|

[Markets]

Dow Jones, Indexes Reverse Lower As Alphabet Eyes This Buy Point; Nvidia Tests Key Price Level

The Dow Jones Industrial Average's mild gains got squeezed in late-afternoon trading Thursday as the blue chip index struggled to snap a three-day losing streak. Meta Platforms rose, but AI pioneer Nvidia backed off session highs and Google parent Alphabet stumbled 1.5%. The Dow Jones index marked a session high of 39,421, up almost 0.8%, but then sank more than 350 points, or 0.9%, with roughly an hour to go in the stock market today.

Published:4/4/2024 2:28:27 PM

|

|

[Markets]

Dow Jones Rallies 275 Points After Surprise Jobless Claims; Nvidia, Tesla Climb

Stock Market Today: The Dow Jones rose 275 points after a surprise jump in initial unemployment claims. Nvidia and Tesla stock rallied.

Published:4/4/2024 9:09:59 AM

|

|

[Markets]

Dow Jones Rises After Surprise Jobless Claims; Nvidia, Tesla Rally

Stock Market Today: The Dow Jones rose after a surprise jump in initial unemployment claims. Nvidia and Tesla stock rallied.

Published:4/4/2024 8:36:12 AM

|

|

[Markets]

Dow Jones Futures Rise After Surprise Jobless Claims; Nvidia, Tesla Rally

Stock Market Today: Dow Jones futures rose after a surprise jump in initial unemployment claims. Nvidia and Tesla stock rallied.

Published:4/4/2024 7:52:31 AM

|

|

[Markets]

Dow Jones Futures Rise Ahead Of Jobless Claims; Nvidia, Tesla Rally

Stock Market Today: Dow Jones futures rose ahead of initial unemployment claims. Nvidia and Tesla stock rallied.

Published:4/4/2024 7:16:12 AM

|

|

[Markets]

S&P 500 and Nasdaq close higher, Dow's third day of Q2 losses

The Dow Jones Industrial Average (^DJI) closed Wednesday lower for the third-straight day of losses in 2024's second quarter, while the S&P 500 (^GSPC) and the Nasdaq Composite (^IXIC) both moved higher. Yahoo Finance's Julie Hyman observes how markets are reacting to Federal Reserve Chair Jerome Powell's recent comments on inflation, while Senior Markets Reporter Jared Blikre examines leaders across sectors and the Nasdaq 100 (^NDX) after the market close. For more expert insight and the latest market action, click here to watch this full episode of Market Domination Overtime. Editor's note: This article was written by Luke Carberry Mogan.

Published:4/3/2024 3:26:36 PM

|

|

[Markets]

Dow Jones Reverses After Jobs Data, Powell Speech Next; Intel Dives On $7 Billion Loss

Stock Market Today: The Dow Jones reversed higher Wednesday ahead of Fed Chair Powell's speech. Intel dived on a $7 billion foundry loss.

Published:4/3/2024 9:17:56 AM

|

|

[Markets]

Dow Jones Falls After Jobs Data, Powell Speech Next; Intel Dives On $7 Billion Loss

Stock Market Today: The Dow Jones dropped Wednesday ahead of Fed Chair Powell's speech. Intel dived on a $7 billion foundry loss.

Published:4/3/2024 8:38:57 AM

|

|

[Markets]

Dow Jones Futures Struggle Ahead Of Jobs Data, Powell Speech; Intel Slides On $7 Billion Loss

Dow Jones futures struggled Wednesday ahead of Fed Chair Powell's speech. Intel tumbled on a $7 billion loss in its chipmaking segment.

Published:4/3/2024 7:14:47 AM

|

|

[Markets]

Meet the Newest Artificial Intelligence (AI) Stock in the Dow Jones: It Soared 950% Over the Last Decade and It's Still a Top Buy

This newly minted Dow Jones stock could create significant shareholder value as the artificial intelligence market expands.

Published:4/3/2024 4:04:15 AM

|

|

[Markets]

Dow Jones Dives As Donald Trump Stock Bounces; Cathie Wood Loads Up On This Stock Down 44%

The Dow Jones fell as a Donald Trump stock rallied. Cathie Wood bought a diving stock. Nvidia and Meta dipped on the stock market today.

Published:4/2/2024 3:47:25 PM

|

|

[Markets]

Dow Jones Dives As UnitedHealth Plummets On This; Donald Trump Stock Jumps

The Dow Jones fell as a Donald Trump stock rallied. Cathie Wood bought a diving stock. Nvidia and Meta dipped on the stock market today.

Published:4/2/2024 2:24:10 PM

|

|

[Markets]

Dow Jones Leader Microsoft, Magnificent Seven Stock Google Boast Rising Profit Estimates

Dow Jones software giant Microsoft, along with Google stock and Deckers, boast rising profit estimates in the stock market today.

Published:4/2/2024 1:19:40 PM

|

|

[Markets]

Dow Jones Dives As Key Treasury Yield Hits 2024 High; Donald Trump Stock Rallies

The Dow Jones fell as a Donald Trump stock rallied. Cathie Wood bought a diving stock. Nvidia and Meta dipped on the stock market today.

Published:4/2/2024 1:04:20 PM

|

|

[Markets]

Dow Jones Dives Nearly 500 Points; Cathie Wood Loads Up On This Stock Amid 45% Downtrend

The Dow Jones fell as Calvin Klein parent PVH cratered. Cathie Wood bought a diving stock. Tesla fell on deliveries. Nvidia and Meta dipped.

Published:4/2/2024 11:26:42 AM

|

|

[Markets]

Dow Jones Dives 1% Cathie Wood Loads Up On This Stock Amid 45% Downtrend

The Dow Jones fell as Calvin Klein parent PVH cratered. Cathie Wood bought a diving stock. Tesla fell on deliveries. Nvidia and Meta dipped.

Published:4/2/2024 10:57:40 AM

|

|

[Markets]

Dow Jones Dives As Calvin Klein Parent Craters; Cathie Wood Loads Up On This Stock Amid 45% Downtrend

The Dow Jones fell as Calvin Klein parent PVH cratered. Cathie Wood bought a diving stock. Tesla fell on deliveries. Nvidia and Meta dipped.

Published:4/2/2024 10:03:51 AM

|

|

[Markets]

Dow Jones Slides 450 Points After Key Economic Data; Tesla Dives On Weak Q1 Deliveries

Stock Market Today: The Dow Jones sold off 400 points Tuesday after key economic data. Tesla stock dived on weak Q1 deliveries.

Published:4/2/2024 9:12:19 AM

|

|

[Markets]

Dow Jones Slides 400 Points Ahead Of Key Economic Data; Tesla Dives On Weak Q1 Deliveries

Stock Market Today: The Dow Jones sold off 400 points Tuesday ahead of key economic data. Tesla stock dived on weak Q1 deliveries.

Published:4/2/2024 8:49:50 AM

|

|

[Markets]

Dow Jones Futures Drop 300 Points Ahead Of Key Economic Data; Tesla Dives On Weak Q1 Deliveries

Stock Market Today: Dow Jones futures dropped 300 points Tuesday ahead of key economic data. Tesla stock dived on weak Q1 deliveries.

Published:4/2/2024 8:13:17 AM

|

|

[Markets]

Dow Jones Futures Slide 300 Points Ahead Of Key Economic Data; Tesla Drops Ahead Of Q1 Deliveries

Stock Market Today: Dow Jones futures dropped 300 points Tuesday ahead of key economic data. Tesla stock fell ahead of Q1 deliveries.

Published:4/2/2024 8:05:58 AM

|

|

[Markets]

Dow Jones Futures Fall 275 Points Ahead Of Key Economic Data; Tesla Slides Ahead Of Q1 Deliveries

Stock Market Today: Dow Jones futures dropped 275 points Tuesday ahead of key economic data. Tesla stock fell ahead of Q1 deliveries.

Published:4/2/2024 7:51:02 AM

|

|

[Markets]

Dow Jones Futures Fall 225 Points Ahead Of Key Economic Data; Tesla Slides Ahead Of Q1 Deliveries

Stock Market Today: Dow Jones futures dropped 225 points Tuesday ahead of key economic data. Tesla stock fell ahead of Q1 deliveries.

Published:4/2/2024 7:29:00 AM

|

|

[Markets]

Dow Jones Futures Fall 200 Points Ahead Of Key Economic Data; Tesla Drops Ahead Of Q1 Deliveries

Stock Market Today: Dow Jones futures dropped 200 points ahead of key economic data. Tesla stock fell ahead of Q1 deliveries.

Published:4/2/2024 7:21:32 AM

|

|

[Markets]

Dow Jones Futures Fall 170 Points Ahead Of Key Economic Data; Tesla Drops Ahead Of Q1 Deliveries

Stock Market Today: Dow Jones futures dropped 170 points ahead of key economic data. Tesla stock fell ahead of Q1 deliveries.

Published:4/2/2024 7:14:02 AM

|

|

[Markets]

Dow Jones Futures Fall: Tesla Q1 Deliveries Next; PVH Plunges 20% On Earnings

Dow Jones Futures: Tesla Q1 deliveries are due Tuesday morning, while Google stock broke out past a new buy point Monday.

Published:4/1/2024 5:23:20 PM

|

|

[Markets]

Dow Jones Futures: Google Stock Hits Buy Point; Tesla Q1 Deliveries Next

Dow Jones Futures: Tesla Q1 deliveries are due Tuesday morning, while Google stock broke out past a new buy point Monday.

Published:4/1/2024 4:02:58 PM

|

|

[Markets]

Stocks Close Mixed To Start New Quarter As Yields Rise; Dow Was Biggest Loser Monday

3M was the biggest gainer while Home Depot was the biggest loser on the Dow Jones Industrial Average Monday.

Published:4/1/2024 3:42:46 PM

|

|

[Markets]

Stocks close first trading day of Q2 2024 mixed

Stocks (^DJI, ^IXIC, ^GSPC) end the first trading day of 2024's second-quarter mixed — the Dow Jones Industrial Average and S&P 500 close lower, while the Nasdaq Composite is in the green. Yahoo Finance's Julie Hyman reviews the day's trading activity after the closing bell, while Jared Blikre outlines the gains seen in select sectors and Nasdaq leaders such as Alphabet (GOOG, GOOGL). For more expert insight and the latest market action, click here to watch this full episode of Market Domination Overtime. Editor's note: This article was written by Luke Carberry Mogan.

Published:4/1/2024 3:21:33 PM

|

|

[Markets]

Stocks Hold Losses As Yields Rise; Home Depot Weighs On Dow

Home Depot stock fell and was the worst performer on the Dow Jones Industrial Average Monday afternoon.

Published:4/1/2024 2:18:54 PM

|

|

[Markets]

Stocks Lose As Treasury Yields Rise; Dow Feels The Most Pain Despite 3M Breakout

Dow Jones stock Microsoft got a boost on news of a potential new data center, not enough to lift the Dow. Indexes have been fading since the open as Treasury yields extended gains following the strong March Institute for Supply Management report. The benchmark 10-year yield added 12 basis points to 4.33% — on pace for the largest one-day increase since Feb. 13.

Published:4/1/2024 12:54:24 PM

|

|

[Markets]

Dow Jones Leader Visa, AI Stock Monday.com Are Near Buy Zones

Dow Jones payments leader Visa, along with AI stock Monday.com, are in or near buy zones in today's stock market action.

Published:4/1/2024 12:42:11 PM

|

|

[Markets]

Why Is the Dow Down While the Nasdaq Is Up?

The Dow Jones Industrial Average started the week's trading on a sluggish note, while the tech-heavy Nasdaq Composite was headed for a fresh high. The 30-component Dow was down 221 points, or 0.6%, as of 10:30 a.m. The Nasdaq, meanwhile, was up 0.2% to 16,417.31. If the Nasdaq holds that level, it’ll be a record.

Published:4/1/2024 9:53:25 AM

|

|

[Markets]

Dow Jones Falls After Inflation Data, Powell Comments; Tesla Raises Model Y Prices

Stock Market Today: The Dow Jones fell Monday after inflation data and Fed Chair Powell's comments. Tesla raised Model Y prices in the U.S.

Published:4/1/2024 8:44:50 AM

|

|

[Markets]

Dow Jones Futures Reverse After Inflation Data, Powell Comments; Tesla Raises Model Y Prices

Stock Market Today: Dow Jones futures fell Monday after inflation data and Fed Chair Powell's comments. Tesla raised Model Y prices in the U.S.

Published:4/1/2024 7:42:48 AM

|

|

[Markets]

Dow Jones Futures Rise On Inflation Data, Powell Comments; Tesla Raises Model Y Prices

Stock Market Today: Dow Jones futures rose Monday on inflation data and Fed Chair Powell's comments. Tesla raised Model Y prices in the U.S.

Published:4/1/2024 7:21:40 AM

|

|

[Markets]

Which Blue Chip Led The Dow Jones Industrials In Q1?

Disney and Caterpillar led gains among Dow Jones stocks in the first quarter. Boeing posted the largest decline.

Published:3/29/2024 12:31:10 PM

|

|

[Markets]

Stocks Close Mixed As Holiday Weekend Gets Underway; S&P 500 And Dow Close At New Highs

The S&P 500 and the Dow Jones Industrial Average closed at record highs on Thursday. Palantir Technologies stock tumbled.

Published:3/28/2024 3:56:02 PM

|

|

[Markets]

How major US stock indexes fared Thursday, 3/28/2024

The Dow Jones Industrial Average rose 0.1%, and the Nasdaq composite slipped 0.1%. Treasury yields inched higher in the bond market following several reports on the economy. The Nasdaq composite fell 20.06 points, or 0.1%, to 16,379.46.

Published:3/28/2024 3:27:47 PM

|

|

[Markets]

S&P 500 Hits Record Close and Notches Best Start to the Year Since 2019

The S&P 500 and Dow Jones Industrial Average each capped off a strong first quarter on Thursday with another record close. The Dow Jones Industrial Average was up 47 points, or 0.1%. The S&P 500 was up 0.1%.

Published:3/28/2024 3:13:47 PM

|

|

[Markets]

Energy Sector Revved Up While Stocks Stall

Much of the market wasn’t going anywhere on Thursday, but energy stocks were an exception. The Dow Jones Industrial Average was flat in Thursday afternoon trading. The S&P 500 was up 0.1%. The Nasdaq Composite was down 0.

Published:3/28/2024 1:32:08 PM

|

|

[Markets]

Dow Jones Rises After Surprise GDP; Apple Slides On Downgrade

Stock Market Today: The Dow Jones rose Thursday after surprise GDP numbers. Apple stock dropped on a brokerage's downgrade.

Published:3/28/2024 8:34:33 AM

|

|

[Markets]

Dow Jones Futures Rise After Surprise GDP; Apple Falls On Downgrade

Stock Market Today: Dow Jones futures rose Thursday after GDP and jobless claims. Apple stock dropped on a brokerage's downgrade.

Published:3/28/2024 7:46:31 AM

|

|

[Markets]

Dow Jones Futures Edge Up Ahead Of GDP, Jobless Claims; Apple Falls On Downgrade

Stock Market Today: Dow Jones futures fell Thursday ahead of GDP and jobless claims. Apple stock dropped on a downgrade.

Published:3/28/2024 7:25:50 AM

|

|

[Markets]

Dow Jones Futures Flat Ahead Of GDP, Jobless Claims; Apple Falls On Downgrade

Stock Market Today: Dow Jones futures fell Thursday ahead of GDP and jobless claims. Apple stock dropped on a downgrade.

Published:3/28/2024 7:18:58 AM

|

|

[Markets]

Stock Futures Stall After S&P 500 Hit Record High

U.S. stock futures dipped early Thursday after the S&P 500 closed at a new record high, snapping a three-day losing streak. Dow Jones Industrial Average futures, S&P 500 futures, and Nasdaq 100 futures all pointed 0.1% lower ahead of the open on the last trading day of the quarter. Investors are still awaiting Friday’s core personal consumption expenditure (PCE) data for a potentially significant update in the Federal Reserve’s battle against inflation.

Published:3/28/2024 5:04:46 AM

|

|

[Markets]

Dow Jones Rallies 300 Points As Nvidia Slides; Donald Trump Stock Surges 23%

Stock Market Today; The Dow Jones rallied 300 points Wednesday, while Donald Trump's stock surged 23% in its second day of trading.

Published:3/27/2024 8:47:34 AM

|

|

[Markets]

Dow Jones Rallies 290 Points As Nvidia Slides; Donald Trump Stock Surges 23%

Stock Market Today; The Dow Jones rebounded from recent losses Wednesday, while Donald Trump's stock surged in its second day of trading.

Published:3/27/2024 8:39:55 AM

|

|

[Markets]

Dow Jones Rebounds From Losses; Donald Trump Stock Surges 23%

Stock Market Today; The Dow Jones rebounded from recent losses Wednesday, while Donald Trump's stock surged in its second day of trading.

Published:3/27/2024 8:33:00 AM

|

|

[Markets]

Dow Jones Giant Disney Sees Price Target Hike Amid 33% Rally To 23-Month Highs

UBS hoisted its price target on Disney stock on growth rate, free cash flow forecasts. The Dow Jones giant is trending toward two-year highs.

Published:3/27/2024 7:30:10 AM

|

|

[Markets]

Dow Jones Futures Rebound From Losses; Donald Trump Stock Surges

Stock Market Today; Dow Jones futures rebounded from recent losses Wednesday, while Donald Trump's stock surged ahead of its second day of trading.

Published:3/27/2024 7:23:08 AM

|

|

[Markets]

Stocks Tread Water In Late Trading; Nasdaq Climbs 0.3% As FedEx Jumps Into Buy Zone

The Dow Jones eased from the day's highs on Tuesday. The Nasdaq remained the leader while Tesla popped and Nvidia was mostly flat.

Published:3/26/2024 2:35:33 PM

|

|

[Markets]

Stocks Slow To Make Big Gains; Dow Holding Near Day's Highs As Krispy Kreme Surges

The Dow Jones was near the day's highs on Tuesday. The Nasdaq led the charge while Krispy Kreme and a Trump stock soared.

Published:3/26/2024 11:42:12 AM

|

|

[Markets]

Stocks Getting Back In Rally Mode; Nasdaq Leads As Trump Stock Scores

The Dow Jones started the day slightly ahead on the stock market today. The small-caps Russell led the charge while a Trump stock soared.

Published:3/26/2024 10:16:37 AM

|

|

[Markets]

Dow Jones Rises As Cathie Wood Buys $28 Million Of Tesla; Donald Trump Stock Soars 50% In Debut

Stock Market Today: The Dow Jones rose Tuesday, as Donald Trump's Truth Social soared 50% in its debut. Cathie Wood bought Tesla stock.

Published:3/26/2024 9:01:43 AM

|

|

[Markets]

Dow Jones Rises As Nvidia Nears New Highs; Cathie Wood Buys $28 Million Of Tesla Stock

Stock Market Today: The Dow Jones rose Tuesday, as Cathie Wood purchased more than $28 million of Tesla stock.

Published:3/26/2024 8:44:08 AM

|

[Markets]

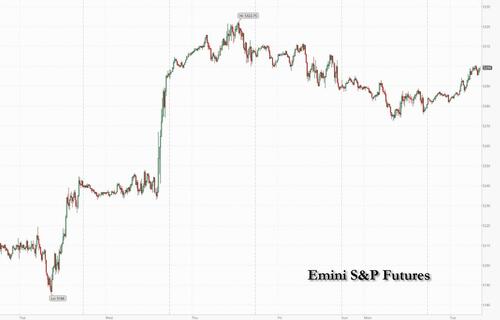

US Futures Rebound Ahead Of Busy Data Calendar As New Record High Looms

US Futures Rebound Ahead Of Busy Data Calendar As New Record High Looms

It's as if Monday's modest dip never happened: S&P futures are trading are higher, surpassing Monday's highs, with both Tech and small-caps outperforming, as investors keep a close eye on any potential market impact from the collapse of a major commuter bridge in Baltimore after it was rammed by a container ship. As of 8:00am ET, S&P futures were 0.4% higher, erasing Monday's 0.3% drop, while Nasdaq futures gained 0.5%. Europe's Estoxx 50 is similar, trading at multiyear high with utilities and financials outperforming. According to a JPM morning note, it is unclear if yesterday’s moves were tied to month-end/quarter-end rebalancing but generally those flows occur before the last day of the period. USD weakness continues as the yen just refused to drop no matter what; commodity performance is mixed with gold approaching ATHs and oil trading at a 5 month high. Today’s macro data calendar is busy with focus on Durable/Cap Goods, Home price indices, Consumer Confidence, and regional activity indicators (Dallas, Philly, and Richmond); we also get a $67BN 5Y bond auction; let’s see if it goes as smoothly as yesterday’s 2Y auction.

In premarket trading, both Mag 7 and Semis are higher (as usual) with TSLA +3.2%. USD weakness continues but commodity performance is mixed with gold approaching ATHs. Shares of Donald Trump’s social media startup surged around 20% in premarket trading after it completed a merger with Digital World Acquisition Corp. Tesla climbed 3%, set to extend gains for a second consecutive session. Italian newspaper Il Sole 24 Ore reports that officials at the country’s Industry Ministry contacted the company about potential production of electric trucks. Here are some other notable premarket movers:

- Dada Nexus ADRs fall 9% after the delivery company reported an unexpected 4Q net loss.

- Krispy Kreme jumps 15% after announcing that its doughnuts would be sold at McDonald’s restaurants across the US.

- Reddit rises 5%, putting the stock on track to extend gains for a second day after the social media company rallied 30% on Monday.

- Seagate climbs 4% as Morgan Stanley raises its recommendation on the computer hardware and storage company to overweight, predicting a period of “structurally stronger gross margins.”

- Stoke Therapeutics soars 90% after the company said data from studies on its STK-001 treatment in Dravet syndrome showed clinically meaningful effects in seizure reduction.

- Trump Media & Technology Group Corp gains 11% after completing a merger with Digital World Acquisition Corp.

As Bloomberg notes, concern about a disconnect between earnings expectations and share prices has grown this week. US durable goods and consumer confidence data are due today ahead of the government’s closely followed personal consumption expenditures price index on Friday when many markets will be closed for Easter holidays. Federal Reserve Chair Jerome Powell is also due to speak the same day.

For Vincent Juvyns, global market strategist at JPMorgan Asset Management, better visibility on the economy means that that focus is turning back to earnings going into the second quarter. “Markets are expensive, not too expensive, but it would be dangerous to bet on further upside without earnings driving it,” he said.

As has been the case for the past 18 months, bearish Morgan Stanley and JPMorgan strategists - Michael Wilson and Marko Kolanovic - were the latest to warn that lofty valuations will be hard to justify if they’re not accompanied by an acceleration in company profits. Or, as we said in Jan 2023, the rally won't end until they finally throw in the towel and turn bullish. Meanwhile, the S&P 500 is up almost 10% this year on a combination of healthy US economic data, Fed rate-cut wagers and optimism about artificial intelligence.

Meanwhile, the Financial Times cited Chief Investment Officer Andrew Balls as saying Pimco is holding a smaller-than-usual position in US Treasuries and prefers the bonds of countries such as the UK and Canada. Pimco believes inflationary pressures may lead the Federal Reserve to cut interest rates more slowly than other major central banks, according to the report.

European stocks also rose, with Stoxx 600 gaining 0.4%, even as miners slumped after iron ore futures tumbled over deepening anxiety regarding Chinese demand. Consumer products and services also underperformed, while the travel and leisure and banking sectors lead the regional index. Among individual stock moves in Europe, A.P. Moller-Maersk A/S fell after the shipping giant said that it chartered a container vessel that hit the Francis Scott Key Bridge in Baltimore on Tuesday. Ocado Group Plc rose after sales at its online grocery business got a boost from price cuts, while BNP Paribas SA gained after Goldman Sachs Group Inc. upgraded the French bank to a buy rating thanks to a better operating backdrop. Here are the most notable European movers:

- BNP Paribas jumps as much as 2.4% after Goldman upgrades the lender to buy from neutral, saying operating backdrop should improve over the coming years

- Rubis gains as much as 4.2% after Oddo upgrades its recommendation on the energy company to outperform after a “surprise” stake purchase by Bollore

- Santander rises as much as 1.4% after a Barclays upgrade to overweight on discounted valuation and most favorable EPS progression into 2025

- Flutter rises as much as 4% as the casino operator’s strong year-to-date US trading and 2024 guidance impress analysts, while its 2023 results were in line

- Lonza rises as much as 1.1% after Mirabaud Securities raised its recommendation to buy, saying a facility acquisition should enable it to meet 2028 margin guidance

- Defense stocks extend Monday’s gains as JPMorgan says it sees potential for the sector to re-rate further as the region’s rearmament cycle continues

- Asos jumps as much as 5.6% after the online retailer’s trading update showed progress on reducing inventory. Berenberg says Asos is delivering on its strategy

- RAI Way rises to as much as 6.4% after a report that the Italian government may approve a decree to allow state TV operator Rai to drop below a 30% stake

- Mobico drops as much as 6.7% after RBC lowers its rating to sector perform, snapping the stock’s clean sweep of positive analyst ratings

- Atos falls as much as 10% after it reported entering a conciliation procedure that will give it time to reach a debt restructuring deal with banks and creditors

- Auto Trader falls as much as 5.5% as JPMorgan places the digital marketplace for vehicles on negative catalyst watch, citing “further legs” to a recent underperformance

- Baloise falls as much as 2.4% after the Swiss insurer reported a miss on full-year net profit due to weakness in its life insurance business

Earlier in the session, Asian stocks were mixed, as Korean stocks rallied and Hong Kong equities erased earlier gains, with the regional benchmark poised for a second quarterly advance. The MSCI Asia Pacific Index was little changed, erasing a gain of as much as 0.5%. South Korea’s Kospi headed for its highest close in almost two years as foreign investors bought local chip stocks following US memory maker Micron’s surge.

Stocks in Hong Kong and mainland China erased earlier gains. Elsewhere, Japanese equities fluctuated as the weak yen supported exporters but prompted warnings from officials. Australian and New Zealand stocks declined. Australia's ASX 200 declined as tech losses clouded over the outperformance in the energy sector, while weaker Consumer Confidence added to the glum mood.

In FX, a gauge of the dollar fell for the second straight session and front-end Treasuries rose ahead of a string of US economic data. The Bloomberg Dollar Spot Index dropped 0.1%, while front-end Treasuries rose; two-year yields dropped 4bps to 4.59%

- GBP/USD rose as much as 0.2% to 1.2664, after the BOE’s Mann said markets are pricing in “too many cuts” for this year; Traders are betting the Bank of England will likely start rate cuts before the Fed or ECB

- USD/CNY rose as much as 0.1% to 7.2203, as China’s central bank boosted its support for the currency by the most since January; New Zealand dollar, Swedish krona and Australian dollar led G-10 gains on bolstered risk sentiment

- EUR/USD ticked up as much as 0.2% to 1.0856 on the back of broad dollar weakness; ECB’s Muller said by June there might be “enough confidence” to start easing policy and hedge funds are betting the euro will weaken, according to options pricing

- USD/JPY was flat at 151.35 after Japan’s Finance Minister Shunichi Suzuki said Tuesday the government will take appropriate steps against excessive currency moves, without ruling out any measures. Dollar-yen is likely to stay above 150, according to Mitul Kotecha, head of foreign exchange and emerging market macro strategy Asia at Barclays Bank Plc in Singapore. “Intervention will really depend on when we get through big levels,” he said on Bloomberg Television. “You’d imagine that once we start breaking through big levels such as 155 or 160, for instance, you’d see more of an aggressive stance from the Japanese authorities.”

- The offshore yuan strengthened for a second day after China’s central bank reinforced its support for the currency.

In rates, treasuries were richer by up to 2bp across long-end of the curve, led by bigger gains in gilts as traders look past comments from BOE’s Mann who said markets are pricing in too many interest-rate cuts this year. 10-year TSY yields are richer by around 1.8bp on the day at 4.23% with gilts outperforming by 3bp in the sector; long-end outperforms slightly over the session, with 5s30s near lows of the day and flatter by 1bp vs Monday’s close. The US session has packed data slate headed by durable goods orders and consumer confidence. Auction cycle continues with $67 billion 5-year note sale. The holiday-accelerated auction cycle resumes with $67b 5-year note sale at 1pm, follows 0.5bp tail for 2-year sale on Monday. This week’s sales conclude with $43b 7-year Wednesday

In commodities, oil was little changed after the biggest gain in a week, with OPEC+ set to affirm its policy of production cuts amid tensions in the Middle East and Russia. Gold hovered near a record high.

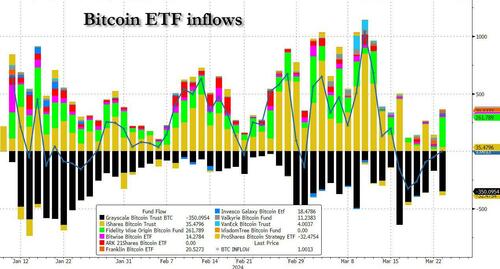

Bitcoin holds above $71k, with Ethereum now back above $3.5k. On Monday, spot bitcoin ETFs registered inflows totalling USD 15.4mln on Monday, ending a five-day run of outflows.

Looking at today's calendar, the US economic schedule includes March Philadelphia Fed non-manufacturing activity and February durable goods orders (8:30am), January FHFA house price index, S&P CoreLogic home prices (9am), March consumer confidence and Richmond Fed manufacturing index (10am) and March Dallas Fed services activity (10:30am); no Fed speakers scheduled.

Market Snapshot

- S&P 500 futures up 0.2% to 5,290.50

- STOXX Europe 600 down 0.2% to 509.03

- MXAP up 0.3% to 176.92

- MXAPJ up 0.3% to 535.99

- Nikkei little changed at 40,398.03

- Topix up 0.1% to 2,780.80

- Hang Seng Index up 0.9% to 16,618.32

- Shanghai Composite up 0.2% to 3,031.48

- Sensex down 0.3% to 72,584.51

- Australia S&P/ASX 200 down 0.4% to 7,780.23

- Kospi up 0.7% to 2,757.09

- German 10Y yield little changed at 2.37%

- Euro up 0.1% to $1.0849

- Brent Futures down 0.1% to $86.64/bbl

- Gold spot up 0.3% to $2,178.34

- US Dollar Index little changed at 104.14

Top Overnight News

- Japan’s BOJ isn’t as dovish as markets think as the central bank adopts a “data dependent” outlook rather than one that’s committed to sustaining policy accommodation regardless of economic conditions. RTRS

- China’s central bank reinforced its support for the under-pressure yuan by strengthening its daily reference rate for the managed currency by the most since January. BBG

- Some US executives in Beijing for a business summit are rejigging their schedules after being invited to meet tomorrow with a top Chinese leader – widely expected to be Xi Jinping. Tim Cook described China as “vibrant and so dynamic,” and pledged fresh investment in applied research. BBG

- The US faces a Liz Truss-style market shock if the government ignores the country’s ballooning federal debt, the head of Congress’s independent fiscal watchdog has warned. Phillip Swagel, director of the Congressional Budget Office, said the mounting US fiscal burden was on an “unprecedented” trajectory, risking a crisis of the kind that sparked a run on the pound and the collapse of Truss’s government in the UK in 2022. FT

- US gas prices are set to hit the highest level in two years just ahead of the summer driving season, creating a fresh headwind for the consumer. BBG

- The Francis Scott Key Bridge in Baltimore collapsed after a container vessel rammed into it early Tuesday, sending vehicles plunging into the water. The disaster will probably cause chaos, both for shipping at one of the busiest ports on the US East Coast and on the roads. Rescuers are searching for at least seven people believed to be in the water. BBG

- The world faces a looming “retirement crisis” that requires a rethink of pensions and working patterns as medical breakthroughs boost longevity, BlackRock chief executive Larry Fink warned on Tuesday in his closely watched annual letter to chief executives and investors. FT

- Bond fund giant Pimco is holding a smaller than usual position in US Treasuries and prefers the bonds of countries such as the UK and Canada, as it believes inflationary pressures may lead the Federal Reserve to cut interest rates more slowly than other major central banks. FT

- Adam Neumann, the former chief executive and co-founder of WeWork, recently submitted an offer to buy the bankrupt co-working company for more than $500 million, according to people familiar with the matter. WSJ

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were choppy after a similarly subdued handover from Wall St owing to early tech headwinds and ahead of month-end. ASX 200 declined as tech losses clouded over the outperformance in the energy sector, while weaker Consumer Confidence added to the glum mood. Nikkei 225 swung between gains and losses amid an indecisive currency and inconclusive Services PPI data. Hang Seng and Shanghai Comp. saw two-way price action with earnings releases in focus, while the mainland failed to sustain early optimism from the PBoC's more forceful liquidity operation.

Top Asian News

- Chinese Vice President Han said it is important to promote economic globalisation and smooth global industrial and supply chains, while they will accelerate the development of new productive forces and provide stability and security for the global economy.

- Japanese Finance Minister Suzuki said it is important for currencies to move in a stable manner reflecting fundamentals and rapid FX moves are undesirable, while he won't rule out any steps to respond to disorderly FX moves.

- Japan's Business Lobby Chief says USD/JPY beyond 150.00 is excessive, according to Kyodo (USD/JPY currently at 151.32).

- China's Deputy Head FX regulator says volatility in FDI inflows is normal.

- Shipments of smartphones within China -31.3% Y/Y at 14mln (prev. 29.5mln M/M) handsets in Feb, via CAICT.

- China has initiated WTO dispute settlement proceedings against the US over interests in the EV industry.

European equities, Stoxx600 (+0.1%), began the session without direction, though caught a bid alongside strength in US equity futures; however, the FTSE 100 (-0.1%) lags, given the underperformance in the Basic Resources sector. European sectors hold a negative tilt; Banks is found at the top of the pile, propped up by BNP Paribas (+1.9%), which benefits from a broker upgrade. Basic Resources is hampered by broader weakness in base metals. US equity futures (ES +0.3%, NQ +0.4%, RTY +0.4%) are entirely in the green, attempting to pare back some of the weakness seen in the prior session.

Top European News

- BoE's Mann says she switched to an unchanged rate vote based on consumer behaviour, labour demand & supply and the financial market curve. Can hold the bank rate for quite some time. Markets are perhaps a bit too complacent when it comes to how long the BoE can hold rates. Markets are pricing in too many rate cuts. In some ways does not have to cut because the market already is. Avoids giving a prediction on the number of 2024 rate cuts.

- ECB's Muller says data can confirm inflation trend for ECB's June meeting, ECB is closer to the point of cutting rates.

- UK MPs warned that pension rules risk 'finishing off' the remaining defined-benefit plans and noted concerns that the new funding regime would require schemes to de-risk inappropriately, according to FT.

- Kantar UK Supermarket update (Mar): Grocery price inflation eased to 4.5% over the four weeks to 17 March, the lowest level since February 2022. Take-home grocery sales rose by 4.6% over the four weeks to 17 March, with an early Easter boosting sales of seasonal treats in the first three months of 2024.

- Sweden's NIER sees 2024 GDP +0.8% (prev. 1.0%), sees 2024 headline inflation 1.9% (prev. 1.7%), End-2024 repo rate 3.00% (prev. 3.30%); Expects Riksbank to start cutting rates in June.

FX

- DXY is marginally softer but holding just above the 104 mark with not much in the way of fresh newsflow. If 104.00 is breached, Friday's low sits at 103.92.

- EUR is trivially firmer vs. the USD with a high print of 1.0853 after moving above 200 and 50DMAs at 1.0836 and 1.0839 respectively.

- GBP is edging higher vs. the USD but yet to test last Friday's high at 1.2675 or 50DMA at 1.2679. Comments from BoE's Mann reasserts her hawkish position on the MPC despite voting unchanged last week.

- JPY is a touch firmer but the USD but only marginally so as Japanese officials continue to try and defend the Yen.

- Antipodeans are both a touch firmer vs. the USD but NZD more so; newsflow very quiet. AUD/USD currently eyeing its 50 and 200DMAs which both sit at 0.6550.

- PBoC set USD/CNY mid-point at 7.0943 vs exp. 7.2037 (prev. 7.0996).

Fixed Income

- USTs are incrementally firmer but with action more contained than in Europe ahead of a handful of data points before the 5yr auction. No concession ahead of the auction yet, and within a 6 tick range between Monday's 110-15 to 110-30 parameters.

- Bunds are modestly firmer as EGBs unwind some of the slight pressure seen on Monday, sparked by Bostic/2yr supply concession; usual hawkish-leaning rhetoric from ECB's Muller and a less-downbeat German GfK spurred no real reaction; currently higher by around 22 ticks at 132.84.

- Gilts initially conformed to the broader positive sentiment in the fixed complex, subsequent hawkish commentary from BoE's Mann did little to cap the upside. The outspoken hawk mentioned that rates can be held at the current level for "quite some time"; Gilts at a fresh 99.70 peak, seemingly driven by Mann's remarks underscoring her shift to be in-line with the majority but on the hawkish end of this. Little reaction seen following the UK auction.

- UK sell GBP 3bln 4.50% 2028 Gilt: b/c 3.48x (prev. 3.34x), average yield 3.928% (prev. 4.095%) & tail 0.3bps (prev. 0.4bps)

Commodities

- Crude price action has been contained and near recent highs despite a quiet European morning, following several geopolitical headlines over the weekend; Brent currently around USD 86.60/bbl.

- Relatively uneventful trade in precious metals thus far in European hours with the Dollar contained and news flow light in a holiday-thinned week ahead of month end. XAU caught a bid in recent trade and now at session highs around USD 2190/oz.

- Base metals are mixed and within confined ranges on Monday amid a lack of macro narrative to drive price action.

- Head of Venezuela's opposition coalition said it was not possible to register a candidate for the presidential election.

- Brazilian miner Vale said it was selected by the US government to begin negotiations for financing related to an iron ore briquette plant and it will negotiate for an award of up to USD 282.9mln for the US project.

- Japan's Eneos says shut Kawasaki No.3 CDU (77k BPD) for maintenance on March 22.

Geopolitics: Middle East

- US Secretary of State Blinken underscored to Israel's Defence Minister Gallant that alternatives exist to a ground invasion of Rafah that would both better ensure Israel's security and protect Palestinian civilians, while it was also reported that White House's Sullivan had a constructive discussion with Israel's Gallant.

- "Israeli sources: The Israeli delegation leaves Doha after Hamas rejected the US proposal approved by Israel", according to Sky News Arabia. Subsequent reports said, Gaza ceasefire and hostage release talks continue and Mossad officials remain in Doha, according to Reuters sources; Mossad team is returning to Israel for consultations on developments

Geopolitics: Other

- New Zealand Foreign Minister Peters confirmed that New Zealand’s concerns about cyber activity have been conveyed directly to the Chinese government and he directed senior foreign ministry officials to speak to the Chinese ambassador, according to Reuters.

US Event Calendar

- 08:30: Feb. Durable Goods Orders, est. 1.0%, prior -6.2%

- Feb. Durables-Less Transportation, est. 0.4%, prior -0.4%

- Feb. Cap Goods Orders Nondef Ex Air, est. 0.1%, prior 0%

- Feb. Cap Goods Ship Nondef Ex Air, est. 0.1%, prior 0.9%

- 08:30: March Philadelphia Fed Non-Manufactu, prior -8.8

- 09:00: Jan. S&P/CS 20 City MoM SA, est. 0.20%, prior 0.21%

- Jan. S&P CS Composite-20 YoY, est. 6.60%, prior 6.13%

- Jan. FHFA House Price Index MoM, est. 0.3%, prior 0.1%

- 10:00: March Conf. Board Consumer Confidenc, est. 107.0, prior 106.7

- March Conf. Board Present Situation, prior 147.2

- March Conf. Board Expectations, prior 79.8

- 10:00: March Richmond Fed Index, est. -5, prior -5

- 10:30: March Dallas Fed Services Activity, prior -3.9

DB's Jim Reid concludes the overnight wrap

I'll be off skiing on Friday, although with the forecast and recent lack of snow it may as well be water skiing. It felt like the market had left for their hols early yesterday as we started what is an Easter shortened week. The most interesting theme of the day was a steady but notable global rates sell-off that, for example, wiped out nearly half of last week's -10.8bps fall in 10yr UST yields. There was no obvious catalyst so maybe thin trading played a part? As we'll see below, there was a little hawkishness in the Fed speak but the moves were steady through the day rather than directly related to any headlines.

10yr US yields closed +4.7bps higher at 4.25% with 2yrs +3.6bps at 4.63%. Markets also trimmed the amount of Fed rate cuts they are expecting this year by -4.7bps to 80bps. We also saw the expected probability of a June cut fall to 79%, down from nearly 86% at the peak last week. It was real yields that drove the sell-off, with the 10yr real yield up +5.9bps after falling for the previous four sessions. The yield increases levelled off following a decent 2yr auction. Bonds totaling $66bn were issued 0.5bps above the pre-sale yield, but with the indirect bidder share reaching its highest level since June. We still have $110bn in Treasury supply to come this week, with a record $67bn 5yr auction later today, so something to keep an eye on.

The rates and yield sell-off was seen across the board with the amount of ECB cuts priced by December coming down -6.1bps to 88bps, with 2yr and 10yr German bund yields climbing +5.6bps and +4.9bps, respectively. The sell-off was marginally larger for 10yr OATs (+5.0bps) and Gilts (+6.0bps).

There was some Fed speak of note with a little caution expressed regarding expectations of Fed cuts. Atlanta Fed President Bostic repeated weekend remarks that he now expected only one rate cut this year (versus two before), suggesting the Fed could be patient if the economy was holding up. Meanwhile, Chicago Fed President Goolsbee said he continued to see three rate cuts in 2024 but highlighted the need to see housing inflation moderate more. And Fed Governor Cook noted that “fully restoring price stability may take a cautious approach to easing monetary policy”. While being mostly consistent with Powell’s narrative last week, these comments underlined the upward narrowing of end-2024 rate expectations we saw in the FOMC dot plot last week (even as the median dot was unchanged at three cuts).

We also heard from a number of ECB officials over in Europe, including the ECB’s Panetta, a known dove, who remarked “ EU inflation [was] quickly falling towards the 2% target”, with the inflation decline allowing “for possible cut in rates.” We also heard from the ECB’s Chief Economist Lane, who reiterated that “we’re seeing good progress on inflation” and was “confident wage normalisation process is on track.” Although relatively dovish, these comments did nothing to suggest that an ECB rate cut could come any earlier than June, which appears to be the baseline based on other recent ECB commentary.

Equity markets had a quiet session with the S&P 500 starting the week on the back foot (-0.31%), and with similar moves in the Dow Jones (-0.41%) and the Nasdaq (-0.27%). The last two sessions have seen the narrowest trading ranges for the S&P 500 since early February, with only one of its 24 industry groups seeing a move of more than 1% yesterday (-1.06% for software & services).

The Magnificent Seven (-0.22%) outperformed marginally even as it was reported that Apple (-0.83%), Alphabet (-0.46%) and Meta (-1.29%) could be at risk of significant fines in the EU amid a new investigation into the firms’ compliance with the Digital Markets Act. The Act looks to restrict the dominance of the biggest online platforms and came into effect earlier this month. Nvidia (+0.76%) managed to secure its sixth day of consecutive gains but the Philadelphia Semiconductor Index fell -0.34% amid a Financial Times report that China had adopted new guidance to limit the use of US-made semiconductors, including those produced by Intel (-1.74%) and AMD (-0.57%), in government computers. Over in Europe, the STOXX 600 (+0.04%) moved sideways, while the German Dax (+0.30%) hit a fresh all-time high.

Credit markets saw a mixed day, with high-yield spreads narrowing in Europe but US IG (+2bps) and high-yield (+4bps) spreads widening modestly after reaching two-year lows last Thursday. On this topic, my credit strategy team have revised their spread targets for US and Europe tighter. You can read more here.

Asian equity markets are fairly quiet this morning with the KOSPI (+0.83%) leading gains powered by chipmaking stocks. TheHang Seng (+0.30%) has bounced after the lunch break but the Shanghai Comp (-0.58%) is struggling after a second day of a stronger Yuan fix. 10yr US yields are a basis point lower with S&P (+0.16%) and Nasdaq (+0.19%) futures both higher.

The limited US data releases yesterday were slightly on the softer side. The Dallas Fed manufacturing index for March came in at -14.4 (vs -10.0 expected), down from -11.3 in February. New home sales were unexpectedly down in February, falling from 664k to 662k (vs 677k expected). On the other hand, the Chicago Fed national activity index improved to 0.05 (vs -0.34 expected), continuing to oscillate around trend levels.

Now to the day ahead. In terms of data, we have the US March Conference Board consumer confidence, the Richmond Fed manufacturing index and business conditions, the Philadelphia Fed non-manufacturing activity, the Dallas Fed services activity, the February durable goods orders and the January FHFA house price index. Outside the US, we have Germany GfK consumer confidence. Lastly, we have a record $67bn US 5yr notes auction.

|

|

[Markets]

Dow Jones Futures Rise As Nvidia Nears New Highs; Cathie Wood Buys $28 Million Of Tesla Stock

Stock Market Today: Dow Jones futures rose Tuesday. Cathie Wood purchased more than $28 million of Tesla stock.

Published:3/26/2024 7:26:57 AM

|

|

[Markets]

Dow Jones Futures Rise; Donald Trump Stock Surges Before IPO

Dow Jones Futures: Nvidia stock rallied near record highs Monday, while Donald Trump's social media platform will IPO Tuesday.

Published:3/26/2024 6:35:43 AM

|

|

[Markets]

Dow Jones Futures Rise: Nvidia Rallies Near Record Highs; Donald Trump Stock Surges Before IPO

Dow Jones Futures: Nvidia stock rallied near record highs Monday, while Donald Trump's social media platform will IPO Tuesday.

Published:3/25/2024 8:00:42 PM

|

|

[Markets]

Dow Jones Futures: Nvidia Rallies Near Record Highs; Donald Trump Stock Set To Debut

Dow Jones Futures: Nvidia stock rallied near record highs Monday, while Donald Trump's social media platform will IPO Tuesday.

Published:3/25/2024 4:07:13 PM

|

|

[Markets]

Dow Jones Dips As Donald Trump Stock Rockets; This Bill Ackman AI Play Eyes Entry Amid Monster Run

The Dow Jones fell as Bitcoin retook a key level. A Donald Trump stock soared on the stock market today. A Bill Ackman pick is near an entry.

Published:3/25/2024 3:44:24 PM

|

|

[Markets]

Dow Jones Dips As Bitcoin Retakes $70,000; Donald Trump Stock Soars Amid Legal Win

The Dow Jones fell as Bitcoin retook a key level. A Donald Trump stock soared on the stock market today. A Bill Ackman pick is near an entry.

Published:3/25/2024 2:28:12 PM

|

|

[Markets]

Dow Jones Giant Verizon, Google Stock Near New Buy Points

Dow Jones leader Verizon and Magnificent Seven member Google stock are approaching buy points in today's stock market.

Published:3/25/2024 1:06:31 PM

|

|

[Markets]

Dow Jones Dips As These AI Stocks Rally; Donald Trump Stock Soars Amid Legal Win

The Dow Jones fell while some AI stocks rallied. A Donald Trump stock soared on the stock market today. A Bill Ackman pick is near an entry.

Published:3/25/2024 12:52:07 PM

|

|

[Markets]

Dow Jones Dips As AI Stocks Nvidia, Super Micro Rally; This Bill Ackman Stock On 43% Run Eyes Entry

The Dow Jones fell while AI stocks Nvidia and Super Micro rose. Tesla stock was up despite a downgrade. A Bill Ackman pick is near an entry,

Published:3/25/2024 11:24:02 AM

|

|

[Markets]

Dow Jones Dips Even As Boeing Rallies On CEO News; This Bill Ackman Stock On 43% Run Eyes Entry

The Dow Jones fell even as Disney and Boeing stock gained. Tesla stock was up despite a downgrade. A Bill Ackman pick is nearing an entry,

Published:3/25/2024 10:03:06 AM

|

|

[Markets]

Dow Jones Drops As Intel, AMD Sell Off; Tesla Stock Slides On Downgrade

Stock Market Today: The Dow Jones dropped as Intel and AMD sold off on China's chip ban. Tesla stock slid on an analyst downgrade.

Published:3/25/2024 8:35:46 AM

|

|

[Markets]

Dow Jones Futures Drop As Intel, AMD Sell Off; Tesla Stock Slides On Downgrade

Stock Market Today: Dow Jones futures dropped as Intel and AMD sold off on China's chip ban. Tesla stock slid on an analyst downgrade.

Published:3/25/2024 7:17:04 AM

|

|

[Markets]

Stock Futures Fall to Start Shortened Week

U.S. stock futures pointed lower early Monday as investors began a shortened trading week in a cautious manner. The Federal Reserve’s preferred inflation metric Friday is potentially the week’s main event, although stock and bond markets will be closed that day in observance of Good Friday. Dow Jones Industrial Average futures fell 0.1% ahead of the open, while futures on the S&P 500 and Nasdaq-100 were also both 0.1% down in early trading.

Published:3/25/2024 5:19:43 AM

|

|

[Markets]

Dow Jones Falls As Nike Dives On Earnings; Lululemon Crashes 17% On Weak Guidance

Stock Market Today: The Dow Jones slipped Friday as Nike stock dived on earnings. Tesla stock tumbled on China production cuts.

Published:3/22/2024 9:12:26 AM

|

|

[Markets]

Dow Jones Futures Dip As Powell Speaks; Tesla Stock Slides On Production Cut

Stock Market Today: Dow Jones futures slipped Friday amid Fed chief Jerome Powell's speech. Tesla stock skidded on China production cuts.

Published:3/22/2024 8:30:19 AM

|

|

[Markets]

Dow Jones Futures Dip Ahead Of Powell Speech; Tesla Stock Slides On Production Cut

Stock Market Today: Dow Jones futures slipped Friday ahead of Fed chief Jerome Powell's speech. Tesla stock skidded on China production cuts.

Published:3/22/2024 7:30:40 AM

|

|

[Markets]

Stock Futures Are Rising Further, Building on Record Highs

U.S. stock futures edged further into record-high territory on Friday amid a rally driven by confidence that the Federal Reserve will cut interest rates multiple times in the coming months. Futures for the Dow Jones Industrial Average gained 10 points, or less than 0.1%, after the index surged 269 points on Thursday to finish at 39,781.S&P 500 futures rose less than 0.1%, with contracts tracking the tech-heavy Nasdaq up 0.1%. All three major indexes finished at all-time highs on Thursday amid the continuation of a rally that kicked off after the latest Fed decision on Wednesday.

Published:3/22/2024 5:15:13 AM

|

|

[Markets]

The Dow Rises 300 Points

The Dow Jones Industrial Average was up more than 300 points on Thursday despite Apple stock taking a significant bite from the index's gains. The Dow was up 311 points, or 0.8%, in recent trading. Apple stock was down about 3.6%, shaving about 39 points off the Dow, according to Dow Jones Market Data.

Published:3/21/2024 10:21:44 AM

|

|

[Markets]

Dow Jones Nears 40,000 Mark For The First Time; Reddit IPO Set To Debut

Stock Market Today: The Dow Jones Industrial Average neared the 40,000 mark for the first time ever. The Reddit IPO is expected to debut.

Published:3/21/2024 8:39:35 AM

|

|

[Markets]

Dow Jones Futures Touch The 40,000 Mark For The First Time; Reddit IPO Set To Debut

Stock Market Today: Dow Jones futures touched the 40,000 mark for the first time. The Reddit IPO will debut after pricing at the top of its range.

Published:3/21/2024 7:33:53 AM

|

|

[Markets]

Dow Jones Futures Rise, Extend Fed-Led Rally, Micron Soars; 7 Stocks In Buy Areas

Futures jumped and Micron soared overnight after the S&P 500 and Dow Jones hit new highs on the Fed's rate-cut outlook. DraftKings and Arista Networks led stocks flashing buy signals.

Published:3/21/2024 6:21:49 AM

|

|

[Markets]

S&P 500 and Dow on Track for Record Closes. Nasdaq Close Behind.

The S&P 500 and Dow Jones Industrial Average were on pace for record closes, while the Nasdaq Composite was nearing its record level, falling a few points short. If the Nasdaq makes the distance, it will be the first time in over two years that the three major indices close at record levels. The Dow was up 223 points, or 0.6%, the S&P 500 was up 0.5% and the Nasdaq was 0.7% higher.

Published:3/20/2024 1:59:06 PM

|

|

[Markets]

Dow Jones Falls 100 Points Ahead Of Fed Decision, Powell; Super Micro Sells Off On Priced Offering

Stock Market Today: The Dow Jones fell ahead of today's Fed decision and Powell's comments. Super Micro slid on its priced stock offering.

Published:3/20/2024 8:54:39 AM

|

|

[Markets]

Stocks Hold Steady Ahead of Fed Rate Decision

Stocks barely moved Wednesday as investors stayed vigilant ahead of a big announcement by the Federal Reserve The Dow Jones Industrial Average was down 0.2% at the open. The S&P 500 was flat, meanwhile the Nasdaq Composite was up 0.2%. Investors are awaiting a decision on interest rates by the central bank.

Published:3/20/2024 8:47:43 AM

|

|

[Markets]

Dow Jones Futures Fall Ahead Of Fed Decision, Powell; Super Micro Slides On Priced Offering

Stock Market Today: Dow Jones futures fell ahead of today's Fed decision and Powell's comments. Super Micro slid on its priced stock offering.

Published:3/20/2024 7:54:33 AM

|

|

[Markets]

Dow Turns Higher. Tech Stocks Pull Back.

The Dow Jones Industrial Average turned higher shortly after the market opened as investors positioned ahead of Federal Reserve Chair Jerome Powell’s press conference on Wednesday. The Dow Jones Industrial Average was up 77 points, or 0.2%. The Nasdaq Composite was down 0.8%.

Published:3/19/2024 10:42:59 AM

|

|

[Markets]

Dow Jones Reverses Ahead Of Fed Meeting; AI Stock Super Micro Plunges 13% On Plan To Sell 2 Million Shares

Stock Market Today: The Dow Jones reversed Tuesday ahead of the Fed meeting. AI stock Super Micro plunged on a stock offering.

Published:3/19/2024 8:53:08 AM

|

|

[Markets]

Dow Jones Futures Fall Ahead Of Fed Meeting; AI Stock Super Micro Plunges On Plan To Sell 2 Million Shares

Stock Market Today: Dow Jones futures dropped Tuesday ahead of the Fed meeting. AI stock Super Micro plunged on a stock offering.

Published:3/19/2024 7:24:09 AM

|

|

[Markets]

Dow Jones Futures Fall: Nvidia CEO Speech In Focus; Google, Tesla Surge Ahead Of Fed Meeting

Dow Jones Futures: Nvidia stock was in focus late Monday during CEO Jensen Huang's speech. Google and Tesla surged ahead of the Fed meeting.

Published:3/18/2024 6:11:41 PM

|

|

[Markets]

Dow Jones Futures: Nvidia CEO Speech In Focus; Google, Tesla Surge Ahead Of Fed Meeting

Dow Jones Futures: Nvidia stock was in focus late Monday during CEO Jensen Huang's speech. Google and Tesla surged ahead of the Fed meeting.

Published:3/18/2024 3:56:57 PM

|

|

[Markets]

Dow Jones Climbs As Donald Trump Stock Dives; Alphabet Nears Entry Amid Apple Hookup Buzz

The Dow Jones gained on the stock market today. A Donald Trump-linked stock fell while Cathie Wood bought a diving stock.

Published:3/18/2024 2:43:36 PM

|

|

[Markets]

Dow Jones Media Giant Disney, AI Stock Arista In Or Near Buy Zones

Dow Jones media giant Disney, along with AI stock Arista and Duolingo, are in or near buy zones in today's stock market action.

Published:3/18/2024 12:41:04 PM

|

|

[Markets]

Dow Jones Climbs As Nvidia AI Event Kicks Off; Cathie Wood Snaps Up Stock Amid 51% Plunge

The Dow Jones gained. An Nvidia AI event started amid reports of a tie-up between Apple and Alphabet. Cathie Wood bought a diving stock.

Published:3/18/2024 10:02:23 AM

|

|

[Markets]

Dow Jones Futures Rise As Nvidia Rallies Ahead Of AI Event; Tesla Surges On Price Hikes

Stock Market Today: Dow Jones futures rose Monday, as Nvidia rallied ahead of its AI event. Tesla stock jumped on price hikes.

Published:3/18/2024 7:45:50 AM

|

|

[Markets]

Dow Jones Futures: Nvidia Rallies Ahead Of AI Event; Tesla Jumps On Price Hikes

Stock Market Today: Dow Jones futures rose Monday, as Nvidia rallied ahead of its AI event. Tesla stock jumped on price hikes.

Published:3/18/2024 7:24:09 AM

|

|

[Markets]

Dow Down More Than 200 Points on Microsoft, Tech Slump

Stocks saw further pressure by noon on Friday, as technology shares sold off ahead of Next week's Federal Reserve meeting. The Dow Jones Industrial Average was down 225 points or 0.6%. Top laggards include Microsoft’s stock, down 2.

Published:3/15/2024 12:36:08 PM

|

|

[Markets]

Dow Jones Falls 150 Points After Economic Data; Cathie Wood Loads Up On Tesla Stock

Stock Market Today: The Dow Jones fell on economic data Friday, Adobe plunged on earnings. Cathie Wood loaded up on Tesla stock.

Published:3/15/2024 9:04:35 AM

|

|

[Markets]

Dow Jones Falls As Adobe Dives 14% On Earnings; Cathie Wood Loads Up On Tesla Stock

Stock Market Today: The Dow Jones fell Friday, as software giant Adobe plunged on earnings. Cathie Wood loaded up on Tesla stock.

Published:3/15/2024 8:34:50 AM

|

|

[Markets]

Dow Jones Futures Rise As Adobe Dives On Earnings; Cathie Wood Loads Up On Tesla Stock

Stock Market Today: Dow Jones futures rose Friday, as software giant Adobe plunged on earnings. Cathie Wood loaded up on Tesla stock.

Published:3/15/2024 7:12:25 AM

|

|

[Markets]

Stocks Fall As Market Looks To Fed Meeting; Nvidia, Super Micro Drop Ahead Of AI Event

The Dow Jones fell after hot inflation data. Nvidia and Super Micro Computer fell after analysts raised their price target on the stocks.

Published:3/14/2024 3:33:45 PM

|

|

[Markets]

How major US stock indexes fared Thursday, 3/14/2024

The Dow Jones Industrial Average lost 0.4%, and the Nasdaq composite fell 0.3%. Treasury yields rose following the latest in a string of data showing inflation was worse than expected. The Nasdaq composite fell 49.24 points, or 0.3%, to 16,128.53.

Published:3/14/2024 3:26:28 PM

|

|

[Markets]

Stocks Fall As Cathie Wood Holding Soars; Nvidia, Super Micro Dive As Analysts See More Upside After Huge Run

The Dow Jones fell after hot inflation data. Nvidia and Super Micro Computer fell after analysts raised their price target on the stocks.

Published:3/14/2024 11:44:17 AM

|

|

[Markets]

Stocks Retreat; Nvidia, Super Micro Fall After Analysts Raise Price Targets, But Cathie Wood's Holding Soars

The Dow Jones fell after hot inflation data. Nvidia and Super Micro Computer fell after analysts raised their price target on the stocks.

Published:3/14/2024 10:48:36 AM

|

|

[Markets]

Dow Jones Futures Higher After Surprise Inflation Data; Nvidia, Tesla Extend Losses

Stock Market Today: Dow Jones futures rose after hot inflation data. Nvidia and Tesla stock extended their losses, with more declines.

Published:3/14/2024 7:39:15 AM

|

|

[Markets]

Dow Jones Futures Rise Ahead Of Key Inflation Data; Nvidia, Tesla Extend Losses

Stock Market Today: Dow Jones futures rose ahead of key inflation data. Nvidia and Tesla stock extended their losses, with more declines.

Published:3/14/2024 7:20:09 AM

|

|

[Markets]

Dow Jones Futures Rise As Tesla Skids, But This Gauge Should Worry You

Dow Jones futures: The stock market rally showed resilience as Nvidia held most of Tuesday's gains. Tesla continued to tumble. Bullish sentiment hit a critical level.

Published:3/14/2024 7:06:31 AM

|

|

[Markets]

Dow Jones Futures: Market Rally, Nvidia Resilient As Tesla Skids; This Gauge Should Worry You

Dow Jones futures: The stock market rally showed resilience as Nvidia held most of Tuesday's gains. Tesla continued to tumble. Bullish sentiment hit a critical level.

Published:3/13/2024 4:28:08 PM

|

|

[Markets]

Dow Jones Rises As Nvidia Gets Big Price-Target Hike; Tesla Stock Slides On Downgrade To Sell

Stock Market Today: The Dow Jones rose Wednesday after the S&P 500 closed at a new high. Tesla stock sold off on a downgrade to sell.

Published:3/13/2024 8:42:46 AM

|

|

[Markets]

Dow Jones Futures Rise As Nvidia Gets Big Price-Target Hike; Tesla Stock Slides On Downgrade To Sell

Stock Market Today: Dow Jones futures rose Wednesday after the S&P 500 closed at a new high. Tesla stock sold off on a downgrade to sell.

Published:3/13/2024 8:09:57 AM

|

|

[Markets]

Stocks Strong Into The Close; Nvidia Lifts Nasdaq As It Reclaims 900 Level

The stock market today showed strength with the Dow Jones gaining more than 200 points. Nvidia lifted the Nasdaq as it reclaimed a key level.

Published:3/12/2024 3:43:31 PM

|

|

[Markets]

GLOBAL MARKETS-Stocks, US yields climb after inflation data

A gauge of global stocks was set to snap a two-session fall on Tuesday, rising along with Treasury yields after data showed U.S. inflation remained sticky in February, indicating the Federal Reserve could keep interest rates higher for longer than is currently expected. On Wall Street, the S&P 500 registered another record high, buoyed in part by a surge in Oracle shares. The Dow Jones Industrial Average rose 235.83 points, or 0.61%, to 39,005.49, the S&P 500 gained 57.33 points, or 1.12%, to 5,175.27 and the Nasdaq Composite increased 246.36 points, or 1.54%, to 16,265.64.

Published:3/12/2024 3:36:20 PM

|

|

[Markets]

Dow Jones Rises On Hot CPI Inflation Data; AI Giant Oracle Surges On Earnings

Stock Market Today: The Dow Jones rose on a hot CPI inflation report. AI giant Oracle soared on strong earnings results.

Published:3/12/2024 9:12:09 AM

|

|

[Markets]

Dow Jones Reverses On Hot CPI Inflation Data; AI Giant Oracle Surges On Earnings

Stock Market Today: The Dow Jones fell on a hot CPI inflation report. AI giant Oracle soared on strong earnings results.

Published:3/12/2024 8:47:54 AM

|

|

[Markets]

Dow Jones Futures Rise On Hot CPI Inflation Data; AI Giant Oracle Surges On Earnings

Stock Market Today: Dow Jones futures rose on a hot CPI inflation report. AI giant Oracle soared on strong earnings results.

Published:3/12/2024 7:51:31 AM

|

|

[Markets]

Dow Jones Futures: AI Giant Soars On Earnings, While Nvidia, Meta Slide; CPI Inflation Report Looms

Dow Jones futures: AI giant Oracle soared on earnings late, while Meta, Nvidia and Super Micro sold off sharply Monday.

Published:3/11/2024 4:15:29 PM

|

|

[Markets]

S&P 500, Nasdaq close lower ahead of February inflation print

The Dow Jones Industrial Average (^DJI) holds its head high, ending the day in the green. The Nasdaq Composite (^IXIC) and S&P 500 (^GSPC) close Monday lower ahead of the February Consumer Price Index (CPI) expected out on Tuesday. Yahoo Finance's Julie Hyman details the major indices' performances over the course of the day while highlights Jared Blikre the sector action seen today and over the past 30 days. For more expert insight and the latest market action, click here to watch this full episode of Yahoo Finance Live. Editor's note: This article was written by Luke Carberry Mogan.

Published:3/11/2024 3:38:27 PM

|

|

[Markets]

Dow Jones Slides 200 Points As Bitcoin Hits Record High; Nvidia Stock Reverses Higher

Stock Market Today: The Dow Jones Industrial Average fell 200 points as bitcoin hit a record high. Nvidia stock reversed higher.

Published:3/11/2024 9:39:22 AM

|

|

[Markets]

Dow Jones Extends Losses As Bitcoin Hits Record High; Nvidia, Super Micro Sell Off

Stock Market Today: The Dow Jones Industrial Average fell as bitcoin hit a record high. Nvidia stock and Super Micro sold off Monday.

Published:3/11/2024 9:14:27 AM

|

|

[Markets]

Dow Jones Futures Extend Losses As Bitcoin Hits Record High; Nvidia Stock Continues To Slide

Stock Market Today: Dow Jones futures fell as bitcoin hit a record high. Nvidia stock continued to slide Monday.

Published:3/11/2024 7:29:26 AM

|

|

[Markets]

Stock Market Improves As Dow Moves Ahead; Super Micro Computer Reverses From A High

The Dow Jones pulled ahead in afternoon trading. Nvidia stock pulled back on Friday after reaching an all-time high.

Published:3/8/2024 2:18:11 PM

|

|

[Markets]

Stock Market Weakens In Afternoon Action; Nvidia Finally Has A Bad Day

The Dow Jones fought to stay afloat. Nvidia stock pulled back on Friday after reaching an all-time high.

Published:3/8/2024 1:28:57 PM

|

|

[Markets]

Dow Jones Climbs On Jobs Report; Nvidia, Super Micro Rally To New Highs

Stock Market Today: The Dow Jones rose on today's jobs report. Nvidia stock and Super Micro surged to record highs.

Published:3/8/2024 9:02:05 AM

|

|

[Markets]

Stocks react to Feb. jobs data, gold and bitcoin move higher

Stock market indexes (^DJI, ^IXIC, ^GSPC) start the day off mixed — the Dow Jones Industrial Average quickly moving into the green — in response to Friday morning's positive jobs report data. Yahoo Finance Senior Markets Reporter Jared Blikre monitors how sectors are also taking advantage of this news, turning his attention to the price action in bitcoin (BTC-USD) and gold (GC=F). For more expert insight and the latest market action, click here to watch this full episode of Yahoo Finance Live. Editor's note: This article was written by Luke Carberry Mogan.

Published:3/8/2024 8:55:11 AM

|

|

[Markets]

Dow Jones Rises On Jobs Report; Nvidia, Super Micro Rally To New Highs

Stock Market Today: The Dow Jones rose on today's jobs report. Nvidia stock and Super Micro surged to record highs.

Published:3/8/2024 8:41:21 AM

|

|

[Markets]

Dow Jones Futures Reverse On Today's Jobs Report; Nvidia, Super Micro Rally To New Highs

Stock Market Today: Dow Jones futures reversed higher on today's jobs report. Nvidia stock and Super Micro surged to record highs.

Published:3/8/2024 7:56:42 AM

|

|

[Markets]

Stock Futures Mixed Ahead of Jobs Report. S&P 500 Building on Record High.

U.S. stock futures were mixed ahead of key jobs data Friday with the S&P 500 was set to open higher after reaching another record closing price. Futures on the S&P 500 rose 0.1% in premarket trading as did those on the Nasdaq Composite. Dow Jones Industrial Average futures were broadly flat.

Published:3/8/2024 3:45:20 AM

|

|

[Markets]

S&P 500 notches new record high, stocks close in green

The S&P 500 (^GSPC) closes Thursday at yet another record high in 2024. The Nasdaq (^IXIC) falls just short of a new high. All in all, the three stock market indices — including the Dow Jones Industrial Average (^DJI) — end the day in the green. Yahoo Finance's Jared Blikre gives his analysis on the record high runs seen across sectors and specific indexes. For more expert insight and the latest market action, click here to watch this full episode of Yahoo Finance Live. Editor's note: This article was written by Luke Carberry Mogan.

Published:3/7/2024 3:52:53 PM

|

|

[Markets]

Dow Jones Rises Ahead Of Powell's Encore; Nvidia Stock Rallies, But Tesla Extends Losses

Stock Market Today: The Dow Jones rallied Thursday ahead of more testimony from Fed Chair Jerome Powell. Nvidia rallied, but Tesla sold off.

Published:3/7/2024 8:38:17 AM

|

|

[Markets]

Dow Jones Futures Rise Ahead Of Powell's Second Act; Nvidia Stock Rallies, But Tesla Extends Losses

Stock Market Today: Dow Jones futures rose Thursday ahead of more testimony from Fed Chair Jerome Powell. Nvidia rallied, but Tesla sold off.

Published:3/7/2024 7:20:48 AM

|

|

[Markets]

Dow Jones Falls As Apple Tumbles On iPhone Sales, Warren Buffett Risk; Cathie Wood Sells Coinbase

The Dow Jones fell in early trades. Cathie Wood sold Coinbase as bitcoin fell. Apple fell on slowing China iPhone sales.

Published:3/5/2024 1:00:08 PM

|

|

[Markets]

Dow Jones Falls As Fed's Powell Testimony Looms; Cathie Wood Sells Coinbase As Bitcoin Rallies

The Dow Jones fell in early trades. Cathie Wood sold Coinbase as bitcoin rallied. Apple fell on slowing China iPhone sales.

Published:3/5/2024 10:30:41 AM

|

|

[Markets]

Dow Jones Falls As Fed Powell Testimony Looms; Cathie Wood Sells Coinbase As Bitcoin Rallies

Dow Jones fell in early trades. Cathie Wood sold Coinbase as Bitcoin rallied. Apple fell on slowing China iPhone sales.

Published:3/5/2024 10:23:37 AM

|

|

[Markets]

Dow Jones Falls As Apple Slides On iPhone Sales; Cathie Wood Sells $30 Million Of Coinbase Stock

Stock Market Today: The Dow Jones dropped as Apple sold off on slowing iPhone sales. Cathie Wood sold $30 million worth of Coinbase stock.

Published:3/5/2024 8:39:54 AM

|

|

[Markets]

Dow Jones Futures Fall As Apple Slides On iPhone Sales; Cathie Wood Sells $30 Million Of Coinbase Stock

Stock Market Today: Dow Jones futures dropped as Apple sold off on iPhone news. Cathie Wood sold $30 million worth of Coinbase stock.

Published:3/5/2024 7:23:55 AM

|

|

[Markets]

Dow Jones Futures: AI Stocks Nvidia, Super Micro Computer Surge To New Highs; Apple, Google, Tesla Stock Sell Off

Dow Jones Futures: AI stocks Nvidia and Super Micro surged to new highs, while Apple stock, Google and Tesla sold off sharply Monday.

Published:3/4/2024 4:15:21 PM

|

|

[Markets]

Dow Jones Dips With 3 Warren Buffett Stocks Near Entries; Cathie Wood Buys This Amid 51% Dive

The Dow Jones fell as Apple crumbled on the stock market today. Cathie Wood bought a diving stock. Some Warren Buffett stocks are near entries.

Published:3/4/2024 3:54:39 PM

|

|

[Markets]

Dow Jones Dips As Supermicro Rockets On S&P Nod; These 3 Warren Buffett Stocks Near Entries

The Dow Jones fell as Apple tumbled amid an EU fine. A trio of Warren Buffett stocks are near entries. Nvidia rose while Tesla got hammered.

Published:3/4/2024 2:48:25 PM

|

|

[Markets]

Dow Jones Dips As Super Micro Rockets On S&P Nod; These 3 Warren Buffett Stocks Near Entries

The Dow Jones fell as Apple tumbled amid an EU fine. A trio of Warren Buffett stocks are near entries. Nvidia rose while Tesla got hammered.

Published:3/4/2024 2:19:40 PM

|

|

[Markets]

Dow Jones Leader IBM, Duolingo, Fortinet Are Among Best Stocks To Buy And Watch

Dow Jones leader IBM is approaching a new buy point, while Duolingo and Fortinet are among the best stocks to buy and watch.

Published:3/4/2024 1:03:20 PM

|

|

[Markets]

Dow Jones Dips As Apple Gets Hit With $2 Bil Fine; These 3 Warren Buffett Stocks Near Entries

The Dow Jones fell as Apple tumbled amid an EU fine. A trio of Warren Buffett stocks are near entries. Nvidia rose while Tesla got hammered..

Published:3/4/2024 10:03:24 AM

|

|

[Markets]

Dow Jones Slides 150 Points As Nvidia Hits Record High; Super Micro Soars On S&P 500 Addition

Stock Market Today: The Dow Jones fell 150 points Monday, as Nvidia stock hit a record high. Super Micro soared on S&P 500 news.

Published:3/4/2024 8:42:39 AM

|

|

[Markets]

Dow Jones Futures Slide 200 Points As Nvidia Hits Record High; Super Micro Soars On S&P 500 Addition

Stock Market Today: Dow Jones futures fell Monday, as Nvidia stock hit a record high. Super Micro soared on S&P 500 news.

Published:3/4/2024 8:27:56 AM

|

|

[Markets]

Dow Jones Futures Fall As Nvidia Hits Record High; Super Micro Soars On S&P 500 Addition

Stock Market Today: Dow Jones futures fell Monday, as Nvidia stock hit a record high. Super Micro soared on S&P 500 news.

Published:3/4/2024 7:22:29 AM

|

|

[Markets]

Deckers, Super Micro to join S&P 500, replacing Whirlpool, Zions Bancorp

Footwear maker Deckers Outdoor Corp. and data-server provider Super Micro Computer Inc. will join the S&P 500 stock index later this month, replacing Whirlpool Corp. and Zions Bancorporation, S&P Dow Jones Indices said Friday.

Published:3/1/2024 5:37:43 PM

|

|

[Markets]

Dow Jones Falls After Inflation Survey; Chip Giant AMD Surges To Record High

Stock Market Today: The Dow Jones dropped Friday after a key inflation survey. Chip giant AMD stock surged to record highs.

Published:3/1/2024 9:08:22 AM

|

|

[Markets]

Dow Jones Futures Fall Ahead Of Inflation Survey; Cybersecurity Leader Zscaler Plunges On Earnings

Stock Market Today: Dow Jones futures dropped Friday ahead of a key inflation survey. Cybersecurity stock Zscaler plunged on earnings.

Published:3/1/2024 7:30:57 AM

|

|

[Markets]

This Dow Jones Stock Is Not To Be Ignored. Why Doing So Would Be 'Misguided.'

One Dow Jones Industrial Average heavyweight is a health care stock this trading expert says is not to be ignored. But is its peer a better bet?

Published:2/29/2024 6:45:54 PM

|

|

[Markets]

Dow Jones Falls On Key Inflation Data; AI Stock Snowflake Crashes On Earnings

Stock Market Today: The Dow Jones dropped Thursday on key inflation data. AI stock Snowflake crashed 23% on earnings.

Published:2/29/2024 9:29:46 AM

|

|

[Markets]

Dow Jones Rises On Key Inflation Data; AI Stock Snowflake Crashes On Earnings

Stock Market Today: The Dow Jones rose Thursday on key inflation data. AI stock Snowflake crashed 23% on earnings.

Published:2/29/2024 8:36:31 AM

|

|

[Markets]

Dow Jones Futures Rise On Key Inflation Data; AI Stock Snowflake Crashes On Earnings

Stock Market Today: Dow Jones futures rose Thursday on key inflation data. AI stock Snowflake crashed 23% on earnings.

Published:2/29/2024 7:58:23 AM

|

|

[Markets]

2 Dow Stocks Billionaire Investors Are Absolutely Piling Into, and 1 They Can't Sell Fast Enough

The latest round of quarterly 13F filings reveals which widely owned Dow Jones stocks billionaire money managers have been buying and selling.

Published:2/29/2024 4:33:59 AM

|

|

[Markets]

Dow, S&P 500 Close Lower; Nasdaq Below Key Level; Taser Maker Soars To All-Time High

The stock market today closed the day negative, with the Dow Jones and S&P 500 posting losses on Wednesday. Taser maker stock hit a new high.

Published:2/28/2024 3:43:39 PM

|

|

[Markets]

Stocks close lower ahead of Thursday's PCE inflation data

Stock market indices (^DJI, ^IXIC, ^GSPC) close Wednesday in the red, the Dow Jones Industrial Average notching its third consecutive day of losses as markets pull back in anticipation of Thursday's Personal Consumption Expenditures (PCE) print. Yahoo Finance Markets Reporter Jared Blikre takes the pulse of US equities after the closing bell, breaking down sector leaders and overall market volatility. For more expert insight and the latest market action, click here to watch this full episode of Yahoo Finance Live. Editor's note: This article was written by Luke Carberry Mogan.

Published:2/28/2024 3:29:10 PM

|

|

[Markets]

Dow, S&P 500 Losses Mount; Baidu Falls After Earnings As Chip Equipment Maker Hits High

The stock market pulled back from day's highs, as the Dow Jones and S&P 500 still show losses. Taser maker Axon rallied after earnings.

Published:2/28/2024 2:38:09 PM

|

|

[Markets]

Dow And S&P Hold In Negative Territory; Urban Outfitters Plunges; Beyond Meat Soars

The stock market today improved some but the Dow Jones and S&P 500 posted modest losses in the noon hour. Beyond Meat rallied after earnings.

Published:2/28/2024 11:25:59 AM

|

|

[Markets]

Dow and S&P Fall After GDP Numbers As Bitcoin Tops $60,000; Beyond Meat On Track For Best Day Ever

The stock market today showed weakness with the Dow Jones and S&P 500 posting losses to start the day. Bitcoin rallied to a milestone.

Published:2/28/2024 10:14:27 AM

|

|

[Markets]

Dow Jones Slides 200 Points On Surprise GDP Data; Cathie Wood Sells More Nvidia Stock