|

[Uncategorized]

NASA’s “Foremost” Mission

“NASA Administrator Charles Bolden said in a recent interview that his “foremost” mission as the head of America’s space exploration agency is to improve relations with the Muslim world.” July 05, 2010 FOXNews.com – NASA Chief: Next Frontier Better Relations … Continue reading →

Published:10/21/2024 1:15:39 PM

|

[Markets]

The Starship Revolution In Space

The Starship Revolution In Space

Authored by Malcom Davis via RealClearDefense,

SpaceX took a big step towards full reusability of space launchers on 13 October, a step towards a transformation in accessing space far more cheaply, frequently and with big payloads.

The remarkably successful fifth test flight of the Starship launcher on that day saw a spectacular recovery of the rocket’s 300-ton first stage, Super Heavy, into the arms of the launch pad gantry. The second stage, also called Starship, meanwhile climbed and accelerated to almost orbital velocity and splashed down precisely in the targeted Indian Ocean location off Western Australia. This took the company closer to landing second stages for re-use.

The full reusability of Starship will dramatically reduce launch costs. That means it’s possible to consider new types of activity in space that simply were not viable technologically or were too expensive with past launch architecture.

Most of the envisaged applications are civilian, but possible military applications include launching surveillance and other satellites far more cheaply, and therefore in greater numbers, and even urgent delivery of large payloads across Earth with suborbital flights.

Once SpaceX achieves the capability for one Starship to take fuel from others in orbit, a single mission will be able to deliver up to 100 metric tons or 100 people to the Moon, to Mars and potentially beyond.

The cost of launch matters. Only the first stage of SpaceX’s existing Falcon launcher returns for re-use, yet that rocket has driven launch costs down to U.S.$2720 per kilogram from the U.S.$25,000 per kg that users paid for NASA Space Shuttle flights. The total cost of a Falcon launch is about U.S.$67 million.

Because no hardware will be lost on a Starship flight, the only costs will be fuel, maintenance and use of the pad: U.S.$10 million or less per launch for a future Starship version and, according to SpaceX CEO Elon Musk, eventually U.S.$2 million to U.S.$3 million. That suggests a launch cost of U.S.$100 to U.S.$200 per kg.

Compare this with NASA’s Space Launch System (SLS) rockets, which will be fully expended on each mission, except for their Orion crew capsules. They will initially cost U.S.$4 billion per launch and may end up around U.S.$2.5 billion. NASA will launch only one SLS per year, at best.

Starship’s capacity means it will be able to launch large numbers of satellites on each mission, further reducing cost and rapidly deploying mega constellations, such as Starlink. Alternatively, it will be able to carry very large payloads into orbit—as much as 200 metric tons in a future version of Starship.

At its Boca Chica launch site in Texas, SpaceX is establishing what it calls the Starfactory, an assembly line that will be able to build a Starship a week, up from three a year now. With two more launch sites at Cape Canaveral, there is a suggestion of up to 44 flights a year from this location. Add in the launch facilities at Boca Chica, and the launch rate can exceed that of Falcon 9, currently one every 2.7 days.

Low cost, high payload to orbit and a fast launch cadence open up new opportunities for radically different purposes, particularly when in-orbit refueling is proven.

The most important role for Starship is supporting NASA’s Artemis program to get humans back to the Moon in preparation for human missions to Mars. SpaceX is developing a special lunar-landing version of Starship. Musk has suggested flying uncrewed Starships to Mars by 2026, and potentially crewed missions there by 2028, with his goal being the establishment of a permanent human presence on the planet’s surface.

Low-cost launches by Starship could also support a permanent human presence on the Moon that could then establish an in-space economy and manufacturing capability based on the use of lunar resources. All indications are that the Moon has substantial ice deposits in its regolith around the south pole, where humans will land first. If the water can be used for a base and in making rocket fuel for Starship launches from weak lunar gravity, the Moon will become a launch pad for exploration and resource exploitation across the inner solar system. That’s more important than Mars colonisation in coming decades.

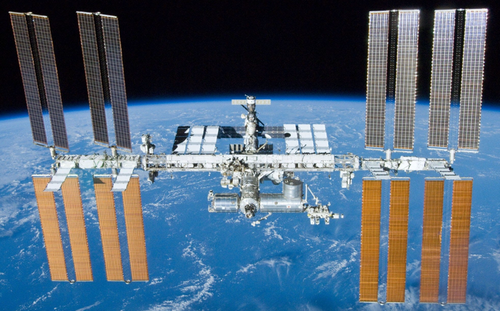

The establishment of a permanent human base on the Moon, and the utilisation of lunar resources opens up a next step in human space activities. This will include construction of large space-based solar power satellites that could solve much of Earth’s energy challenges for the 21st century and beyond. Another option will be large commercial space platforms to replace the International Space Station at the end of its life in 2030. Robotic space manufacturing using lunar resources and 3D printing would create the possibility of an in-space industry that could foster technological innovation in the 2030s and 2040s.

Starship’s promise of low-cost and frequent space access opens up this new golden era of space exploration and resource exploitation.

Malcolm Davis is a senior analyst with ASPI.

|

|

[Uncategorized]

SpaceX Falcon Heavy Rocket Launches NASA’s Europa Clipper

Meanwhile, CEO Elon Musk and his company are being attacked by naysayers, haters, academics, and bureaucrats.

The post SpaceX Falcon Heavy Rocket Launches NASA’s Europa Clipper first appeared on Le·gal In·sur·rec·tion.

Published:10/16/2024 5:01:43 PM

|

[Markets]

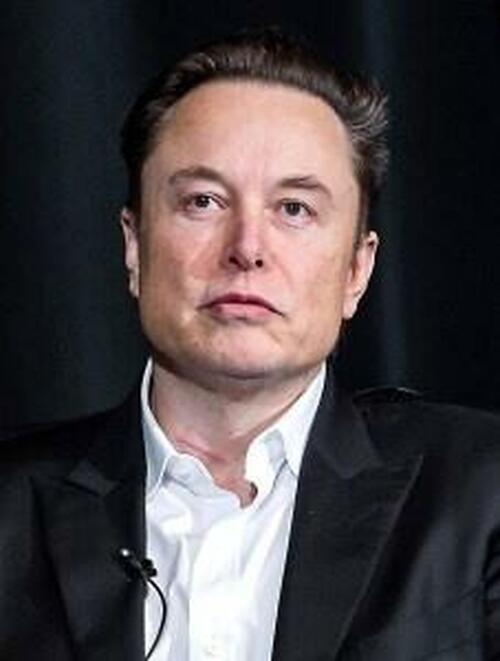

Liberals Are Losing Their Minds Over Elon Musk

Liberals Are Losing Their Minds Over Elon Musk

Authored by Jonathan Turley,

This week, Elton John publicly renounced the Rocket Man - no, not the 1972 song, but Elon Musk, whom he called an “a**hole” in an awards ceremony.

Sir Elton, 77, is only the latest among celebrities and pundits to denounce Musk for his support of former president Donald Trump and his opposition to censorship. Musk-mania is so overwhelming that some are calling for his arrest, deportation and debarment from federal contracts.

This week, the California Coastal Commission rejected a request from the Air Force for additional launches from Vandenberg Air Force Base. It is not because the military agency did not need the launches. It was not because the nation and the community would not benefit from them. Rather, it was reportedly because, according to one commissioner, Musk has “aggressively injected himself into the presidential race.”

By a 6-4 vote, the California Coastal Commission rejected the military’s plan to let SpaceX launch up to 50 rockets per year from the base in Santa Barbara County.

Musk’s SpaceX is becoming a critical part of national security programs. It will even be launching a rescue mission for two astronauts stranded in space. The advances of SpaceX under Musk are legendary. The Air Force wanted to waive the requirement for separate permits for SpaceX in carrying out these critical missions.

To the disappointment of many, SpaceX is now valued at over $200 billion and just signed a new $1 billion contract with NASA. Yet neither the national security value nor the demands for SpaceX services appear to hold much interest for officials like Commissioner Gretchen Newsom (no relation to California’s governor, Gavin Newsom): “Elon Musk is hopping about the country, spewing and tweeting political falsehoods and attacking FEMA while claiming his desire to help the hurricane victims with free Starlink access to the internet.”

Newsom is the former political director for the International Brotherhood of Electrical Workers (IBEW) Local 569. It did not seem to matter to her that increased launches meant more work for electrical workers and others. Rather, it’s all about politics.

Commission Chair Caryl Hart added “here we’re dealing with a company, the head of which has aggressively injected himself into the presidential race and he’s managed a company in a way that was just described by Commissioner Newsom that I find to be very disturbing.”

In my book “The Indispensable Right: Free Speech in an Age of Rage,” I discuss how Musk became persona non grata when he bought Twitter and announced that he was dismantling the company’s massive censorship apparatus.

He then outraged many on the left by releasing the Twitter Files, showing the extensive coordination of the company with the government in a censorship system described by a federal court as “Orwellian.”

After the purchase, former Democratic presidential nominee Hillary Clinton called upon Europeans to force Musk to censor her fellow Americans under the notorious Digital Services Act. Clinton has even suggested the arrest of those responsible for views that she considers disinformation.

Silicon Valley investor Roger McNamee called for Musk’s arrest and said that, as a condition of getting government contracts, officials should “require him to moderate his speech in the interest of national security.”

Former Clinton Secretary of Labor Robert Reich wants Musk arrested for simply refusing to censor other people.

Former MSNBC host Keith Olbermann called for Musk to be deported and all federal contracts cancelled with this company. As with many in the “Save Democracy” movement, Olbermann was unconcerned with the denial of free speech or constitutional protections. “If we can’t do that by conventional means, President Biden, you have presidential immunity. Get Elon Musk the F out of our country and do it now.”

Of course, none of these figures are even slightly bothered about other business leaders with political opinions, so long as, like McNamee, they are supporting Harris or at least denouncing Trump. Musk has failed to yield to a movement infamous for cancel campaigns and coercion. The usual alliance of media, academia, government and corporate forces hit Musk, his companies and even advertisers on X.

Other corporate officials collapsed like a house of cards to demands for censorship — see, for example, Facebook’s Mark Zuckerberg. Musk, in contrast, responded by courageously releasing the Twitter Files and exposing the largest censorship system in our history.

That is why I describe Musk as arguably the single most important figure in this generation in defense of free speech. The intense hatred for Musk is due to the fact that he was the immovable object in the path of their formerly unstoppable force.

The left will now kill jobs, cancel national security programs and gut the Constitution in its unrelenting campaign to get Musk. His very existence undermines the power of the anti-free speech movement. In a culture of groupthink, Musk is viewed as a type of free-thought contagion that must be eliminated.

Their frustration became anger, which became rage. As Elton John put it in “Rocket Man,” he was supposed to be “burning out his fuse up here alone.”

Yet, here he remains.

George Bernard Shaw once said “a reasonable man adjusts himself to the world. An unreasonable man expects the world to adjust itself to him. Therefore, all progress is made by unreasonable people.”

With all of his idiosyncrasies and eccentricities, Elon Musk just might be that brilliantly unreasonable person.

* * *

Jonathan Turley is the Shapiro Professor of Public Interest Law at George Washington University and the author of “The Indispensable Right: Free Speech in an Age of Rage.”

|

|

[Science]

The Hunt for Life on Europa Is About to Kick Up a Gear

NASA’s Europa Clipper mission is set for launch, finally revealing if this icy moon of Jupiter is habitable or not.

Published:10/11/2024 7:32:52 AM

|

|

[Space]

Mission to Jupiter’s icy moon, Europa, begins on October 10th…amazing work by Galileo 400+ years ago on the largest planet in our solar system and its moons

Europa is a world that shows strong evidence for an ocean of liquid water beneath its icy crust which could very well host conditions favorable for life. NASA will place a highly capable, radiation-tolerant spacecraft named “Clipper” into a long, looping orbit around Jupiter to perform repeated flybys of the icy moon.

Published:10/5/2024 9:00:18 AM

|

|

[Uncategorized]

“Arctic sea ice is headed toward a historic low”

“Arctic sea ice is headed toward a historic low 09-30-2024 This is the conclusion of researchers at NASA and the National Snow and Ice Data Center (NSIDC).” Arctic sea ice is headed toward a historic low – Earth.com There has … Continue reading →

Published:10/1/2024 3:21:51 PM

|

[Markets]

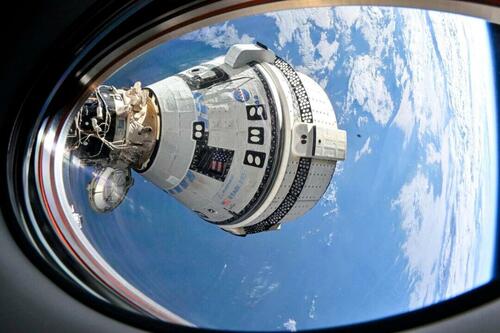

SpaceX Launches Rescue Mission For Two Stranded Boeing Starliner Astronauts On ISS

SpaceX Launches Rescue Mission For Two Stranded Boeing Starliner Astronauts On ISS

Just two weeks after SpaceX completed the historic Polaris Dawn mission, which included the first private spacewalk and the highest orbit since the Apollo era...

... Elon Musk's space company launched a Falcon rocket from Cape Canaveral, Florida, on Saturday to rescue the stranded Boeing Starliner astronauts on the International Space Station.

NASA astronaut Nick Hague and Russian cosmonaut Alexander Gorbunov are aboard the Dragon capsule and will reach the ISS on Sunday afternoon.

Since NASA rotates ISS crews every six months, the stranded astronauts, Suni Williams and Butch Wilmore, won't return to Earth until late February.

Boeing's first astronaut flight with the Starliner launched in June was only supposed to last a week, but multiple failures, including thruster troubles and helium leaks, led NASA officials to deem the spacecraft too dangerous for Williams and Wilmore. The crewless Starliner returned to Earth earlier this month, landing without a problem in New Mexico.

After Saturday's launch, NASA Deputy Administrator Pam Melroy said "human spaceflight" is very "complicated and dynamic."

SpaceX noted after launch.

Meanwhile.

Where is Jeff Bezos' Blue Origin?

|

|

[Science]

An International Space Station Leak Is Getting Worse—and Keeping NASA Up at Night

A NASA inspector general report gives new details on a leak that has plagued the ISS for five years, and reveals that the agency considers it the highest-level risk.

Published:9/28/2024 10:44:52 AM

|

[Markets]

"What Could Go Wrong? Probably More Than You Might Imagine..."

"What Could Go Wrong? Probably More Than You Might Imagine..."

Authored by James Howard Kunstler,

Wheezing Past The Graveyard

"The Democrats are self-immolating on the altar of their own tenuous relationship with common decency."

- Tom Luongo

What could go wrong? Probably more than you might imagine. We have just turned the corner into autumn. Now, things get serious, even gravely dark. America has never been so into dancing skeletons and morbidity. The small-town yards are filling up with inflatable signifiers of hell and death. Don’t you wonder what all this signifies besides good old family fun? The zeitgeist maybe having a little sport with us, you think?

We are chiefly preoccupied with our badly dysfunctional self-governance, of course, and the method for periodically revising it, which we call an election. Nobody has confidence in the process, which has acquired so many layers of absurd, needless complexity for the sole purpose of perverting the outcome that every lawyer in the land will have a hefty guaranteed annual income in the probably futile effort to sort it out come November 6. There is your hell-scape, with overtones of death on a pale horse. . . and all. Chaos. . . riots. . . anarchy. . . civil war.

The threat of World War Three may have abated for the moment, but in a peculiar and disconcerting way, viz. a coup in the executive branch. The gadfly Col. Lawrence Wilkerson, long ago chief-of-staff to Sec’y of State Colin Powell, reports that the Pentagon has cancelled “Joe Biden,” that is, taken him out of the decision-loop for anything. Well, you ask yourself, how is it possible he had even remained remotely close to any decision-loop this long, in any case, given the problem of his obviously broken brain? But now, it is unofficially official: just eat your mint-chocolate ice-cream and shut up, and let Dr. Jill run those “cabinet meeting” photo ops.

According to Col. Wilkerson, Sec’y of Defense Lloyd Austin told the “president” to his face that there will be no flinging of US-supplied long-range missiles from Ukraine “deep into Russia,” as the neocon-infested White House been chattering about endlessly. Wiser heads deep in the DOD HQ have decided the matter. Lump it, if you must, Tony Blinken and Jake Sullivan. The Russians’ “red-line” on such a caper is so wide you can see it from the International Space Station — that is, if you’re an astronaut marooned up there due to combined NASA/Boeing incompetence. . . but that’s another story.

Meanwhile, UK Prime Minister Keir Starmer was all revved up for the missile operation and flew to Washington for a one-to-one meet-up with “JB” to get the go-ahead. The Brits are avid for another World War. The last two went so well for them that they kissed their vast empire goodbye. Now they want to kiss goodbye their sceptered isle itself, which has almost no economy left and is overrun by cultural hostiles who are not into Shakespeare. The Brits’ floundering government is a posse of monomaniacs fixated on defeating Russia which, at this point in history, is like a dormouse (Glis glis) facing down a brown bear (Ursus arctos).

“Joe Biden,” reportedly “furious” at losing his executive power, was constrained to tell Mr. Starmer that the missile strike op was off, which left the UK PM miffed that he had crossed the ocean for no reason. Who knows, the Brits are so nuts these days that perhaps they’ll try to pull it off on their own. Mr. Zelensky, the no-longer-elected leader of Ukraine was begging them to try it because Ukraine has nothing left. NATO as a whole really has nothing left, either. Not much of a combined military, scant munitions left in the cupboard, and no will to wage war among the depressed citizens of its member nations.

There is nothing left except to come to terms on a settlement that will leave Ukraine not a member of NATO. The entire affair has been a humiliation for NATO and America, especially for the “Joe Biden” management team (whatever it actually consists of these days). The longer they refuse to engage in talks, the less of Ukraine will be left as a sovereign entity — having proven to the world that its sovereignty rests solely on its capacity to be used as a catspaw by the American neocon / intel blob. You’re reminded that for seventy years prior to 2014, Ukraine was not a problem for anyone until we made it a problem on-purpose — our purpose being idiotic and malicious — and Ukraine could, in theory, revert to not being a problem for anyone again. Wouldn’t that be wonderful?

The neocon / intel blob’s other catspaw (domestic version), candidate Kamala Harris, is promising all kinds of good things “when [she] is in-office.” For some reason, nobody on The New York Times’s enormous staff of Ivy League germinated journalist-geniuses has informed Ms. Harris that she is actually in-office now, and has been since 1/20/2021. Why no good things for us plebes all these many months? No rainbows, unicorns, tax cuts, or ten-pound blocks of government cheese? Nothing but a disintegrating dollar, floods of savage mutts crossing the border and landing everywhere from Springfield, Ohio, to Nantucket, and endless raging bullshit about fighting “misinformation” — i.e., any idea that contradicts the Democratic Party’s agenda for assisted national suicide.

Ms. Harris’s gaslight-powered campaign has lost its loft in recent days, its most newsworthy event being last week’s cuddle hour with America’s official Care-Bear, Oprah. . . because, you see, there is nothing left except to pander to the emotional void induced by Woke-ism in the desperately needy minds of X-million voters of the birthing-person persuasion — especially among those unhappy souls who never got around to the birthing. Ms. Harris’s loathsome accessory, Tim Walz, has performed so discordantly that the campaign had to hang him in a closet somewhere, along with all his assorted skeletons, and lock the door.

As ever, October surprises await: monsters, demons, ghouls, shrieking ghosts, the walking dead, and all the paid-up minions of the teachers’ union.

|

[Markets]

Escaping Bureaucratic Gravity: The Case For Free Market Economics In Space Exploration

Escaping Bureaucratic Gravity: The Case For Free Market Economics In Space Exploration

Via SchiffGold.com,

The spirit of space exploration is one of curiosity and innovation, not suffocating government bureaucracy...

Thus, as we stand on the cusp of a new era in astronautics, it’s time to apply free market principles in venturing into this new frontier. The recent surge in private sector involvement in space has demonstrated that when economic freedom is promoted, innovation flourishes and costs plummet. To fully realize the benefits of space exploration, we must embrace market-driven solutions and reduce government barriers to entry.

The success of companies like SpaceX has shown the power of competition and innovation in dramatically reducing launch costs. According to NASA, the average cost to launch a payload to low Earth orbit on the Space Shuttle was about $54,500 per kilogram. In contrast, SpaceX’s Falcon 9 rocket has brought that cost down to approximately $2,720 per kilogram – a reduction of 95%. This cost reduction has opened up new possibilities for scientific missions, satellite deployment, and even space tourism.

The benefits of private sector involvement extend beyond just launch costs. The development of reusable rockets, pioneered by SpaceX and now being pursued by other companies, promises to further slash costs and increase launch frequency. In 2022 alone, there were 61 successful orbital launches by SpaceX, 12 times the amount launched by all of Europe combined. These launches enable faster iteration and testing of new technologies, accelerating the pace of space innovation.

The economic potential of a commercial space sector is significant. According to a report by Morgan Stanley, the global space industry could generate revenue of $1.1 trillion in 2040, up from $350 billion in 2020. This growth will create high-paying jobs, drive technological innovation, and potentially open up entirely new industries such as space manufacturing and resource extraction.

Some argue that space exploration is too important or complex to be left to private companies. However, history has shown that government monopolies in any sector tend to lead to inefficiency, stagnation, and inflated costs. The role of government should be to set broad goals and ensure safety standards, not to micromanage industries.

A free market approach doesn’t mean abandoning government involvement entirely. Rather, it means leveraging the strengths of both public and private sectors. NASA’s Commercial Crew and Commercial Cargo programs have demonstrated the success of this model. By partnering with private companies to deliver cargo and crew to the International Space Station, NASA has not only reduced costs but also fostered a competitive commercial space industry in the United States.

Innovation thrives in a privatized industry. While the government should continue funding basic scientific research, commercial companies have demonstrated a remarkable ability to create and innovate in areas like propulsion, spacesuit design, and rocket efficiency. This approach ensures that cutting-edge discoveries continue to fuel the next generation of space technologies.

To fully harness the potential of free market principles in space exploration, several policy changes are needed. First, we must streamline regulations. The current regulatory framework for commercial space activities is often slow and cumbersome. Simplifying and expediting the approval process for launches, satellite deployments, and other space activities would encourage more companies to enter the market.

We should also expand public-private partnerships. Building on the success of programs like Commercial Crew, NASA and other space agencies should look for more opportunities to partner with private companies on ambitious projects like lunar bases or Mars missions.

The exploration of space represents one of the greatest challenges and opportunities of our time. By embracing free market principles, we can accelerate progress and open up new frontiers for scientific discovery and economic growth. The success of companies like SpaceX has shown that private enterprise can achieve what was once thought possible only through government programs.

As we look to the future – to establishing permanent bases on the Moon, sending humans to Mars, and perhaps one day venturing to the outer solar system – it’s clear that the dynamism and innovation of the free market will be essential. By creating the right regulatory and economic environment, we can usher in a new golden age of space exploration.

The stars are calling, and free markets can help us answer.

|

[Markets]

Boeing's Head Of Space & Defense Ted Colbert Exits Company

Boeing's Head Of Space & Defense Ted Colbert Exits Company

The head of Boeing’s space and defense business is leaving the company after years of losses from fixed-price contracts and a high-profile debacle with its space capsule that left two astronauts in space...

Kelly Ortberg, Boeing’s new president and CEO, said on Friday that Ted Colbert, the head of the corporation’s troubled space and defense unit, will leave the company effective immediately.

As Caden Pearson reports via The Epoch Times, the move marks the first major leadership change under Ortberg, who took over in August.

“I want to thank Ted for his 15 years of service at The Boeing Company, supporting our customers, our people, and our communities,” Ortberg wrote in a memo to employees.

Steve Parker, the unit’s chief operating officer, will assume Colbert’s responsibilities until a permanent replacement is named.

Boeing’s space business has suffered repeated setbacks, including NASA’s recent decision to send the Starliner capsule back to Earth without astronauts after years of issues.

Colbert’s exit also comes as Boeing grapples with a broader financial crunch.

The company announced furloughs for thousands of white-collar workers, while more than 32,000 workers remain on strike.

“At this critical juncture, our priority is to restore the trust of our customers and meet the high standards they expect of us to enable their critical missions around the world,” Ortberg wrote.

“Working together we can and will improve our performance and ensure we deliver on our commitments.”

The company’s troubles extend to its commercial division, with a new Alaska Airlines 737 Max 9 experiencing a mid-air emergency in January due to missing bolts. Boeing also faces ongoing scrutiny from the Federal Aviation Administration (FAA), which has restricted the company from increasing production of the 737 Max until it makes substantial safety and quality improvements.

In July, Boeing agreed to plead guilty to a criminal fraud conspiracy charge and pay $243.6 million in penalties after breaching a 2021 deferred prosecution agreement. The U.S. government alleged that Boeing knowingly misrepresented information to the FAA about key software on the 737 Max, the same plane involved in two fatal crashes in 2018 and 2019.

Ortberg, in a separate email to employees on Friday, emphasized the need for Boeing to regain its leadership in managing defense programs.

“Historically, Boeing held a superior reputation for our ability to manage programs, and we need to ensure it remains a key differentiator for us in the future,” Ortberg wrote.

He said he had learned more about future investments for the company to be more competitive in the future, as well as near-term challenges engineers face with first-time quality and execution.

Parker, who joined Boeing’s industrial leadership team two years ago, was tapped to help overhaul Boeing’s defense programs and improve production efficiency.

He had previously led Boeing’s bomber and fighter programs as well as its defense plants in St. Louis.

Colbert joined Boeing in 2009 after working at Citigroup and Ford Motor. He served as Boeing’s chief information officer and lead its global-services business before running the defense unit from April 2022 after the previous leader was ousted.

As The FT reports, Boeing’s defence business reported losses in 2022, 2023 and the second quarter of 2024.

The division has laboured under fixed-price contracts for several large programs, which represent just 15 per cent of revenues but have racked up nearly $14bn in charges over the past decade.

Jefferies analyst Sheila Kahyaoglu estimated the fixed-price programs could consume $2.6bn in cash this year, and $1.8bn in 2025.

The programs include the KC-46 refuelling tanker, the T-7A Air Force training aircraft and the MQ-25 refuelling drone, as well as the US president’s Air Force One jet and the CST-100 Starliner spacecraft that was built to ferry astronauts to the International Space Station.

Boeing suffered a black eye last month when Nasa decided to forgo bringing astronauts Sunita Williams and Barry Wilmore back to Earth on Boeing’s spacecraft.

Due to technical problems, the agency now plans to bring the pair home in February on a SpaceX spacecraft.

Of course, given the color of Colbert's skin, we assume there will be an imminent tirade from leftists that (structural) racism played a role in his dismissal (as opposed to his role running the group that literally lost billions of dollars for shareholders)... Or, perhaps we should ask the families of the stranded astronauts how they feel about his 'work'?

|

|

[World]

A huge NASA contract has sent Intuitive Machines’ stock skyrocketing. This analyst sees even more upside.

Intuitive Machines is “the leading beneficiary of NASA’s lunar commercialization efforts,” says B. Riley Securities analyst Mike Crawford.

Published:9/20/2024 6:47:33 AM

|

|

[Markets]

With huge NASA contract, Intuitive Machines closer to becoming ‘preeminent lunar infrastructure player’, says analyst

The award of a NASA contract worth up to $4.82 billion has cemented Intuitive Machines Inc.’s position as a key partner in the space agency’s ambitious plans for lunar exploration, according to analyst firm Benchmark.

Published:9/19/2024 6:37:42 AM

|

|

[Uncategorized]

“getting smaller”

“Petermann Glacier in Greenland is getting smaller, according to NASA and glaciologists, not larger, as claimed in social media posts saying that the glacier has defied news reports by growing three metres a day for the past 11 years.” Fact … Continue reading →

Published:9/18/2024 9:44:54 AM

|

|

[World]

Intuitive Machines’ stock soars, boosted by NASA contract worth up to $4.82 billion

Shares of Intuitive Machines Inc. were set to skyrocket Wednesday, lifted by the award of a NASA contract that could be worth up to $4.82 billion.

Published:9/18/2024 6:50:41 AM

|

|

[Uncategorized]

Rapidly Accelerating Sea Level Rise

NASA shows that sea level rose at a rate of 0.9 mm/year from 1950 to 1995, and then accelerated to 3.3 mm/year from 1995 to 2018, but I can’t find any tide gauges which reflect that change. Sea Level | … Continue reading →

Published:9/16/2024 11:58:56 AM

|

[Markets]

Welcome Back To Planet Earth: SpaceX Polaris Dawn Crew Returns After Historic Spacewalk Mission

Welcome Back To Planet Earth: SpaceX Polaris Dawn Crew Returns After Historic Spacewalk Mission

The five-day Polaris Dawn mission, operated by Elon Musk's SpaceX, ended early Sunday as the Crew Dragon capsule safely splashed down off the coast of Florida. The mission, hailed as a massive success, featured the world's first commercial spacewalk with astronauts traveling further into space than any humans for more than half a century and marked a breakthrough in testing inter-satellite laser communication through SpaceX's Starlink network.

The Crew Dragon capsule carrying four astronauts, including billionaire entrepreneur Jared Isaacman, SpaceX engineer Sarah Gillis, and two others, splashed down off the coast of Dry Tortugas, Florida, around 0337 ET.

Welcome back to planet Earth.

By 0600 ET, the crew exited the Crew Dragon capsule.

The mission's top focus was testing SpaceX's most advanced spacesuits at an apogee - or farthest point from Earth - than any human has traveled since NASA's Apollo Program ended in 1972. Astronauts Isaacman and Gillis exited the spacecraft for ten minutes each to test the new suits.

The inter-satellite laser communication between the Dragon Spacecraft and SpaceX's Starlink satellite constellation was also successfully tested during the mission.

Looking ahead, Musk revealed one week ago that the Starship mega rocket will begin flying Mars missions in two years when the next Earth-Mars transfer window opens. The mission will be uncrewed to test the rocket's ability to land intact on the Red Planet.

Democrats are fuming over SpaceX's space successes, while Boeing's Starship and Jeff Bezos' Blue Origin are light-years behind Musk.

So far, the Biden administration has not congratulated Musk on Polaris Dawn's push to advance humanity toward becoming a multi-planetary species because of politics.

|

|

[World]

Indigenous Colombian coca company challenges Coca-Cola’s trademark

Coca Nasa, producer of Coca Pola, or coca beer, says it’s motivated by what it claims is bullying by the beverage giant.

Published:9/15/2024 4:08:36 AM

|

|

[Markets]

SpaceX Polaris crew of four set to splash down after historic mission

The mission was commissioned by billionaire Jared Isaacman, who made a fortune as the founder of Shift4 Payments, and did not involve NASA.

Published:9/15/2024 2:00:38 AM

|

|

[]

I Have Seen the Future of Drone Warfare and It Is Frighteningly Beautiful

Published:9/13/2024 8:31:54 AM

|

[Markets]

Professor Warns Of "European Christian Imperialism" In Outer Space

Professor Warns Of "European Christian Imperialism" In Outer Space

Authored by Dave Huber via The College Fix,

One of the sillier aspects of DEI/critical theory is the erosion of reason and rationality in the cause of righting “oppression.”

We’ve seen this with the gender movement, in particular; less known is how it’s creeping into hard sciences like astronomy.

For instance, remember last summer when an “indigenous scholars” group warned that listening — yes, just listening — for alien civilizations could be viewed as “eavesdropping” or “surveillance” (do we have the aliens’ permission)?

What about the Canadian government’s efforts at “decolonizing light“? Or the Stanford University academic who claimed efforts to colonize Mars are “patriarchal” and “another example of male entitlement”? Etc. …

Now, Wesleyan University Dean of Social Sciences Mary-Jane Rubenstein, a “philosopher of science and religion” (who’s also affiliated with the school’s Feminist, Gender, and Sexuality Studies Program), says she’s noticed how “many of the factors that drove European Christian imperialism” have been put to use in “high-speed, high-tech forms.”

Rubenstein wonders if “colonial practices” like “exploitation of environmental resources and the destruction of landscapes,” all “in the name of ideals such as destiny, civilization and the salvation of humanity,” will be part of man’s expansion into space.

Of course, we’re reasonably sure that, especially in our own solar system, there is no life — not even microbes — about which to worry. Hence, what’s the big deal if we help save Earth by exploiting Mars, Mercury, the asteroid belt, etc. for mineral and other resources?

To her credit, Rubenstein notes that Mars Society President Robert Zubrin has made this exact case. In a 2020 op-ed, Zubrin ripped a “manifesto” from a NASA DEI — diversity, equity, and inclusion — group which had argued “we must actively work to prevent capitalist extraction on other worlds.”

Such “brilliantly demonstrates how the ideologies responsible for the destruction of university liberal-arts education can be put to work to abort space exploration as well,” Zubrin wrote.

Zubrin noted that since the DEI group makes no sense on a scientific basis, it has to resort to “a combination of ancient pantheistic mysticism and postmodern socialist thought” — such as stating that even though there is no evidence of even microbes on planets such as Mars, “harming [them] would be as immoral as anything that was done to Native Americans or Africans.”

But Rubenstein (pictured) says various Indigenous beliefs “stand in stark contrast with many in the industry’s insistence that space is empty and inanimate.”

These include a group of Australian natives who say their ancestors “guide human life from their home in the galaxy” (and that artificial satellites are a danger to this “relationship”), Inuit who claim their ancestors actually live on “celestial bodies,” and Navajo who hold Earth’s moon as sacred.

“Secular space enthusiasts do not need to agree that outer space is populated, animate or sacred in order to treat it with the care and respect Indigenous communities are requesting from the industry,” Rubenstein says.

Indeed, in his review of Rubenstein’s book “Astrotopia: The Dangerous Religion of the Corporate Space Race,” Vox.com’s Sigal Samuel noted “in fact, some believe these celestial bodies should have fundamental rights of their own.”

So … critical post-modernists would have humans prioritize Natives’ beliefs in the exploration of (lifeless) space … over those of European Christians?

We should forego extracting precious minerals from asteroids, comets, and neighboring planets … because they all have some sort of “pantheistic mystical” Bill of Rights?

Just something else to ponder the next time the Left tells you they’re the “party of science.”

|

[Markets]

Boeing Starliner Spacecraft Returns To Earth Without Crew

Boeing Starliner Spacecraft Returns To Earth Without Crew

Boeing's Starliner spacecraft left the International Space Station (ISS) on Friday evening and landed in White Sands, New Mexico, in the early hours of Saturday, without astronauts Barry "Butch" Wilmore and Sunita "Suni" Williams.

The Starliner autonomously undocked from the ISS at 6:04 PM Friday, New York time. Shortly after undocking, Starliner performed what is called the "breakout burn" to avoid an ISS collision.

The uncrewed spacecraft landed in White Sands Space Harbor in New Mexico one minute after midnight.

On August 24, NASA officials decided astronauts Wilmore and Williams would not return to Earth in Boeing's beleaguered Starliner spacecraft following a series of unexpected engine failures and helium leaks that turned what was supposed to be a week-long mission into a flawed three-month mission.

Both astronauts stranded on the ISS will return in a SpaceX Crew Dragon spacecraft in February - extending a week-long mission on the ISS to eight months.

Steve Stich, NASA's commercial crew program manager, called Starliner's landing in White Sands "a bullseye landing," adding, "We've got some things we know we've got to work on."

For Boeing, this was the Starliner spacecraft's first test flight, which ended in a series of failures and massive public embarrassment since Elon Musk's SpaceX would rescue the stranded astronauts.

"We're going to take our time to figure out what we need to do to go fly Starliner One right," Stich said.

Boeing is heading back to the drawing board on Starliner, and as for Jeff Bezos' Blue Origin—who knows what's going on there? The bottom line: SpaceX still doesn't have serious competition.

|

|

[Markets]

Boeing’s Starliner returns but faces an uncertain future

NASA and Boeing will begin to assess what went wrong with the spacecraft’s thrusters and try to determine if Boeing will have to make design changes.

Published:9/6/2024 11:17:27 PM

|

|

[Science]

Boeing Starliner Returns Home to an Uncertain Future

NASA has three more operational Starliner missions on the books. It hasn't yet decided if it will commit to any more than that.

Published:9/6/2024 5:42:29 PM

|

|

[Markets]

What’s next for Boeing after the Starliner snafu?

Boeing’s troubled Starliner capsule will leave the International Space Station on Friday and return to Earth uncrewed — leaving two NASA astronauts to catch a ride home with SpaceX.

Published:9/5/2024 2:16:33 PM

|

|

[]

Houston, You Have Another Problem?

Published:9/5/2024 11:11:16 AM

|

|

[Uncategorized]

Source of ‘Pulsing Sound’ From Boeing’s Troubled Starliner Identified

Meanwhile, NASA sets return date for empty spacecraft, as it crew remains aboard the ISS until February.

The post Source of ‘Pulsing Sound’ From Boeing’s Troubled Starliner Identified first appeared on Le·gal In·sur·rec·tion.

Published:9/3/2024 8:12:55 AM

|

[Markets]

NASA Astronaut Says 'Strange Noise' Emitting From Troubled Boeing Starliner Docked At ISS

NASA Astronaut Says 'Strange Noise' Emitting From Troubled Boeing Starliner Docked At ISS

On Saturday, NASA astronaut Butch Wilmore noticed a speaker in Boeing's troubled Starliner spacecraft emitting bizarre noises.

"I've got a question about Starliner," Wilmore told Mission Control at Johnson Space Center in Houston. He said, "There's a strange noise coming through the speaker ... I don't know what's making it."

Wilmore is Starliner's commander. He asked Mission Control to analyze the audio inside the spacecraft. Minutes later, flight controllers in Houston told Wilmore the audio sounded like "pulsing noise, almost like a sonar ping."

This past weekend's sonar-like noises came days before the troubled Starliner spacecraft is scheduled to return to Earth on Friday. This flight will be uncrewed, leaving Wilmore and Sunita "Suni" Williams stranded on the International Space Station.

According to NASA, Starliner has sustained multiple helium leaks, and five of its "Reaction Control Systems" have unexpectedly malfunctioned. Last week, NASA Administrator Bill Nelson decided to tap Elon Musk's SpaceX to bring the astronauts home.

Former Canadian astronaut Chris Hadfield wrote on X, "There are several noises I'd prefer not to hear inside my spaceship, including this one that @Boeing Starliner is now making."

Musk commented on Hadfield's post with a "!"...

Ars Technica pointed out:

Astronauts notice such oddities in space from time to time. For example, during China's first human spaceflight int 2003, astronaut Yang Liwei said he heard what sounded like an iron bucket being knocked by a wooden hammer while in orbit. Later, scientists realized the noise was due to small deformations in the spacecraft due to a difference in pressure between its inner and outer walls.

It's time for NASA to undock the Starliner from the ISS before something catastrophically happens.

|

|

[cad194ab-5157-5f4c-ab48-b94fe2a585dd]

Gingrich & Walker: Kamala Harris' abandoned astronauts should already be back on Earth

Vice President Kamala Harris chaired the National Space Council. As a result of Harris’ lack of leadership, NASA has regressed back into bureaucratic timidity.

Published:8/31/2024 7:14:48 AM

|

|

[Markets]

Intuitive Machines’ stock skyrockets, lifted by NASA lunar contract

Space-exploration company Intuitive Machines Inc. was awarded a $116.9 million NASA contract to deliver six science and technology payloads to the moon’s south pole.

Published:8/30/2024 1:28:35 PM

|

|

[Markets]

Boeing has recorded $1.5 billion of Starliner forward losses, says Jefferies

NASA’s decision to bring Starliner astronauts Butch Wilmore and Suni Williams home on a SpaceX spacecraft represents “another hit” for Boeing, says Jefferies.

Published:8/26/2024 1:48:52 PM

|

[Entertainment]

NASA Reveals Plan to Return Their 2 Stranded Astronauts to Earth

A plan to bring the two NASA astronauts stranded on the International Space Station back home to Earth has been unveiled.

The government agency announced Aug. 24 that Butch Wilmore and Suni...

A plan to bring the two NASA astronauts stranded on the International Space Station back home to Earth has been unveiled.

The government agency announced Aug. 24 that Butch Wilmore and Suni...

Published:8/24/2024 3:46:08 PM

|

|

[]

Boeing Astronauts Face Spacesuit Incompatibility Issues

Published:8/24/2024 2:49:49 PM

|

[Markets]

SpaceX Prepares For Historic Spacewalk Under Polaris Dawn Mission

SpaceX Prepares For Historic Spacewalk Under Polaris Dawn Mission

While Jeff Bezos' Blue Origin struggles to get its rocket off the ground, Elon Musk's SpaceX continues to dominate the space race with the most rocket launches and satellite deployments to low-Earth orbit worldwide. Meanwhile, Musk has become a target for Democrats, with even the White House weaponizing federal agencies against the billionaire, given his support for free speech through the X platform and support for former President Trump.

Next Monday, Musk's SpaceX will usher in a new era of commercial space exploration when a Falcon 9 rocket ferries four astronauts to space via Dragon capsule under the Polaris Program to test and develop new spaceflight technology.

"This milestone mission will include testing a next-generation spacesuit during the first commercial spacewalk; endeavoring to achieve the highest altitude of any human spaceflight mission since the Apollo program; and testing a new communication system using Starlink," the Polaris Program wrote in a release.

It added, "The four crewmembers will also use their approximately five days on-orbit to conduct nearly 40 critical health research experiments, all while raising funds for St. Jude Children's Research Hospital."

Here are the four major milestones the Polaris Dawn's four-person crew will attempt to achieve next week:

-

Flying higher than any previous Dragon mission to date and reaching the highest Earth orbit ever flown while moving through portions of the Van Allen radiation belt at an orbital altitude of 190 x 1,400 kilometers (870 miles) from Earth's surface – or more than three times higher than the International Space Station. This will be the highest altitude of any human spaceflight mission in more than a half-century since the Apollo program;

-

Attempting the first-ever commercial spacewalk. This will take place at an elliptical orbit of 190 x 700 kilometers (435 miles) above Earth in newly developed SpaceX EVA spacesuits. During the spacewalk, the crew will conduct a series of tests that will provide necessary data that will allow SpaceX teams to produce and scale for future long-duration missions. The crew worked with SpaceX engineers throughout suit development, testing various iterations for mobility and performance (along with mobility aids and systems procedures), and conducted operations inside vacuum chambers to validate pre-breathe protocols and the readiness of the EVA suit;

-

Testing laser-based satellite communication using optical links between the Dragon spacecraft and Starlink satellites, revolutionizing the speed and quality of space communications;

-

Conducting nearly 40 experiments for critical scientific research designed to advance our knowledge of human health both on Earth and during future long-duration space flights

Separately, NASA is set to announce the planned return of two stranded Boeing Starliner astronauts aboard the ISS on early Saturday afternoon. Reports have already suggested that the space agency has discussed the possibility of ferrying the astronauts on a SpaceX Dragon.

If NASA selects Musk's SpaceX to rescue the stranded astronauts on the ISS, it could trigger rage among Democrats, as Trump's most outspoken supporter would dominate the news cycle on the rescue mission while leftist MSM artificially propping up Kamala Harris fades into darkness.

|

|

[Markets]

Boeing Starliner saga: NASA to provide update on how astronauts will be brought home

NASA will provide an update Saturday on whether Boeing Co.’s Starliner spacecraft will be used to bring astronauts Butch Wilmore and Suni Williams back from their extended stay on the International Space Station.

Published:8/23/2024 9:06:35 AM

|

|

[Uncategorized]

Orwellian NASA Maps

The most active US hurricane season was 1886, when Texas was hit by four hurricanes and Florida was hit by three, yet according to NASA’s very detailed (and fake) global temperature map, Atlantic temperatures were quite cool. gt_1886_720x360.jpg (720×360) How … Continue reading →

Published:8/23/2024 7:24:42 AM

|

|

[World]

NASA to decide how Starliner astronauts will be brought home by end of August

NASA will make a decision on how to bring astronauts Butch Wilmore and Suni Williams home by the end of August, the space agency said during a press conference Wednesday.

Published:8/14/2024 5:13:53 PM

|

|

[Markets]

Boeing Starliner saga: Do NASA astronauts get overtime in space?

The issues that have dogged Boeing Co.’s Starliner capsule on its first crewed flight have meant an extended stay at the International Space Station for NASA astronauts Butch Wilmore and Suni Williams.

Published:8/14/2024 4:26:56 PM

|

[Markets]

SpaceX Plans "First Human Spaceflight To Explore Earth From Polar Orbit"

SpaceX Plans "First Human Spaceflight To Explore Earth From Polar Orbit"

With Boeing's Starliner stuck at the International Space Station, SpaceX is forging ahead, announcing that the "first human spaceflight mission to explore Earth from a polar orbit" will launch later this year.

"As early as this year, Falcon 9 will launch Dragon's sixth commercial astronaut mission, Fram2, which will be the first human spaceflight mission to explore Earth from a polar orbit and fly over the Earth's polar regions for the first time," SpaceX wrote in a press release.

SpaceX said the Fram2 mission will be commanded by Chun Wang, an entrepreneur and adventurer from Malta.

Joining Wang will be Jannicke Mikkelsen from Norway, who will serve as vehicle commander; Eric Philips of Australia, the vehicle pilot; and Germany's Rabea Rogge, mission specialist. Musk's space company said, "This will be the first spaceflight for each of the crewmembers."

"Throughout the 3-to-5-day mission, the crew plans to observe Earth's polar regions through Dragon's cupola at an altitude of 425-450 km [249 to 264 miles], leveraging insight from space physicists and citizen scientists to study unusual light emissions resembling auroras," SpaceX noted.

The company added, "The crew will study green fragments and mauve ribbons of continuous emissions comparable to the phenomenon known as STEVE (Strong Thermal Emission Velocity Enhancement), which has been measured at an altitude of approximately 400-500 km [249 to 311 miles] above Earth's atmosphere."

Fram2 crew will also study how spaceflight affects the human body; this study includes capturing the first-ever X-ray image of a human in space.

Returning to Boeing's stranded Starliner, NASA could soon decide to have SpaceX rescue the two-person crew on the ISS.

|

[Markets]

NASA Inspector General Report Criticizes Boeing's Quality Control

NASA Inspector General Report Criticizes Boeing's Quality Control

Authored by Katabella Roberts via The Epoch Times (emphasis ours),

NASA’s Office of Inspector General (OIG) has raised concerns over quality control and standards at plane maker Boeing and its efforts to help the space agency return astronauts to the Moon.

Boeing's Starliner spacecraft which launched astronauts Butch Wilmore and Suni Williams to the International Space Station docked to the Harmony module's forward port on July 3, 2024, seen from a window on the SpaceX Dragon Endeavour spacecraft docked to the adjacent port. (NASA via AP) Boeing's Starliner spacecraft which launched astronauts Butch Wilmore and Suni Williams to the International Space Station docked to the Harmony module's forward port on July 3, 2024, seen from a window on the SpaceX Dragon Endeavour spacecraft docked to the adjacent port. (NASA via AP)

A report from NASA’s OIG released on Aug. 8 focuses on the Space Launch System (SLS) version 1B—the powerful heavy-lift rocket system that NASA plans to use to send the crewed Orion spacecraft and large cargo to the Moon in 2028 as part of the Artemis IV mission.

According to NASA’s report, a “critical component” of this upgrade is Boeing’s development of the SLS’s new upper stage, the Exploration Upper Stage (EUS), which will aid in sending the Orion on its mission.

Once it is complete, EUS will give the SLS a 40 percent upgrade in carrying capability, going from 27 metric tons under Block 1—the SLS rocket’s first iteration—to 38 metric tons with Block 1B, according to the report.

However, progress on the SLS, which has been under development since 2014, has been plagued with issues, including Boeing’s “ineffective quality management and inexperienced workforce,” along with continued cost increases and schedule delays, the report said.

As part of its report, NASA’s OIG interviewed officials at NASA Headquarters, Marshall Space Flight Center, Boeing, and DCMA between August 2023 through May 2024.

It also visited the Michoud Assembly Facility in New Orleans, Louisiana, to observe the SLS core stage and EUS production.

The OIG found that Boeing’s quality management system at Michoud “does not adhere” to international standards established under the global association SAE International.

The report pointed to 71 “Corrective Action Requests”(CARs) issued by the Defense Contract Management Agency (DCMA) at Michoud between 2021 and 2023 to address “deficiencies in quality.”

NASA’s OIG said this is a “high number of CARs for a space flight system at this stage in development and reflects a recurring and degraded state of product quality control.”

“Boeing’s process to address deficiencies to date has been ineffective, and the company has generally been nonresponsive in taking corrective actions when the same quality control issues reoccur,” the report said.

‘Foreign Object Debris’ Found in Fuel Tank

The report highlights other issues, including “foreign object debris ” identified inside the SLS Core Stage 2 liquid hydrogen fuel tank.

The debris included “metal shavings, Teflon, and other debris on and underneath the entry platform and ladder assembly on the forward dome panels inside of the tank.”

“Foreign object debris can damage hardware and potentially injure flight crew when entrapped within crewed flight articles,” the report stated.

The liquid hydrogen fuel tank was subsequently cleaned, reinspected, and found to meet standards, according to the report.

In another incident during its visit to Michoud in April 2023, the OIG said it observed substandard welding on a liquid oxygen fuel tank dome, a critical component of the SLS Core Stage 3.

The report said that on another occasion, Boeing officials “incorrectly approved hardware processing under unacceptable environmental conditions.”

“Quality control issues at Michoud are largely due to the lack of a sufficient number of trained and experienced aerospace workers at Boeing,” the report said.

To mitigate such challenges, Boeing provides training and work orders to its employees, the report noted.

However, the OIG said it found these efforts to be “inadequate” considering the “significant quality control deficiencies at Michoud.”

The Artemis I Space Launch System (SLS) and Orion spacecraft, atop the mobile launcher, are prepared for a wet dress rehearsal to practice timelines and procedures for launch at Launch Complex 39B at NASA's Kennedy Space Center, Fla., on June 14, 2022. (Cory Huston/NASA via AP) The Artemis I Space Launch System (SLS) and Orion spacecraft, atop the mobile launcher, are prepared for a wet dress rehearsal to practice timelines and procedures for launch at Launch Complex 39B at NASA's Kennedy Space Center, Fla., on June 14, 2022. (Cory Huston/NASA via AP)

Rising Costs

Boeing’s EUS contract has soared from the initially agreed-upon cost of $962 million in 2017 to over $2 billion through 2025, and the company’s delivery of the EUS to NASA has been postponed six years from an initial February 2021 date established in 2016 to April 2027, the report stated.

“Given Boeing’s quality management and its related workforce challenges, we are concerned these factors could potentially impact the safety of the SLS and Orion spacecraft including its crew and cargo,” it concluded.

The OIG report included a number of recommendations, including that Boeing work with the Associate Administrator for Exploration Systems Development Mission Directorate (ESDMD), among others, to develop a quality management system training program compliant with international standards.

The report said that NASA officials would review the program.

It also recommended financial penalties for Boeing’s “noncompliance with quality control standards,” although NASA ultimately decided not to fine the planemaker, according to the report.

The Epoch Times has contacted Boeing for comment.

Stuck in Space

The report comes as NASA astronauts Butch Wilmore and Suni Williams remain stuck in space aboard the Boeing Starliner due to ongoing issues with its thrusters.

NASA said during a press conference earlier this week that it is considering bringing the two astronauts back on SpaceX’s Crew-9 mission in February 2025.

Wilmore and Williams launched on June 5 from Cape Canaveral Space Force Station in Florida and docked with the ISS on June 6. They were originally set to return around one week later, on June 14.

|

|

[Gear]

Humans Are Going to the Moon’s South Pole. This Is How They’ll Drive There

As NASA gears up to send a lunar terrain vehicle to the moon, it has asked tire designers to make a set of wheels that can survive the harsh conditions.

Published:8/12/2024 6:48:15 AM

|

|

[]

Boeing Gets Massive Contract With Air Force for Some Reason

Published:8/11/2024 4:47:15 PM

|

|

[]

NASA Astronauts May Be Stuck on Space Station Until FEBRUARY (Guess Who Chairs National Space Council)

Published:8/11/2024 3:09:52 PM

|

|

[Uncategorized]

NASA Considers Both Boeing and SpaceX Options for Bringing Starliner Astronauts Back to Earth

SpaceX Dragon has made over 20 trips to the International Space Station, while Boeing's men have been waiting over 50 days to hitch a ride back home.

The post NASA Considers Both Boeing and SpaceX Options for Bringing Starliner Astronauts Back to Earth first appeared on Le·gal In·sur·rec·tion.

Published:8/3/2024 3:33:10 PM

|

|

[Science]

NASA Is ‘Evaluating All Options’ to Get the Boeing Starliner Crew Home

Eight weeks after the Starliner spacecraft launched, NASA is still looking for possible answers to its technical issues—including the possibility of SpaceX lending a hand.

Published:8/3/2024 7:52:27 AM

|

|

[Uncategorized]

Petermann Fact Check

Greenland’s Petermann Glacier has grown nearly ten miles over the last 12 years, and the press and NASA boldly declare the exact opposite. NASA Worldview NASA Worldview

Published:7/30/2024 7:41:24 AM

|

|

[Uncategorized]

Hottest Day Ever

NASA claims July 22 was earth’s hottest day on record. In this video I look at the junk science behind this idiotic propaganda.

Published:7/29/2024 9:42:23 PM

|

|

[Uncategorized]

Hottest Day Ever

“NASA Data Shows July 22 Was Earth’s Hottest Day on Record” NASA Data Shows July 22 Was Earth’s Hottest Day on Record – NASA In the US, July 22 was 110th warmest since 1895, about ten degrees cooler than 1901. … Continue reading →

Published:7/29/2024 11:59:07 AM

|

|

[Culture]

Escaping Gravity Takes a Brutally Honest Look at NASA

Lori Garver's new memoir details her struggles to get NASA colleagues to embrace SpaceX and Blue Origin.

Published:7/27/2024 6:26:48 PM

|

|

[]

*NOW* Is It Cool If We Call Our Starliner Astronauts Stranded?

Published:7/26/2024 6:19:42 AM

|

[Markets]

Major American Cities Facing 'Day Zero Water' Crisis, Say Experts

Major American Cities Facing 'Day Zero Water' Crisis, Say Experts

Authored by Autumn Spredemann via The Epoch Times (emphasis ours),

The term “day zero water” has become synonymous with a worst-case scenario for public water resources. It refers to a moment in which a city or region’s water supply is almost depleted and officials cut tap supply to communities.

A buoy that reads “No Boats” lays on dry waterbed at Lake Mead, Nev., on July 23, 2022. Water levels in Lake Mead are at the lowest level since April 1937 when the reservoir was first filled with water, according to NASA. (Frederic J. Brown/AFP via Getty Images) A buoy that reads “No Boats” lays on dry waterbed at Lake Mead, Nev., on July 23, 2022. Water levels in Lake Mead are at the lowest level since April 1937 when the reservoir was first filled with water, according to NASA. (Frederic J. Brown/AFP via Getty Images)

This crisis was narrowly averted in 2018 in Cape Town, South Africa, which approached the threshold of a day zero event after rationing was almost not enough.

Subsequently, environmental researchers and resource insiders have voiced concern over the possibility of water running out in U.S. cities after years of drought have reduced groundwater in places such as the Great Plains and the Southwest.

In a recent study published in Nature, researchers noted “rapid groundwater-level declines” globally in the 21st century of more than 0.5 meters (20 inches) per year across 170,000 monitoring wells and 1,693 aquifer systems.

This includes water resources in the United States.

The study authors further observed groundwater declines have accelerated over the past four decades, highlighting an “urgent need for more effective measures to address groundwater depletion.”

The U.S. Environmental Protection Agency (EPA) has also expressed concerns over national water assets.

The agency highlights on its website a Government Accountability Office report from 2014 that stated that 40 out of 50 state water managers “expected shortages in some portion of their states under average conditions in the next 10 years.”

Groups such as the United Nations Environment Programme (UNEP) attribute much of the groundwater loss to climate change.

“The conditions in the American West, which we’re seeing around the Colorado River basin, have been so dry for more than 20 years that we’re no longer speaking of a drought,” Lis Mullin Bernhardt said in a statement in May.

Ms. Bernhardt, an ecosystems expert at the UNEP, called it “aridification” and a “new very dry normal.”

However, some experts say poor water management and aging pipe infrastructure also play a significant role in depleting groundwater reserves.

“Given current consumption patterns and the increasing strain on water resources due to factors like climate change and population growth, a Day Zero water crisis is certainly a possibility for some U.S. cities,” Natalya Holm told The Epoch Times in an email.

Ms. Holm is a U.S. senior project manager for the Climate Risk & Water Stewardship Services Lead at Antea Group, an international environmental consulting firm.

She explained the cities most at risk include a combination of high population density, limited water sources, and inadequate infrastructure to manage supply challenges.

“For instance, cities like Los Angeles, Las Vegas, and Miami face significant water stress due to their geographical location, reliance on limited local water sources, and high water demand caused by urbanization,” she said.

Park visitors look at the bleached “bathtub ring” visible on the banks of Lake Mead near the Hoover Dam in Lake Mead National Recreation Area, Ariz., on Aug. 19, 2022. (Justin Sullivan/Getty Images) Park visitors look at the bleached “bathtub ring” visible on the banks of Lake Mead near the Hoover Dam in Lake Mead National Recreation Area, Ariz., on Aug. 19, 2022. (Justin Sullivan/Getty Images)

The Israel-based company Watergen, which makes water from the air, also identified Los Angeles and Miami—along with Atlanta, Phoenix, and El Paso—as urban centers at risk of a Day Zero event due to drought and saltwater contamination.

“Water supply sustainability and security can present a risk to communities if they are not proactively addressing these risks,” Barbara Martin, director of engineering and technical services at the American Water Works Association, told The Epoch Times via email.

Ms. Martin said that communities face risks over water sustainability and security if officials aren’t proactive with infrastructure planning, asset management, and emergency preparedness.

She said that while nothing can eliminate the risk of a Day Zero water crisis, public educational resources will help, as well as water asset managers bolstering their resilience planning.

Down the Drain

Water pipe infrastructure in the United States is in desperate need of repair.

Moreover, the agency expects necessary replacements to cost $500 billion.

In a May press release, the Biden administration announced a $3 billion initiative to replace toxic lead pipes in U.S. waterworks.

The funding is part of a more than $50 billion spending package already approved to upgrade American water infrastructure.

The White House statement called the initiative “the largest investment in clean and safe water in American history.”

However, the number falls drastically short of the EPA’s estimated need for shoring up water loss due to leakage.

“Among the 2.2 million miles of pipe that comprise our drinking water infrastructure ... the EPA estimates that 240,000 water main breaks occur in the U.S. each year,” Ms. Martin pointed out.

She stressed that it’s critical to ensure utilities have strong programs for asset management, capital improvement planning, condition assessment, and water loss control in addition to “supporting effective and timely infrastructure renewal and replacement.”

Ms. Martin emphasized that continued investment in U.S. water infrastructure is needed to address this challenge.

Ms. Holm called the U.S. water pipe network “unique” in its high number of water systems per capita. She says this creates distinctive challenges.

“What that means is, especially in rural areas, there are a lot of very small water systems serving a very small population ... it leads to fragmentation and inefficiencies in water management, preventing coordinated efforts for sustainable water use and infrastructure upkeep.”

This fragmentation complicates regulatory oversight and equitable access to safe and reliable water, according to Ms. Holm.

Wastewater undergoes the microfiltration treatment process at the Groundwater Replenishment System, the world's largest wastewater recycling plant, in the Orange County Water District in Fountain Valley, Calif., on July 20, 2022. (Mario Tama/Getty Images) Wastewater undergoes the microfiltration treatment process at the Groundwater Replenishment System, the world's largest wastewater recycling plant, in the Orange County Water District in Fountain Valley, Calif., on July 20, 2022. (Mario Tama/Getty Images)

Ongoing water loss through pipe leakage is also a money hemorrhage for those working in resource management, according to Ms. Holm.

She said that some systems have reported water losses exceeding 60 percent. That kind of loss to pipe leakage is referred to as “non-revenue water.”

“The utility [company] brought it up from the ground or pulled it from a river, treated it, pumped it out into the system, used the energy to bring it out to the system, and got no revenue back from it.

“Nobody used it, and the water supplier lost out on 60 percent of the revenue, which means less money going into their infrastructure repair, improvement, and expansion funds,” she said.

In its latest infrastructure report card, the American Society of Civil Engineers observed a water main break in the United States every two minutes, resulting in an estimated loss of 6 billion gallons of treated water every day.

“Addressing this issue requires substantial investment in infrastructure renewal and maintenance,” Ms. Holm said.

“This includes adopting modern technologies for leak detection and repair, prioritizing infrastructure upgrades in vulnerable areas, and enhancing coordination between federal, state, and local agencies to ensure effective management of water distribution networks.”

Read more here...

|

|

[Markets]

NASA ‘not quite ready’ to bring Boeing Starliner astronauts home

Boeing’s Starliner spacecraft carrying NASA astronauts Butch Wilmore and Suni Williams reached the International Space Station on June 6

Published:7/25/2024 12:50:49 PM

|

|

[]

Daily Tech News 24 July 2024

Top Story SpaceX is cheaper and more capable than any other rocket company, and it's not even close. Here's why that's a bad thing. (Ars Technica) NASA estimated that de-orbiting the ISS in 2030 would cost $1.7 billion. SpaceX gave...

Published:7/24/2024 4:32:40 AM

|

[Markets]

The CrowdStrike Global Outage Shows the Serious Dangers Of A Centralized, Digitized World

The CrowdStrike Global Outage Shows the Serious Dangers Of A Centralized, Digitized World

Authored by "Dr. R P" via DailySceptic.org,

The perils of over-reliance on digital systems have been once again highlighted by the crashing of computer systems around the world due to an update to the Falcon antivirus and security product from CrowdStrike affecting its interaction with Windows operating systems. The update has caused chaos for banking, retail, railways, airports, healthcare and for a wide range of other businesses and infrastructure where the Falcon software runs on Windows systems. Advice for bringing affected computers back into working order has been published but the exact mechanism by which the update caused “Blue Screen of Death” errors does not appear to have yet been reported.

It appears that in many cases, whilst the update was distributed automatically over the internet to systems, the workaround to fix the problem requires the machines to be rebooted in Windows’ safe mode, which usually requires physical access. The person at the keyboard then needs to know the password for the computer’s administrator account, and use this level of access to delete a file within a subdirectory of Windows’ System32. This process can be more complicated where Microsoft’s BitLocker encryption is in use. In many organisations the recovery keys for BitLocker have themselves been stored on a computer unable to start properly due to the CrowdStrike update. The quote “Men go mad in herds, while they only recover their senses slowly, one by one”, originally from Charles Mackay in 1841, seems applicable now to computers too. They crash en masse, then require individual attention before they will work again.

It should be noted that while the perils of centralisation with a physical single point of failure are obvious to all but technocratic politicians and civil servants, this massive outage shows another way in which a “single point” of failure can occur. The single point in this case is not a particular server in one building somewhere on the planet; but rather a change within a single piece of software, that change then being rolled out to many individual systems around the globe. These systems then entered a state euphemistically described as Total Inability To Support Usual Performance (acronym intentional) among the tech community. There was a reason that NASA put a fifth backup flight computer in the space shuttle, running software written entirely independently of the software on its primary four computers. A single point of failure where software is concerned doesn’t have to happen at only a single point in space.

There is a very clear lesson to be learned here.

Systems which can collapse at scale, even when they are not centralised in the physical sense, eventually will collapse in such a fashion.

Advocates of Central Bank Digital Currencies (CBDCs) and Digital ID systems should consider these lessons.

This update ‘only’ knocked out an estimated 8.5 million computers, belonging to over 24,000 organisations subscribed to CrowdStrike’s Falcon software.

A country reliant on a CBDC instead of cash would see an end to all transactions as a consequence of a similar failure affecting a component within whatever software stack was being used to operate CBDC infrastructure. That could mean a fault within the software on physically centralised or partly centralised servers logging transactions and holding records; or a fault within the software running on masses of devices operating as payment terminals in a wide variety of locations.

In that dystopian CBDC-dependent nation, one would be looking at electric vehicles (already a bad idea simply on account of the abysmal energy density of batteries compared to chemical fuels) stranded at charging stations, unable to make payments to initiate the charging procedure. Consider that the World Economic Forum once advertised with slogans on the theme of “what if extreme weather froze your bank account”, right at the time when Justin Trudeau was freezing bank accounts on account of his extreme intolerance for peaceful protest. The reality is that in the centralised totalitarian model of society the WEF hungers for, this scenario becomes more probable, not less. That is to say, that as well as increasing the opportunities for censorship-obsessed elites to deliberately interfere in people’s lives, centralisation also increases the vulnerability of a society to accidental errors. Where Governments dream of requiring digital ID or age verification for internet access, or client-side scanning to look for objectionable opinions and only allow messages to be sent when approved as sufficiently “double plus good”, one could even imagine a situation where direct messages and online posts attempting to report a fault in the software stack running the verification or approval algorithms would be blocked from being sent. This wouldn’t need to be a matter of a deliberate attempt to cover up the fault, but instead the inability to report the fault would be a natural consequence of the fault itself. A censorship apparatus built on a principle of scanning everything before it can be shared ends up censoring absolutely everything if it is unable to perform scans.

Where old systems, like cash, just work, the alternatives which Big Tech and Big Government claim are more convenient can collapse. Where computer systems you actually own and have true control of just work, systems which can be remotely updated can crash catastrophically. When Big Government pushes for things to be more “secure”, it usually has in mind intrusive projects to stop “bad people” from using “SMART” systems, rather than measures to actually make systems more resilient in the event of crises. Government, after all, tries to whip up anger against truly secure encryption by describing it as warrant-proof, though in an age where lawfare is becoming common and courts allow the monitoring of vast numbers of innocent people it is hard to see how such a level of protection is undesirable. Meanwhile Big Tech companies seek to create an “experience” for users, which in practice comes to mean an ever more interlinked web of dependencies, often centred around a server to which the devices regularly phone-home to check that the user has the company’s permission to use the things they have bought. Concerningly, even farming has now become a field in which equipment manufacturers are displaying this ‘Big Tech’ attitude. This risks farmers’ livelihoods and entire nations’ food security in the event of software crashes. And that could include software crashes within Digital Rights Management subsystems of software which aren’t even there for the benefit of the user in the first place.