Attempt Was "Staged" Like "Stupid Tubi Movie Set"

By Emma Arns of CampusReform

A professor at Carnegie Mellon University took to social media after the assassination attempt of former President Donald Trump and suggested that the shooting was “staged,” suggesting that the shooter was part of a “stupid show.”

Uju Anya, an associate professor of second language acquisition at Carnegie Mellon University, made the comments just hours after the attempted assassination.

“People dying doesn’t make the attack any less staged. Someone who thought the attack was real could’ve killed others trying to prevent harm. Also, someone could’ve shot the shooter to hide the plot,” associate professor of second language acquisition, Uju Anya, tweeted.

“Politicians kill all the time and kill many more people to steal power,” she added. “And people died behind this farce. Actual people’s lives gone for them to stage this stupid show.”

Anya currently teaches and conducts research primarily “examining race, gender, sexual, and social class identities in new language learning through the experiences of African American students,” according to her website.

“It was staged. Like a stupid Tubi movie set in the Bronx with palm trees in the background,” she added.

“They lie, and people die. That’s exactly what they do. That’s the record. Whatever ‘attack’ on him they set up to stoke his followers’ fears and sentiments, threat and persecution has now cost lives,” Anya said.

When an X user commented “someone is dead,” Anya responded, “a dead person can’t reveal the setup.”

Trump was grazed by a bullet Saturday at his Pennsylvania rally. The gunman was taken down by Trump’s Secret Service team, and Corey Comperatore, an attendee, was killed.

Anya considers herself an “antiracist” a “feminist” and an ally of the LGBT+ community, as referenced in her X account biography.

She is also the author of two books, “Racialized identities in second language learning” and “Racial equity on college campuses”.

Campus Reform has reached out to Anya and Carnegie Mellon University for comment. This article will be updated accordingly.

|

[Markets]

Leftists Prove They Are Zealots In The Wake Of Trump Shooting

Leftists Prove They Are Zealots In The Wake Of Trump Shooting

The response by a large portion of the political left to the attempted assassination of Donald Trump has revealed a disturbing ideological madness - A dedication to lies and delusions that goes deep into the realm of zealotry. It's something that thousands of commentators have warned about over the years. The general public has long denied the claim as being "reactionary" and many thought conservatives were exaggerating. Recent events prove otherwise.

What else would you expect from the same group of people that can't define what a woman is? The same people that think sexualized drag performances and graphically sexual picture books are a good idea for young children in public schools? The same people that engaged in years of violent rioting because of the death of a hardcore criminal and fentanyl addict who happened to be black? The same people that supported medical authoritarianism and mass censorship during the covid pandemic? The same people that claimed "stagflation was transitory"? The people that bought into the Russiagate hoax, refused to believe that Hunter Biden's laptop was real and denied Joe Biden's steep cognitive decline?

This zealotry continues to be exposed through their response to the attempted assassination of Donal Trump. The narrative in the media is that now is the time for "cool heads" and calm, yet, at the same time they are working diligently to peddle the conspiracy that the plot was staged by Trump himself.

The envy from Joy Reid is transparent - The leftists are furious about that iconic photo and they wish they could diminish it somehow. They aren't honest enough to say "Hey, I don't like Trump's policies, but that moment was ballsy."

She seems to be asserting that Trump trusted a sniper enough to barely miss his face so that he could get a great photo. This would mean that the plan was for Trump to fake an ear injury with hundreds of people and cameras around him, and that the shooter would have to fire close enough to his head to make it believable, hitting three bystanders and killing one of them in the process. And of course, most of Trump's Secret Service security team and local police would have to be in on the plot, not to mention the photographer.

Keep in mind, there's no evidence to support any of this and the leftists suggesting the conspiracy are the same people who argued that conservatives should "follow the science" during the pandemic lockdowns. When it comes to leftists and Trump, reason goes completely out the window and their true insanity shines through. Those that aren't entertaining conspiracies about the shooting are simply enraged that the shooter missed.

Why are these people like this? One could assume they've always been this way - Zealots with a pure hatred for anyone that contradicts their ideology and Trump happens to be a convenient magnet for their animosity. Then again, it's more likely that they have been radicalized by the very media that's calling for conservatives to "calm down" after the attack, not to mention the Biden Administration. Remember this speech painting MAGA Republicans as monsters ready to tear down "democracy"?

When leftists are referred to as "useful idiots" it's important to understand what that means. It means that they are willing to say anything and do anything to further a cause which, in the end, doesn't even benefit them. It means they have ascended to a dangerous level of incompetence; a world in which reason and logic have no meaning and everything they do to win is emotionally justified.

|

|

[Entertainment]

Need a break from the news? 5 feel-good books offer refuge.

Find solace in books like “A Good Life,” “Big in Sweden,” “Experienced,” “Joe Nuthin’s Guide to Life” and “Pets and the City.”

Published:7/19/2024 7:30:50 AM

|

[Markets]

A Time Of Shame And Sorrow: When It Comes To Political Violence, We All Lose

A Time Of Shame And Sorrow: When It Comes To Political Violence, We All Lose

Authored by John & Nisha Whitehead via The Rutherford Institute,

“Whenever any American's life is taken by another American unnecessarily—whether it is done in the name of the law or in the defiance of law, by one man or a gang, in cold blood or in passion, in an attack of violence or in response to violence—whenever we tear at the fabric of life which another man has painfully and clumsily woven for himself and his children, the whole nation is degraded.”

- Robert F. Kennedy on the assassination of Martin Luther King Jr. (1968)

There’s a subtext to this assassination attempt on former President Trump that must not be ignored, and it is simply this: America is being pushed to the brink of a national nervous breakdown.

More than 50 years after John F. Kennedy, Martin Luther King Jr., and Robert F. Kennedy were assassinated, America has become a ticking time bomb of political violence in words and deeds.

Magnified by an echo chamber of nasty tweets and government-sanctioned brutality, our politically polarizing culture of callousness, cruelty, meanness, ignorance, incivility, hatred, intolerance, indecency and injustice have only served to ratchet up the tension.

Consumed with back-biting, partisan politics, sniping, toxic hate, meanness and materialism, a culture of meanness has come to characterize many aspects of the nation’s governmental and social policies. “Meanness today is a state of mind,” writes professor Nicolaus Mills in his book The Triumph of Meanness, “the product of a culture of spite and cruelty that has had an enormous impact on us.”

This casual cruelty is made possible by a growing polarization within the populace that emphasizes what divides us—race, religion, economic status, sexuality, ancestry, politics, etc.—rather than what unites us: we are all Americans, and in a larger, more global sense, we are all human.

This is what writer Anna Quindlen refers to as “the politics of exclusion, what might be thought of as the cult of otherness… It divides the country as surely as the Mason-Dixon line once did. And it makes for mean-spirited and punitive politics and social policy.”

This is more than meanness, however.

We are imploding on multiple fronts, all at once.

This is what happens when ego, greed and power are allowed to take precedence over liberty, equality and justice.

This is the psychopathic mindset adopted by the architects of the Deep State, and it applies equally whether you’re talking about Democrats or Republicans.

Beware, because this kind of psychopathology can spread like a virus among the populace.

As an academic study into pathocracy concluded, “[T]yranny does not flourish because perpetuators are helpless and ignorant of their actions. It flourishes because they actively identify with those who promote vicious acts as virtuous.”

People don’t simply line up and salute. It is through one’s own personal identification with a given leader, party or social order that they become agents of good or evil. To this end, “we the people” have become “we the police state.”

By failing to actively take a stand for good, we become agents of evil. It’s not the person in charge who is solely to blame for the carnage. It’s the populace that looks away from the injustice, that empowers the totalitarian regime, that welcomes the building blocks of tyranny.

This realization hit me full-force a few years ago. I had stopped into a bookstore and was struck by all of the books on Hitler, everywhere I turned. Yet had there been no Hitler, there still would have been a Nazi regime. There still would have been gas chambers and concentration camps and a Holocaust.

Hitler wasn’t the architect of the Holocaust. He was merely the figurehead. Same goes for the American police state: had there been no Trump or Obama or Bush, there still would have been a police state. There still would have been police shootings and private prisons and endless wars and government pathocracy.

Why? Because “we the people” have paved the way for this tyranny to prevail.

By turning Hitler into a super-villain who singlehandedly terrorized the world—not so different from how Trump is often depicted—historians have given Hitler’s accomplices (the German government, the citizens that opted for security and order over liberty, the religious institutions that failed to speak out against evil, the individuals who followed orders even when it meant a death sentence for their fellow citizens) a free pass.

This is how tyranny rises and freedom falls.

None of us who remain silent and impassive in the face of evil, racism, extreme materialism, meanness, intolerance, cruelty, injustice and ignorance get a free pass.

Those among us who follow figureheads without question, who turn a blind eye to injustice and turn their backs on need, who march in lockstep with tyrants and bigots, who allow politics to trump principle, who give in to meanness and greed, and who fail to be outraged by the many wrongs being perpetrated in our midst, it is these individuals who must shoulder the blame when the darkness wins.

“Darkness cannot drive out darkness; only light can do that. Hate cannot drive out hate, only love can do that,” Martin Luther King Jr. sermonized.

The darkness is winning.

It’s not just on the world stage we must worry about the darkness winning.

The darkness is winning in our communities. It’s winning in our homes, our neighborhoods, our churches and synagogues, and our government bodies. It’s winning in the hearts of men and women the world over who are embracing hatred over love. It’s winning in every new generation that is being raised to care only for themselves, without any sense of moral or civic duty to stand for freedom.

John F. Kennedy, killed by an assassin’s bullet five years before King would be similarly executed, spoke of a torch that had been “passed to a new generation of Americans—born in this century, tempered by war, disciplined by a hard and bitter peace, proud of our ancient heritage—and unwilling to witness or permit the slow undoing of those human rights to which this nation has always been committed, and to which we are committed today at home and around the world.”

Once again, a torch is being passed to a new generation, but this torch is setting the world on fire, burning down the foundations put in place by our ancestors, and igniting all of the ugliest sentiments in our hearts.

This fire is not liberating; it is destroying.

We are teaching our children all the wrong things: we are teaching them to hate, teaching them to worship false idols (materialism, celebrity, technology, politics), teaching them to prize vain pursuits and superficial ideals over kindness, goodness and depth.

We are on the wrong side of the revolution.

“If we are to get on to the right side of the world revolution,” advised King, “we as a nation must undergo a radical revolution of values. We must rapidly begin the shift from a thing-oriented society to a person-oriented society.“

Freedom demands responsibility.

Freedom demands that we stop thinking as Democrats and Republicans and start thinking like human beings, or at the very least, Americans.

JFK was killed in 1963 for daring to challenge the Deep State.

King was killed in 1968 for daring to challenge the military industrial complex.

Robert F. Kennedy offered these remarks to a polarized nation in the wake of King’s assassination:

“In this difficult day, in this difficult time for the United States, it is perhaps well to ask what kind of a nation we are and what direction we want to move in. [Y]ou can be filled with bitterness, with hatred, and a desire for revenge. We can move in that direction as a country, in great polarization…filled with hatred toward one another. Or we can make an effort … to understand and to comprehend, and to replace that violence, that stain of bloodshed that has spread across our land, with an effort to understand with compassion and love… What we need in the United States is not division; what we need in the United States is not hatred; what we need in the United States is not violence or lawlessness; but love and wisdom, and compassion toward one another, and a feeling of justice toward those who still suffer within our country, whether they be white or they be black.”

Two months later, RFK was also killed by an assassin’s bullet.

Fifty-plus years later, we’re still being terrorized by assassins’ bullets, but what these madmen are really trying to kill is that dream of a world in which all Americans “would be guaranteed the unalienable rights of life, liberty, and the pursuit of happiness.”

We haven’t dared to dream that dream in such a long time.

But imagine…

Imagine what this country would be like if Americans put aside their differences and dared to stand up—united—for freedom.

Imagine what this country would be like if Americans put aside their differences and dared to speak out—with one voice—against injustice.

Imagine what this country would be like if Americans put aside their differences and dared to push back—with the full force of our collective numbers—against government corruption and despotism.

As I make clear in my book Battlefield America: The War on the American People and in its fictional counterpart The Erik Blair Diaries, tyranny wouldn’t stand a chance.

|

|

[Entertainment]

Washington Post hardcover bestsellers

A snapshot of popular books.

Published:7/17/2024 7:04:35 AM

|

[Entertainment]

Olympic Moments That Ring True as Among the Most Memorable in History

These Olympic moments deserve their own podium.

Because even if they didn’t all include a medal, they still secured their place in the history books.

Often, these moments featured celebratory...

These Olympic moments deserve their own podium.

Because even if they didn’t all include a medal, they still secured their place in the history books.

Often, these moments featured celebratory...

Published:7/13/2024 3:14:54 AM

|

[Entertainment]

Pregnant Lea Michele Reunites With Scream Queens Costar Emma Roberts

The Chanels are back in action.

It was one for the books as Lea Michele gave a glimpse into her Hamptons reunion with Scream Queens costar Emma Roberts.

The Glee alum posted a slew of photo...

The Chanels are back in action.

It was one for the books as Lea Michele gave a glimpse into her Hamptons reunion with Scream Queens costar Emma Roberts.

The Glee alum posted a slew of photo...

Published:7/12/2024 8:02:23 PM

|

|

[In Education]

Pentagon Schools Encouraged Students To Be Left-Wing Activists, Pushed DEI On Kids And Teachers, Docs Show

by Robert Schmad at CDN -

Teachers at Pentagon schools promoted materials that train students to be social justice activists and pushed diversity, equity and inclusion (DEI) on teachers, according to a new Open The Books report shared exclusively with the Daily Caller News Foundation. Department of Defense Education Activity (DODEA) schools, which serve children of …

Click to read the rest HERE-> Pentagon Schools Encouraged Students To Be Left-Wing Activists, Pushed DEI On Kids And Teachers, Docs Show first posted at Conservative Daily News

Published:7/11/2024 6:55:54 PM

|

[Markets]

Anarchy In The UK

Anarchy In The UK

Authored by Joakim Book via The Mises Institute,

Anarchism [an·ar·chism] n.

1. “a political theory holding all forms of governmental authority to be unnecessary and undesirable and advocating a society based on voluntary cooperation and free association of individuals and groups”

Merriam Webster

The venerable British magazine The Economist has us worried in their May 11 issue titled “The New Economic Order.” Contemplating what seems to be the collapse of the global, liberal order—Francis Fukuyama’s End of History story, more or less—the leader article argues that “a worrying number of triggers could set off a descent into anarchy, where might is right and war is once again the resort of great powers.”

Later in the piece we’re told that once the precious conditions of the last three decades break, “it is unlikely to be replaced by new rules. Instead, world affairs will descend into their natural state of anarchy that favors banditry and violence.”

Adding to the unhelpful pile is Oxford English Dictionary, giving us a wholly misleading entry for anarchy:

“political or social disorder resulting from the absence or disregard of government or the rule of law.”

Granted, this is how most people think about anarchy. Upon mentioning this frightful word, most react in horror. Yes, communist types from the tweed-wearing intellectual to the stone-hurling Antifa member embrace the term for themselves in their literal banditry and violence.

But anarchy only means “disorder” to the mind that can’t fathom anything but top-down dirigisme. Altogether foreign is a universe of emergent order, of “the products of human action but not human design” in the famous phrase that harks back to Adam Ferguson (Adam Smith’s contemporary during the Scottish Enlightenment). Instead, it’s a state of affairs of rules, not rulers. The etymological origin is a?a???a, where an means “without” and a???a “rulers.” Anarchy isn’t disaster, destruction, or war but rules without rulers.

We’re sometimes told that nation-states are acting with respect to one another in a state of anarchy, since nothing—no world government or court—binds them, and a plethora of ever-passing democratically rulers merely play an infinitely lived game of mutual interaction. The equivalence is false, since nation-states aren’t natural entities, but contrived aggregations of mafiosos that extract maximum value from their (tax) hostages via the use of violence.

It was roughly a decade ago that the social purpose of “property rights” clicked for me, and it was directly in connection with a world of an-archy—rules without rulers.

I hadn’t thought much about the concept or its role in economic affairs, but picturing the frontier setting in Terry Anderson’s and P.J. Hill’s The Not So Wild Wild West made it obvious. We humans establish property rights, not in some pen-wielding constitutional setting or faraway legal process involving bribing (sorry, “lobbying”) and political horse-trading, but by literally fencing land when the (transaction) cost of the process makes sense given the scarcity of land. And land only becomes scarce when humans have conflicting uses for the exact same plot of land.

Until then, a hyperabundant resource (well, “resource…”) like land—more than you can fence or cultivate or put livestock on even if you wanted to—becomes like a non-resource like oxygen: All possible and practical demands for it won’t make more than a negligible dent in its availability.

In the excellent book The Company of Strangers: A Natural History of Economic Life, economics professor Paul Seabright gets to the same point using property rights over water:

“Property rights are, above all, rules that determine how water may be used, and water use is a social institution whose rules we collectively invent.” But, he adds crucially, “Rules are worth making only if we can afford the expense of enforcing them,” which explains the classic difference in riparian vs prior appropriation rights between eastern and western United States.

In his slam-dunk Bitcoin: Everything Divided by 21 Million, Swedish author Knut Svanholm hits on exactly that very Austrian point:

“Economics only applies to scarce goods. Things in abundance are free because their supply greatly exceeds the demand. The air you breathe is an example of such goods.”

Similarly, the core thesis of Anderson and Hill’s work is positively blasphemous to most statists and the average man on the street alike, misunderstanding the state of anarchy in which the rules themselves evolve:

The West during this time is often perceived as a place of great chaos, with little respect for property or life. Our research indicates that this was not the case; property rights were protected, and civil order prevailed. Private agencies provided the necessary basis for an orderly society in which property was protected and conflicts were resolved.

Hobbes was off; there is no need for an overbearing Leviathan threating all of us with violence. Rousseau’s general will is nonsense. Left to their own devices, humans—aided by social institutions—are pretty nice.

Plenty of our everyday interactions are anarchical, too, merely mundane instances of repeat games in the pursuit of common wellbeing. Svanholm clearly realizes that Bitcoin is anarchism; it’s rules without rulers, and your option is to obey them or exit. Nobody “runs it,” and there’s no management to replace or CEO to jail. Still, it functions.

For freedom to prevail, we instead choose to submit ourselves to good rules, not dismantling every last hard and difficult obstacle standing in our way to an imagined utopia. In a forthcoming book about the Christian faith and Bitcoin, Jordan Bush, executive director at educational foundation Thank God for Bitcoin, gives an allegory about a fish in pursuit of ultimate freedom:

“I’m going to free myself from the confines of the water and live on land.” He swims as fast as he can, leaps out of the water, and comes to rest on the riverbank only to find that he fundamentally misunderstood the nature of freedom. Freedom isn’t found in the pursuit of the absolute absence of restrictions. It’s found by submitting oneself completely to the right restrictions—the ones that correspond to one’s nature.

Broadly speaking, faith groups are pretty anarchical: They join together in commune or various religious institutions, but your faith is with God—not the leaders of those man-made organizations; you leave, or re-create them, when they break apart. Most friendships, too, are anarchic: You cooperate and do together what both parties voluntarily agree to. Contrary to Bitcoin, the rules of which are crystal clear, friendships are hazy and often undefined. They can be negotiated, expanded, or reduced; nobody but the parties to the interaction governs it (no Friendship Tsar at the Office for Friendly Relations)—and you leave, i.e., dissolve the friendship, when it no longer functions.

In none of these anarchic domains do we find “might is right” or the destruction of property that the word traditionally invokes. Anarchy doesn’t mean anything goes, the purview of the postmodern left—or might is right, the ever-lasting claim of the extreme right.

It may well be the case that the on-going regime shifts in the global world order will take place through destruction and conflict—but it won’t be because of anarchy.

Anarchy is rules without rulers. The Economist overlooked that first, crucial part.

|

|

[Entertainment]

Washington Post paperback bestsellers

A snapshot of popular books.

Published:7/10/2024 7:13:06 AM

|

|

[Culture]

Everyone Is Trying to Make This TikTok Go Viral—and It Never Will

The app’s algorithm is so powerful that ordinary TikTok users can’t get their favorite videos into the record books. Homegrown viral campaigns like the egg that took over Instagram are a thing of the past.

Published:7/10/2024 6:08:07 AM

|

|

[Uncategorized]

Town Admits First Amendment Violation After Firing Librarian Who Endorsed Conservative Candidates Opposed to ‘Inappropriate’ Children’s Books

The library and town admitted 'regret' for violating the librarian's 'constitutional rights.'

The post Town Admits First Amendment Violation After Firing Librarian Who Endorsed Conservative Candidates Opposed to ‘Inappropriate’ Children’s Books first appeared on Le·gal In·sur·rec·tion.

Published:7/9/2024 7:45:53 AM

|

[Markets]

How Do Americans Prepare For Retirement?

How Do Americans Prepare For Retirement?

While the U.S. has no mandatory retirement age and forcing older workers to retire is, in fact, illegal according to the Age Discrimination in Employment Act, the OECD's Pensions at a Glance report suggests an effective labor market exit age of 65.2 for men and 65.3 for women in the United States in 2022.

One possible reason for the U.S. ranking 13th out of 39 OECD countries regarding the highest retirement age is pensions without additional private savings not being sufficient to sustain an adequate standard of living.

When choosing how to best save up for old age, there is a clear generational divide in the country.

Statista's Florian Zandt highlights a Consumer Insight survey from 2022 which shows that, on average, a savings book or deposit is still the most suitable method for many respondents, ranking particularly high among Baby Boomers (28 percent) and Gen Z (22 percent).

The former group also heavily relies on overnight deposits, with 29 percent of survey participants investing in these specific types of deposits lasting from one day to the next.

You will find more infographics at Statista

Interestingly, real estate ranks highest in the age cluster of survey respondents aged 18 to 29. 24 percent of said respondents see it as best suited for retirement savings, even though median house sale prices increased by almost 30 percent between the first quarters of 2020 and 2024.

Another popular retirement scheme in this group is company pension plans. The only cluster of respondents with a popularity share below 20 percent consisted of those born between 1965 and 1979.

Trust in government pensions is low across the board, trailed only by investing in commodities like precious metals. As with savings books and company pensions, the former is seen as especially suitable by both the youngest and the oldest participants in the survey.

|

|

[]

Daily Tech News 7 July 2024

Top Story Merle Myers did not kill himself: A former Boeing inspector says parts marked for scrap ended up being built into planes. (CNN)Meyers, a 30-year veteran of Boeing, described to CNN what he says was an elaborate off-the-books practice...

Published:7/7/2024 3:15:46 AM

|

[Markets]

Inside The Chinese Money-Laundering Network Fueling America's Fentanyl Crisis

Inside The Chinese Money-Laundering Network Fueling America's Fentanyl Crisis

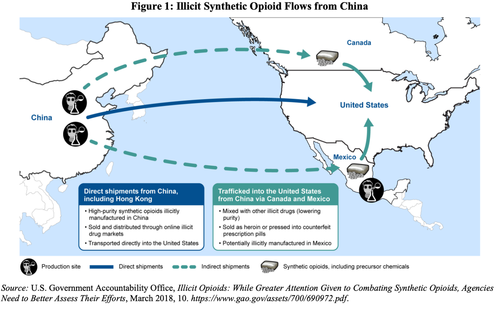

It's worth noting that 100,000 Americans die in drug-related deaths per year, the vast majority from pills cooked with fentanyl, an opioid analog 50 times more potent than heroin. Every six months, the US drug death catastrophe eclipses the Vietnam War.

Fueling the fentanyl epidemic across the US are Chinese money launderers helping international drug traffickers, like Mexican cartels. Capital flight from China is not a new phenomenon, but in recent years, the scale of these transfers, washed through the drug trade, has become very alarming.

Paul Murphy from the Financial Times has provided the most straightforward explanation yet of the new Chinese money laundering network fueling America's fentanyl crisis:

First, understand that Chinese nationals are barred from transferring more than $50,000 out of China each year. And yet, as you are surely aware, there are many many Chinese nationals living very comfortable lives in the west, as students perhaps, or tourists, or simply not working.

Now understand that Mexican drug cartels are harvesting untold billions of dollars, in cash, selling drugs in North America — and that the pill of the moment is fentanyl, which kills about 70,000 people a year in the US.

The chemicals to make fentanyl come from China. These are shipped to Mexico by otherwise legit Chinese chemical manufacturers.

In Mexico, the cartels turn the chemicals into pills and smuggle these north across the border, where they are sold for cash — dollar bills that then need to be cleaned.

Murphy continued:

Meanwhile, in New York for instance, there will be a Chinese student attending an educational establishment, where the fees will be circa $66,000 a year, books and extras another $10,000, food and lodging costs of maybe $5,000 a month, or a lot more.

The $50,000 Chinese transfer cap doesn't cover these things, so she will go on WeChat and broadcast a message to her network of friends saying: "I need dollars in New York to meet my outgoings. Can anyone help?"

In due course, someone associated with what is a very efficient Chinese underground banking system will get in touch and tell the student to meet a courier at a preordained time and place, typically a park in Brooklyn. There, the student will be handed a bundle of cash.

Back in China, the parents of the student will then be asked to transfer the same amount of money (plus commission) to an account that will eventually make its way to the chemical company that produced the precursor ingredients for fentanyl, settling the outstanding bill for the Mexican drug cartel.

Murphy explained, "Drug addicts in the US are facilitating the Western education of Chinese youth, as well as helping to fund the lifestyles of other Chinese nations living outside China."

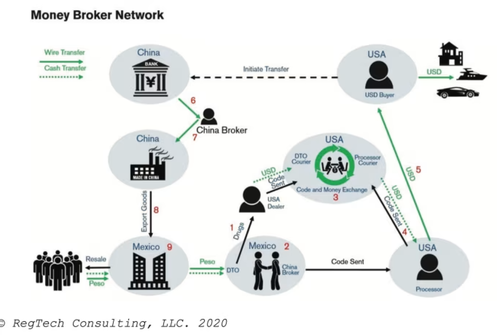

He provided a flow chart showing how the complex laundering system works.

Source: FT Source: FT

In a separate report last week, FT's Joe Miller and James Kynge published an in-depth analysis of the Chinese-Mexican laundering network in a report titled "The new money laundering network fuelling the fentanyl crisis."

The report sheds light on the less understood part of the money laundering operation — the demand for dollars from wealthy Chinese individuals. While capital flight from China is not new, the methods have become increasingly creative, involving chemical companies that, in turn, have fueled America's opioid epidemic.

"The levels of capital flight in the past three years have been quite alarming," one senior Chinese official told FT, adding, "Some wealthy private entrepreneurs are losing confidence in China's future. They feel unsafe, so they find ways to get their money out."

Brad Setser, a former US Treasury official and an expert on global capital flows at the Council on Foreign Relations, estimated that capital flight from China is running at an annualized rate of about $516 billion as of 1Q24. This figure was even higher in the 3Q22, reaching almost $738 billion.

"The whole system of drug trafficking is being sustained by a network of clandestine [Chinese] money brokers," said Giovanni Melillo, the chief prosecutor for Italy's National Anti-Mafia and Terrorism Directorate. His office has been coordinating laundering probes across Italy this past year.

Previous cases of money laundering in the US involving Chinese nationals have raised serious questions about how much Beijing knows about these dark laundering networks. For instance, a recent Wall Street Journal report revealed that Chinese crime groups and drug traffickers used the Toronto-Dominion Bank to launder money from US fentanyl sales.

In mid-April, the House Select Committee on China revealed that the Chinese Communist Party used tax rebates to subsidize the manufacturing and exporting of fentanyl chemicals to overseas customers.

The biggest mystery here is why the Biden administration hasn't taken a tougher stance on China while America's fentanyl epidemic kills as many citizens each year as two Vietnam Wars.

|

|

[Entertainment]

Washington Post hardcover bestsellers

A snapshot of popular books.

Published:7/3/2024 7:09:32 AM

|

|

[9e366c9c-8b15-5dbc-b08f-cd6badbc5c74]

10 movies based on best-selling books

Many movies develop a story already established in a popular book. "Harry Potter," "The Hunger Games" and "The Godfather" were best-selling books before they were movies.

Published:7/2/2024 3:40:22 PM

|

[Markets]

Customized B Vitamin Therapy Could Help Parkinson’s Patients, New Study Suggests

Customized B Vitamin Therapy Could Help Parkinson’s Patients, New Study Suggests

Authored by George Citroner via The Epoch Times (emphasis ours),

A team of Japanese scientists has uncovered an unexpected link between the gut and the brain. The discovery may offer fresh insights into managing a condition that affects 9 million people worldwide.

Deficiency of 2 B Vitamins Linked to Parkinson’s

The study, published in npj Parkinson’s Disease, suggests that vitamin B deficiency may contribute to Parkinson’s development by compromising the intestinal barrier, which typically prevents toxins from entering the bloodstream. Toxins in the bloodstream may lead to neuroinflammation, which is inflammation in the nervous system often associated with neurodegenerative diseases and other neurological conditions.

Researchers used shotgun sequencing to analyze stool samples, allowing them to identify changes in the microbial community and genetic makeup. The study found fewer genes in Parkinson’s patients’ gut bacteria responsible for making vitamins B2 (riboflavin) and B7 (biotin). Both have anti-inflammatory properties and may help counteract the neuroinflammation associated with Parkinson’s disease.

This suggests that B vitamin supplementation could potentially relieve Parkinson’s symptoms and even slow disease progression, Hiroshi Nishiwaki, the lead study author, said in a press release.

Previous research has already shown that high doses of riboflavin contribute to the recovery of some motor functions in Parkinson’s patients. While there’s no specific research on biotin supplementation for Parkinson’s, one study found that high doses of biotin improved symptoms in patients with multiple sclerosis, another neurological disorder.

Customized for Individual Microbiomes

The findings also suggest that vitamin therapy could potentially be customized based on each patient’s unique microbiome profile to delay the onset of Parkinson’s-associated symptoms.